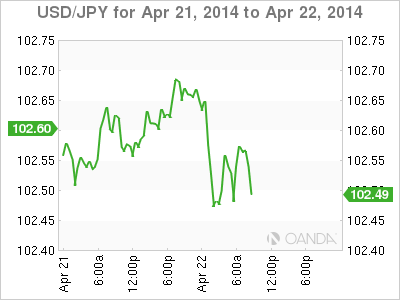

The Japanese yen remains at high levels, as USD/JPY continues to trade in the mid-102 range. In economic news, it's a quiet day on the release front. Today's key US event is Existing Home Sales, while there are no Japanese releases on Tuesday.

Japan's trade deficit ballooned in March, jumping to -1.71 trillion yen, well above the estimate of -1.27 trillion. Besides weighing on the yen, the weak figure has raised speculation that the Bank of Japan may have to step in with further easing, as the economy has softened. Consumer consumption could drop as the recent sales tax hike weighs on consumers, and the BOJ could be forced into action as early as June or July. As well, China has been experiencing a slowdown, which is bad news for Japanese exports.

US releases ended the week on a high note, as employment and manufacturing numbers were strong. The all-important Unemployment Claims was up slightly to 304 thousand, but had no trouble beating the estimate of 316 thousand. With the Federal Reserve planning another trim to its QE program at the end of the month and speculation rising about a possible interest rate increase next year, every employment release is under the market microscope. Meanwhile, the Philly Fed Manufacturing Index soared to 16.6 points, its best showing since September. This was well above the estimate of 9.6 points.

The ongoing crisis in Ukraine hasn't had much of an effect on the markets until now, but that could quickly change if the charged situation spirals out of control. Russian President Putin has threatened to act on his "right" to invade Ukraine, and has steeply raised the price that Ukraine must pay for its gas supplies. Ukrainian Prime Minister Arseniy Yatsenyuk blasted the move as "economic aggression" and said his country must prepare for a complete cutoff of Russian gas. Meanwhile, US vice-president Joe Biden is in Kiev in a show of support for Ukraine, and the US has said it will increase sanctions if no progress is made in resolving the crisis.

USD/JPY 102.50 H: 102.73 L: 102.41

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter gross domestic product (GDP) data on Thursday.