On Monday, the U.S. Dollar Index (USDIDX) rose due to good macroeconomic data in the U.S.. The Leading indicator for March rose by 0.8%. This is more than the preliminary forecasts. Technically the U.S. Dollar Index has been closing positively for seven consecutive days. Meanwhile, according to the Commission Commodity Futures Trading (CFTC), the net sell net short in the USD has been formed last week for the first time since October. Today at 14-00 CET, we will see the Real Estate market data from the United States for March, as well as the manufacturing index from the Federal Reserve Bank of Richmond in April. The overall prognosis is positive in our opinion.

At 15-00 CET, we will see the EZ Consumer Confidence index for April. According to forecasts, it may be the highest of the last six years. It is difficult to say yet, which data will influence the market stronger and where the Euro vs. the U.S. Dollar will move at the session. The Euro is rising in the morning. In our opinion, the neutral trend may continue, as market participants await further clarification on the possible ECB monetary emission. The ECB President, Mario Draghi is going to speak in Amsterdam on Thursday. He said earlier that the excessive growth of the Euro (EURUSD) can be a trigger to start easing the monetary policy. These words provoked the Euro weakening. Now some investors expect a similar reaction of the market and they are not in a hurry to buy the single currency.

The former Japanese Deputy Minister of Finance, Eisuke Sakakibara, known as "Mr. Yen", said that the Yen is more likely to move towards 110 Yen (USDJPY) per Dollar than to 100. Tomorrow morning at 1-25 CET we will observe the speech by the deputy head of the Bank of Japan, Hiroshi Nakaso.

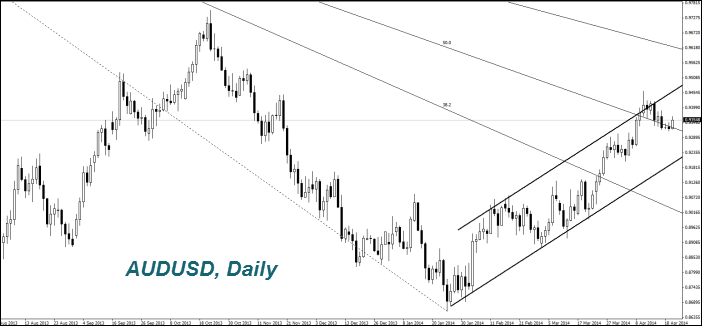

The Australian Dollar (AUDUSD) rose (growth on the chart) due to the good Leading indicator data for February, which was released early this morning. Tomorrow, at 2-30 CET, we will see the important macroeconomic inflation data from Australia for the first quarter. It is expected to grow that increases the likelihood of raising the interest rates and may contribute to further strengthening of the Australian Dollar. Recall that the Reserve Bank of Australia set a range of acceptable inflation rate at 2%-3%.

This week will bring the important economic information from Canada. Today at 13-30 CET, we will see the wholesale trade data in February and the retail trade on Wednesday. In our opinion, the preliminary forecasts are more negative (in favor of growth on the chart) for the Canadian Dollar (USDCAD).

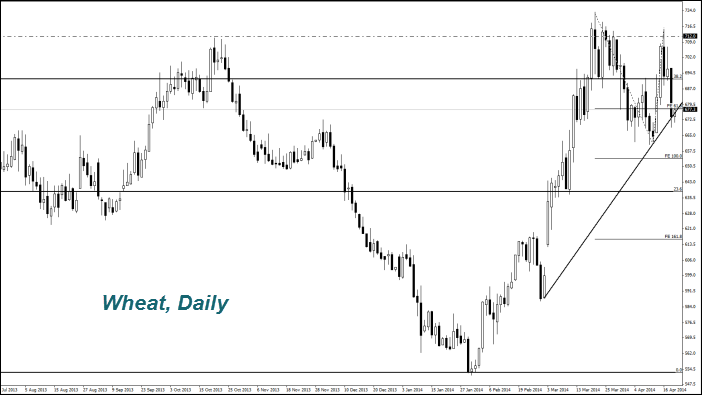

Yesterday's drop in the Wheat price appeared to be the highest since the beginning of the year. Mainly, it was due to this rainy weather in the U.S., Germany, France and Russia. Market participants expect that the rain will continue for five days. In this regard, we can count on a higher yield. The weather conditions rating (good-to-excellent) for the Wheat, which is calculated by the USDA (USDA), has not been changed for a week and stayed at 34%.

The Corn price decrease was less significant, since its planting in the U.S. has been slower than expected. According to the USDA, the 6% area under maize were sown on April 20th, while market participants expected 9%. There was the 14% area planted last year at the same date.

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.