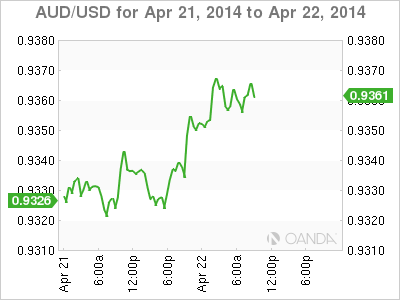

AUD/USD has posted slight gains in Tuesday trading. The pair continues to trade at high levels, as the pair remains in the mid-0.93 range early in the North American session. On the release front, Tuesday's key event is US Existing Home Sales. The indicator has been softening, and the markets expect the downward trend to continue. Australian CB Leading Index showed little change in March. The markets are waiting for CPI, this week's major event, which will be published early on Wednesday.

US releases ended last week on a high note, as employment and manufacturing numbers were strong. The all-important Unemployment Claims was up slightly to 304 thousand, but had no trouble beating the estimate of 316 thousand. With the Federal Reserve planning another trim to its QE program at the end of the month and speculation rising about a possible interest rate increase next year, every employment release is under the market microscope. Meanwhile, the Philly Fed Manufacturing Index soared to 16.6 points, its best showing since September. This was well above the estimate of 9.6 points.

The ongoing crisis in Ukraine hasn't had much of an effect on the markets until now, but that could quickly change if the charged situation spirals out of control. Russian President Putin has threatened to act on his "right" to invade Ukraine, and has steeply raised the price that Ukraine must pay for its gas supplies. Ukrainian Prime Minister Arseniy Yatsenyuk blasted the move as "economic aggression" and said his country must prepare for a complete cutoff of Russian gas. Meanwhile, US Vice-President Joe Biden is in Kiev in a show of support for Ukraine, and the US has said it will increase sanctions if no progress is made in resolving the crisis.

AUD/USD 0.9365 H: 0.9370 L: 0.9332

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.