The U.S. economic data disappointed investors on Wednesday. As a result, the U.S.Dollar Index (USDIDX) has greatly decreased. The U.S. GDP growth in the first quarter was only 0.1%. This is much less than the expected 1.2% and the minimum of the fourth quarter of 2012. And even these 0.1% were mainly provided by the large-scale government health care spending, not by the private sector progress.

However, the Fed reduced the monthly redemption volume for government bonds to $10 billion to $45 billion, as it was expected. Now investors are counting on the QE program ending in October. The other three economic indicators that were announced yesterday, were positive, better than the preliminary forecasts. However, it has not helped the U.S. currency. Today at 16:00 CET, we will see the U.S. business activity index (ISM Manufacturing) for April. In our opinion, it is the main Thursday data. Before it comes out, we will see the weekly unemployment rate and personal income - expenses for March at 14-30. All preliminary forecasts are positive. Another factor that may affect the U.S. Dollar will be the speech by the Fed Chairman, Janet Yellen at 13-30 CET.

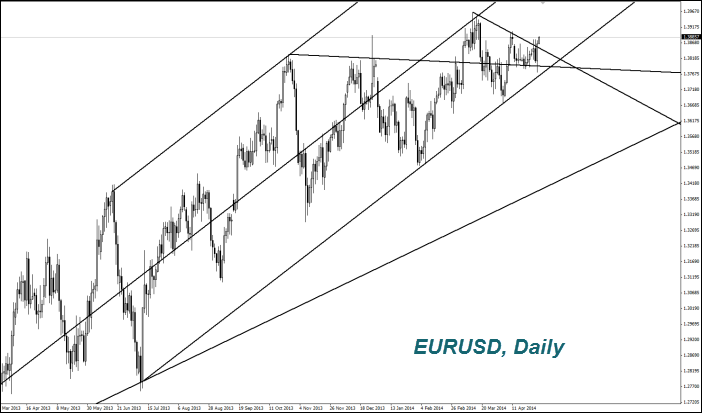

The Euro (EURUSD) rose logically rose yesterday due to the USD weakening. This was facilitated by the inflation increase in the EZ in April to 0.7% from 0.5%. This reduces the likelihood of the ECB monetary emission despite the fact that the CPI increase was slightly lower than expected (0.8%) and below the "dangerous" level of 1% set by the ECB. Today the financial markets in Germany and in most other European countries, except England, are closed due to the holiday (The Labor Day).

The Chinese manufacturing PMI for April appeared to be slightly worse than expected, but better than in March. The main negative was manifested in export performance. This caused declines in some commodity futures. The Renminbi (USDCNH) rose to a maximum of 18 months on the chart. This means a strong weakening of the Chinese currency against the due to economic growth slowdown. There is a day off in China today (The Labor Day).

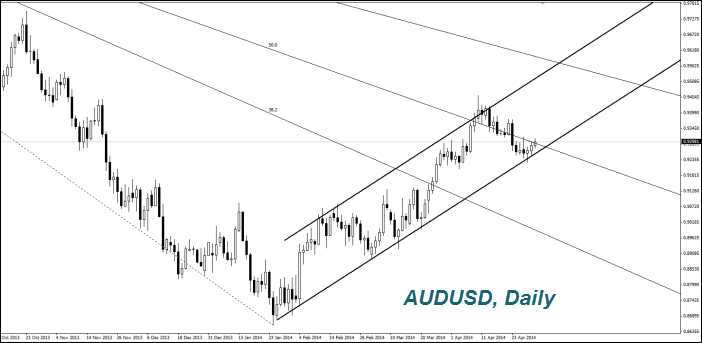

The Australian Dollar strengthened (rise on the AUDUSD chart), thanks to good economic data. The higher export prices exceeded import prices n the first quarter. In general, the value figures were much better than expected. Tomorrow at 3-00 CET, we will see the data on the Australian real estate market in March and the Q1 PPI at 3-30 CET.

The Canadian dollar was one of the few currencies that have demonstrated the weakening vs. the U.S. dollar after the weak data on the U.S. GDP. It looked like poor growth in the USDCAD chart. The causes are difficult to explain, but some market participants do not exclude a rate cut in Canada. Note that there are no Bank of Canada meetings planned in May meetings. The Canadian GDP rose by 2.6% last February in annual terms, beating expectations. The Bank of Canada Governor, Stephen Poloz noted that the dependence of the Canadian dollar on the world prices for the Oil, metals and some other products is almost mathematical and confirmed by observations over the past 30 years .

The Silver prices (XAGUSD) had fallen by 13% over the past six months and came close to annual lows. Whereas the Gold (XAUUSD) has fallen in price by only 2.5 % over the same period. At the same time the S&P spot index of 24 commodities rose by 4.8%. We believe that the advanced silver price reduction was due to the fact that a half of its volume is used in the global industry and the proportion of the Gold is only 10%. Accordingly, the Silver prices are more sensitive to global production decrease. According to the Metals Focus Ltd, the industrial use of silver this year will increase by 2.9% to a maximum level since 2005 (890.7 million ounces). We believe that if the forecast is justified, it can boost the Silver prices. This should be confirmed by a decrease in inventories, which is not observed. The silver inventories on the Comex Exchange turned out in March the highest since 1997.

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.