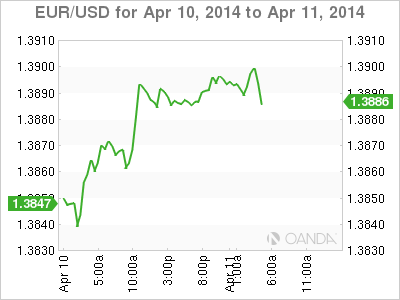

EUR/USD is on a tear, as the currency trades just under the 1.39 line on Friday. The euro has gained close to 200 points this week against the sagging US dollar. The greenback failed to make a dent in the euro rally despite an excellent reading from US Unemployment Claims. On Friday, German inflation indicators were weak but met expectations. Later in the day, ECB head Mario Draghi holds a press conference in Washington. Today's US highlights are the Producer Price Index and UoM Consumer Sentiment.

The Federal Reserve minutes were eagerly awaited by the markets, but didn't deliver much in the way of breaking news. Policymakers expressed concern about speculation over a possible rise in interest rates, but didn't say when the central bank might change its current monetary policy. Under its QE program, the Fed is purchasing $55 billion in assets every month. There have been three tapers to QE so far, and the Fed chair Janet Yellen has said that the Fed plans to wind up QE late in the year. However, if there are any setbacks on the inflation or employment fronts, the Fed could be forced to delay further tapers. As the tapers are dollar-positive, any delay would be bearish for the greenback.

Tensions between the US and Russia continue to worsen over the Ukraine. On Monday, pro-Russian demonstrators took over a government building in an industrial city in the east of the country and declared their independence. Russia has warned the Ukraine not to react with force, while the US has accused Russia of continuing to foment unrest in the Ukraine ahead of elections in May. With the country split down the middle between pro-Western and pro-Russian camps, we could see the turmoil continue.

EUR/USD 1.3892 H: 1.3905 L: 1.3886

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.