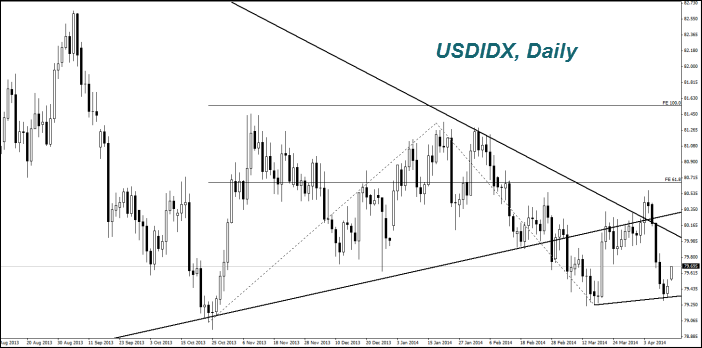

As we suggested in the previous review, on Friday the dollar index (USDIDX) rose for the first time during a week. The reason of this was higher-than-expected Michigan consumer confidence index. Today at 13-30 CET we are expecting for information on retail sales for March from the USA and 15-00 CET - U.S. wholesale inventories. Preliminary forecasts, in our opinion, are positive for the U.S. dollar.

Stock indexes S&P500 (SP500) and Nasdaq (Nd100) reduced per week by 2.6% and 3.1%, respectively, and it turned out to be the highest since June 2012. Negative dynamics of the market on Friday were supported by: weak quarterly reporting of JPMorgan Chase and rising March producer price index by 0.5%. This is its biggest increase in the past nine months. Investors fear a possible reduction in the profitability of corporations due to inflation.

This morning, Euro continued to decline. Over the weekend, ECB President Mario Draghi said that the ECB "does not exclude further monetary policy easing, and it firmly reiterates that it continues to expect the key ECB interest rates to remain at present or lower levels for an extended period of time". In the last 12 months strengthening of the euro against the U.S. dollar was 5.5 % and against the Japanese yen 10%. Today at 17-45 CET the head of the French Central Bank and the ECB Governing Council member Christian Noer will speak. After Mario Draghi's speech the majority of market participants has decided that the ECB does not want to strengthen the euro above 1.39 dollars, although no specific numbers were mentioned. It is possible that Christian Noer's statements will be more specific. According to the U.S. Commission on commodity futures trading, the amount of net purchase positions (net longs) in Euro decreased by 23.3 thousand per week - to its lowest level since late February.

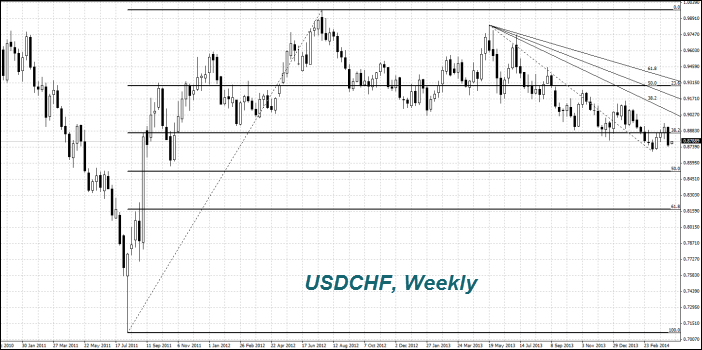

The Head of the Swiss National Bank (SNB) Thomas Jordan said that Switzerland can benefit from easing monetary policy in the eurozone in case of Swiss franc weakening in tandem with the euro. Recall that in September 2011 the SNB does not allow the strengthening of the Swiss currency less than 1.2 francs per euro. This level may become a strong support. This year the SNB expects zero inflation. In 2015 it is expected to reach 0.4%. Swiss GDP growth this year could be around 2%.

The cost of cattle (Fcattle) reached a new historic high. Japan has reduced import duties on Australian meat cattle, thus opening its domestic market for Australian producers. Negotiations with the United States, about which we wrote in the previous reviews, is not yet finished. Australia is the world's third largest producer of beef after the United States and India. A message regarding increase in cattle imports to China by 40% last year has contributed to beef prices rising. About 2014 opinion was divided. USDA predicts a drop in beef exports to China this year by 10% due to high prices and increasing domestic production to 5.76 million tons. Organization for Economic Cooperation and Development expects beef exports to China will grow annually by 7% during 8 years until it reaches 850 thousand tons. It should be noted that the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) expects that exports of live cattle from Australia this year will be the highest for six years, to 600 thousand. We believe that futures prices for cattle will depend heavily on the news about its real consumption in China and progress of negotiations between Japan and the USA.

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

EUR/USD stays weak near 1.0650 ahead of Eurozone PMI data

EUR/USD remains on the back foot near 1.0650 in European trading on Tuesday. Resurgent US Dollar demand amid a cautious risk tone weighs on the pair. Investors stay wary ahead of the preliminary Eurozone and US business PMI data.

GBP/USD eases below 1.2350, UK PMIs eyed

GBP/USD is dropping below 1.2350 in the European session, as the US Dollar sees fresh buying interest on tepid risk sentiment. The further downside in the pair could remain capped, as traders await the UK PMI reports for fresh trading impetus.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

Focus on April PMIs today

In the euro area, focus today will be on the euro area PMIs for April. The previous months' PMIs have shown a return of the two-speed economy with the service sector in expansionary territory and manufacturing sector stuck in contraction.