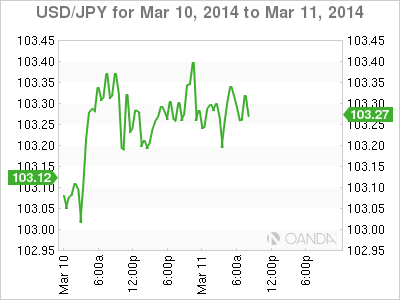

USD/JPY is steady in Tuesday trading, as the pair trades slightly above the 103 line in the European session. In economic news, the Bank of Japan said it was continuing its current monetary policy. In the US, today's highlight is JOLTS Job Openings. The markets are not expecting much change from last month's numbers.

There were no surprises from the BOJ, which released its Monetary Policy Statement on Tuesday. The BOJ said it would continue to expand monetary policy by 60-70 trillion each year. The Bank sounded optimistic about the economy, noting that economic growth and inflation are in line with its forecasts.

Japanese Current Account weakened in February, as the deficit ballooned to -$0.59 trillion, up from -$0.20 trillion a month earlier. This matched the estimate. GDP travelled a similar route, dropping to 0.2% in February, down from 0.3% a month earlier. This was the lowest reading since Q4 of 2012, although it too matched the forecast. The yen did not react to these readings, and continues to trade above the 103 line.

US Nonfarm Payrolls was a pleasant surprise on Friday, as the key employment release jumped to 175 thousand in February, up from 113 thousand a month earlier. This was well above the estimate of 151 thousand. The Unemployment rate edged up to 6.7%, slightly above the estimate of 6.6%. With a solid Unemployment Claims earlier last week, the markets can breathe more comfortably as the Fed is likely to take its scissors and trim QE next week for the third time. New York Fed President William Dudley stated last week that the threshold to alter the Fed's program to wind up QE was "pretty high". In other words, short of a serious economic downturn in the US economy, we can expect the QE tapers to continue.

USD/JPY 103.28 H: 103.42 L: 103.19

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.