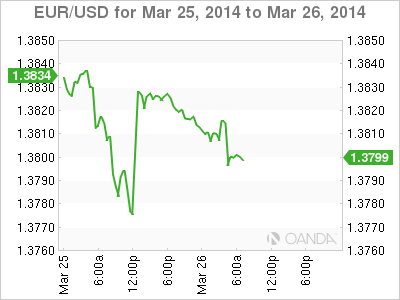

EUR/USD has edged downwards on Wednesday, as the pair trades close just below the 1.38 level. In economic news, German Ifo Business Climate weakened in February but met expectations. In economic news, German Consumer Climate remains at high levels and matched the forecast. In the US, Tuesday's numbers were a mix. Consumer Confidence hit a six-year high, but New Home Sales slipped in February. Wednesday's key release is Core Durable Goods Orders. The markets are expecting a much smaller gain than in the previous release.

German Consumer Climate remains at high levels, posting a second straight reading of 8.5 points, matching the forecast. The indicator has steadily risen, and the last time we saw a stronger reading was back in 2007, before the global economic crisis. German Business Climate also looked sharp in February. Increasing consumer confidence usually translates into more consumer spending, which is a critical component of economic growth.

US numbers were a mix on Tuesday. CB Consumer Confidence jumped to 82.3 points, easily surpassing the estimate of 78.7 points. This was the key indicator's best showing since December 2007. The news wasn't as good from the housing sector, as New Home Sales fell to 440 thousand, down sharply from the January release of 468 thousand. The reading was short of the estimate of 447 thousand. We'll get a look at Pending Home Sales on Thursday.

The US and its European allies have imposed limited sanctions on Russia after its annexation of Crimea, but are holding off on additional measures if Russia does not take further military action. The lack of a tough response from the West reflects divisions within Europe over how strong a stance to take against Moscow. Meanwhile, the Ukraine has signed an association agreement with the EU and is seeking a loan package of up to $20 billion from the IMF. Ukraine's economy has suffered badly after months of political turmoil.

EUR/USD 1.3800 H: 1.3823 L: 1.3790

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD rebounds to 1.0650 on renewed USD weakness

EUR/USD gained traction and rose to the 1.0650 area in the early American session on Tuesday. Disappointing housing data from the US seem to be weighing on the US Dollar, helping the pair stretch higher.

GBP/USD climbs above 1.2450 after US data

GBP/USD extended its recovery from the multi-month low it touched near 1.2400 and turned positive on the day above 1.2450. The modest selling pressure surrounding the US Dollar after dismal housing data supports the pair's rebound.

Gold retreats to $2,370 as US yields push higher

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world supported by a strong US labour market.