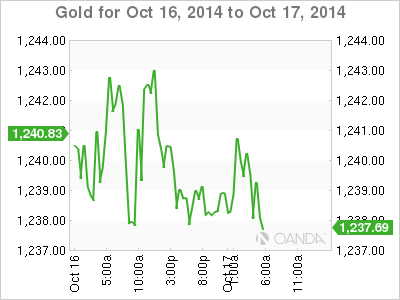

Gold is almost unchanged on Friday, as the spot price stands at $1237.89 per ounce in the European session. In the US, it’s another busy day, with the release of Building Permits and the UoM Consumer Sentiment. As well, Federal Reserve Chair Janet Yellen will deliver remarks at an event in Boston.

Earlier in the week, US retail sales and inflation numbers sagged, and gold responded by pushing past resistance at $1240. Core Retail Sales dipped 0.2%, its first decline since April 2013. It was a similar story with Core Retail Sales, which posted a decline of 0.3%, its first loss since January. This points to a decrease in consumer spending, a key component of economic growth. Meanwhile, PPI fell by 0.1%, after a reading of 0.0% a month earlier. All three events missed their estimates.

There was better news on Thursday, as US Unemployment Claims dropped to 264 thousand, marking a 14 -year low. The estimate stood at 286 thousand. Manufacturing numbers were a mix, as Industrial Production gained 1.0%, its best showing since November. The Philly Fed Manufacturing Index dipped to 20.7 points, but this beat the estimate of 19.9 points.

XAU/USD 1238.95 H: 1241.72 L: 1237.89

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns. Gold confirmed a symmetrical triangle breakdown on 4H but defends 50-SMA support.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.