There was a reduction on most of world stock indices observed on Tuesday. The U.S. Federal Reserve Chairman, Janet Yellen said that the discount rate may be increased earlier than expected. If macroeconomic indicators continue to improve. After that, the U.S. currency significantly strengthened.

As for the stock market, she noted that the assessment of individual companies may be overestimated, including small-cap, biotechnology, as well as media and social network sectors. In this regard, the Nasdaq and S&P500 fell down. The Dow Jones industrial average rose due to the good quarterly reporting and the rise in prices for the shares of JPMorgan Chase and Goldman Sachs. IBM signed a contract with Apple for supplying mobile devices to corporate clients, which led to rise in their share prices. Yesterday's economic data from the U.S. was worse than the preliminary forecasts. Retail sales in June increased less than expected. Nevertheless, a number of investment banks, including Goldman Sachs, raised the GDP growth forecasts for the second quarter to 3-3.4%. Trading volume on the U.S. exchanges was almost 13% above the monthly average yesterday. The expected news from the U.S. for today are: the PPI, expected to be released at 12-30 CET, industrial production at 13-15 CET and the Beige Book economic review at 18-00 CET. At 14-00 CET, the Fed Chairman, Janet Yellen will give another speech. However, it is unlikely to be as significant to the financial markets, as it was yesterday. In our opinion, the forecasts for the U.S. data are negative. However, stock futures indexes are traded positively. We believe that this is the reaction to the strong macroeconomic fundamentals regarding Chinese economy, as well as the good Intel reporting, released on Tuesday after the closing bell rang. The Bank of America report is expected to be released before the trades start.

European markets had the prices decreased yesterday. German macroeconomic investor’s confidence index for July (ZEW) collapsed to its lowest level since December 2012. The drop in share prices of the Portuguese Banco Espirito Santo by 14.6% added an additional negative. Some investors have suggested that its problems do affect the economy of Italy, Spain and Portugal. Today, the EU stocks are rising after the Chinese statistics release. The Chinese GDP growth in the second quarter slightly exceeded the forecasts and made 7.5%. Industrial production in June also turned out better than expected and increased by 9.2%. We do not exclude that it may help the growth in quotations of commodity futures. The European data on foreign trade are expected to be released today at 9-00 CET. The forecast is positive.

Nikkei rose slightly today within its neutral trend along with the global trend. Let us note that tonight the weekly data on investments from the Japanese Ministry of Finance is expected to strike, and the next significant macroeconomic information will be released only on July 24th.

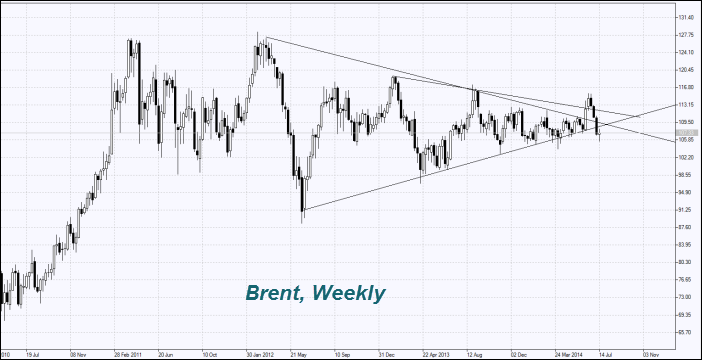

The Oil prices are corrected upward today after decline within the previous three weeks. Its consumption in China for June peaked within 17 months and showed 10.2 million barrels per day. Compared to May, it increased by 8.4%. China imported 5.66 million barrels of oil per day in June. The American Petroleum Institute expects the U.S. inventories to reduce in weekly terms by 4.8 million barrels, market participants expect a 2.75 million decline. This is an additional factor of the price growth. The official data will be released today at 14-30 CET.

The natural gas price continues to decline. The Chilean company (ENAP) stated it was going to start exporting liquefied shale gas to the U.S. starting in 2016. The response from the U.S. authorities was not received yet, but in principle the approval has been given previously. Let us note that the current decline in gas prices occurs despite the fact that its holdings in the United States are a quarter below the last year's level.

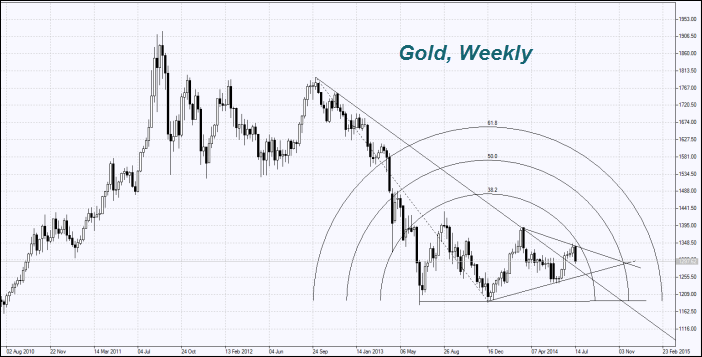

The Gold price declined significantly due to possible increase of the interest rates in the U.S. earlier than expected. Futures trading volume in the United States are below the average for 100 days by 23%.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.