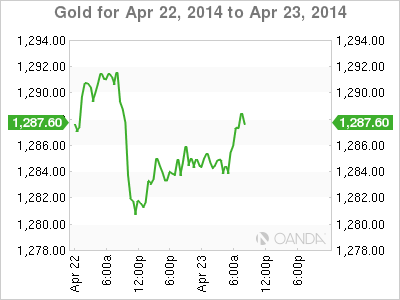

Gold prices are flat in Wednesday trading, with a spot price of $1287.51 late in the European session. Gold dipped to a two-month low on Tuesday as Existing Homes Sales beat the estimate and the Richmond Manufacturing Index rebounded sharply, hitting a three-month high. In Wednesday releases, the highlight of the day is New Home Sales. The markets are expecting a stronger reading in March.

Gold dropped to a low of $1277.16 on Tuesday, the metal's lowest level since February. Solid US releases in April have made the precious metal less attractive as a hedge against the greenback, and gold has slid from a high of $1331 in little more than a week. On Tuesday, US Existing Home Sales has been on a long downturn, reflecting trouble in the housing sector. The key indicator edged lower in March, dropping to 4.59 million, down from 4.60 million a month earlier. However, it did beat the estimate of 4.57 million, marking the first time that the indicator has beaten the forecast since August. There was also good news form the manufacturing sector, as the Richmond Manufacturing Index jumped to 7 points, crushing the estimate of 0 points.

US inflation levels have been lukewarm, but so far the Federal Reserve has done little more than point out that it would like to see inflation move closer to the Fed's target of 2%. The House Price Index, a gauge of activity in the housing sector, rose a respectable 0.6% last month, matching the forecast. It's a different tale in the Eurozone, where inflation continues to be persistently low and there is real concern about deflation, which could inflict serious damage on the fragile Eurozone economy. The ECB has balked at taking any action to deal with inflation, but its hand may be forced if inflation levels don't show some life.

The markets haven't reacted to events in Ukraine so far, but that could change if the violence in the east of the country worsens. Russian President Vladimir Putin has threatened to act on his "right" to invade Ukraine, and has also given the country an ultimatum regarding its gas debt. The gas supply from Russia to western Europe is in danger, and if the situation spills out of control, we could see a sharp response from the markets. US Vice-President Joe Biden is in Kiev for a symbolic visit. The West doesn't have many cards to play against Russia, so every move by Putin will be scrutinized and could impact on the markets.

XAU/USD 1285.32 H: 1289.00 L: 1282.22

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.