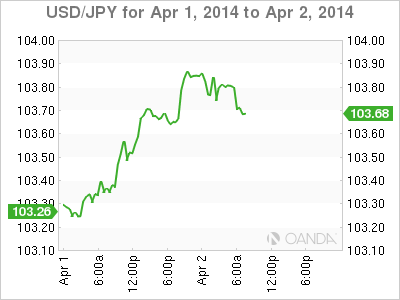

USD/JPY continues to trade at high levels as the pair trades in the mid-103 range in Wednesday's European session. The pair came close to the 104 line, its highest level since late January. In the US, ADP Nonfarm Payrolls posted a sharp gain, matching expectations. There are no Japanese releases on Wednesday.

The first US employment release of the week met high expectations, as ADP Nonfarm Payrolls jumped to 191 thousand, up from 139 thousand a month earlier. This practically matched the estimate of 192 thousand. The markets will get a good look at the US employment picture in the next few days, with Unemployment Claims, the Unemployment Rate and NFP still to come.

The important Japanese Tankan indexes painted a mixed picture last month, and the yen did not react to these releases. The Manufacturing Index rose slightly to 17 points, falling short of the estimate of 19 points. However, the Non-Manufacturing Index looked sharper, jumping to 24 points from 20 points a month earlier, matching the forecast. On Monday, Preliminary Industrial Production starting off the week with a whimper, declining 2.3% in February, an eight-month low.

Earlier in the week, Fed chair Janet Yellen said that inflation and employment levels needed to improve considerably, and the Federal Reserve would continue to provide monetary stimulus for some time. Currently, the Fed is purchasing $55 billion in assets under its QE scheme. There have been three tapers to QE so far, and Yellen plans to wind up the program in the fall, provided that the US economy does not run into any serious turbulence. At the same time, the Federal Reserve has stated that it has no plans to raise interest rates until sometime in 2015.

USD/JPY 103.65 H: 103.93 L: 103.61

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.