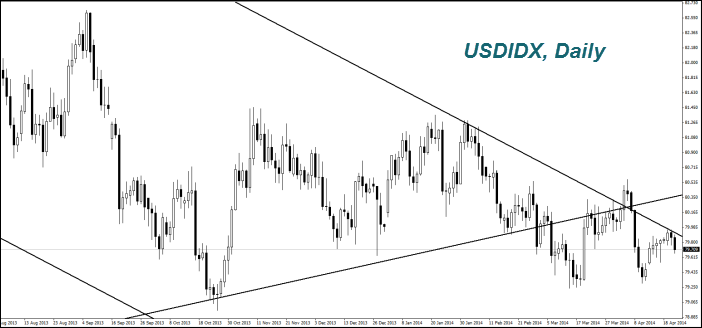

The U.S. Dollar Index (USDIDX) fell yesterday and the same trend is continuing this morning. The Home Sales in the U.S. secondary market for March reached the minimum of one and a half year, and got 7.5% lower than in March 2013. Note that market participants expected even more weak performance due to extremely cold weather during the winter season. We believe that the negative impact of lower sales will be limited, because they make up a small part of the GDP. Furthermore, the average price of homes compared to last year increased by 7.9% and now it is on a 6-month high. Thus, the volume of sales in monetary terms has remained roughly at last year's level. Today, at 15-00 CET, there are the U.S. primary real estate market data for March expected to come out. At 14-45 CET, we will see the Market agency clarified PMI for April. In our opinion, the preliminary forecasts are positive for the U.S. Dollar Index.

Yesterday's economic data in the EZ were neutral. Today, market participants' attention is focused on the manufacturing PMI for April, coming out at 10-00 CET. The forecast is neutral. We do not expect any powerful movements of the Euro (EURUSD). Since investors will most likely wait for tomorrow's speech of the ECB President.

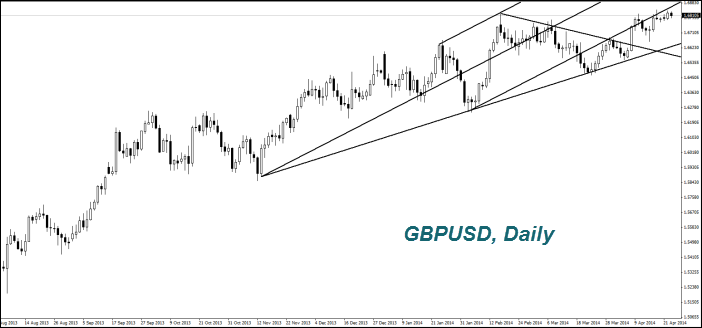

The British Pound (GBPUSD) strengthened slightly yesterday due to corporate news. British pharmaceutical company, GlaxoSmithKline sells some of its patents on cure for cancer to the Swiss company (Novartis) for $14.5B, when it buys production patents on several vaccines for $7.1B from Novartis. It is expected that the difference will be converted into the GBP. Earlier, the British telecommunications holding - Vodafone sold a part of its business and also converted Pounds into Dollars. The Pound slightly reduced (weakened) this morning, before the BOE report from its last meeting (Minutes), which will be released at 9:30 CET. Market participants doubt that the bank will raise interest rates before the parliamentary elections in May next year. Previously it was assumed that this can be done in the first half of 2015.

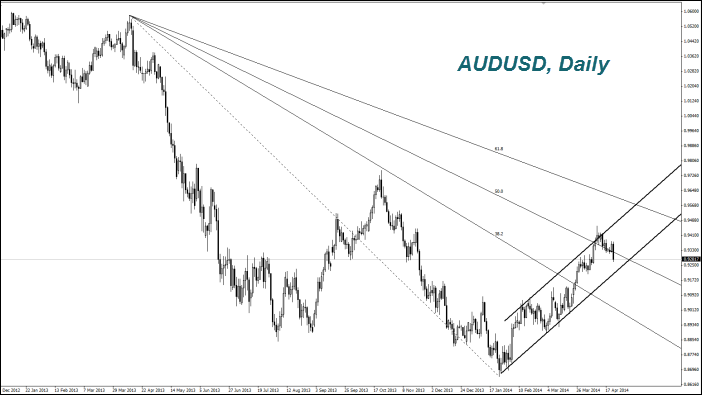

The Australian Dollar (AUDUSD) dropped markedly yesterday (weakening in the chart) after the CPI for the first quarter fell less than expected. Investors believe that it reduces the rate hike likelihood. Today, the Reserve Bank of New Zealand is going to increase the discount rate to 3% from 2.75%. We do not exclude that it may have a short-term positive impact on the New Zealand and Australian currencies.

Chinese PMI for April rose slightly from 48 to 48.3 points and has not had a major impact on commodity futures.

The Soyb prices continued to decline. As we have mentioned in previous reviews, the negative factor was China's abandonment of previously concluded contracts for supply of beans due to the recent outbreak of avian influenza. A few days ago, the U.S. and Japan bought Brazilian soybean, originally intended for China. However, according to investors its surplus still may be seen in the global market. An additional negative factor was the increase in the soybean forecast from the Rosario Grains Exchange for the harvest in Argentina by 200 thousand tons to 54.9 million tons.

The Wheat prices rose after the Australian government has lowered its forecast for the crop this year to 24.8 million tons compared to 27.8 million tonnes for last year. Moreover, such a negative outlook is granted despite the increase of wheat acreage by 3.3 million acres this year. Australian Government experts explained it with expectations of El Nino in July, which may cause a serious drought on the eastern coast of the country.

Note that the news about the slowdown in maize (Corn) planting in the U.S., which we wrote in the previous review, provoked a good price growth yesterday. Since there are many reviews from different companies, dedicated to the USDA data, which had a negative view regarding this year's harvest.

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold clings to strong daily gains above $2,380

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.