The U.S. Dollar Index was corrected downward on Monday. The Chicago (PMI) for March was much weaker than expected and amounted to 55.9 points. In addition, the Fed Chairman, Janet Yellen said the U.S. economy still needs support from the Fed. Market participants decided that the soft monetary policy may be continued. This reduces the chances for the next contraction in the QE or the asset purchasing program at the next Fed meeting on April 30 as well as a negative impact on the U.S.Dollar. Note that the U.S. regulator has its step taking associated with the unemployment level and considered the level 6.5% acceptable. Because of this, the U.S. labor market data on Friday may strongly influence the currency market. Today, investors will monitor the ISM Manufacturing for March, which will be released at 16-00 CET. In our opinion, the preliminary forecast (54 points) is a positive for the U.S. currency.

Despite the weakening USD, the rising (EURUSD) was limited yesterday by the negative inflation data for March. It was the lowest since November 2009. Theoretically, this could prompt the ECB cut interest rates to prevent deflation at its next meeting this Thursday. Recall that the consumer price growth of less than 1 % was observed for six consecutive months. Today, at 9-55 CET and 10-00 CET EU we will see the important data on: Unemployment in Germany and the EZ PMI Manufacturing. They can affect the Euro if they differ markedly from neutral predictions.

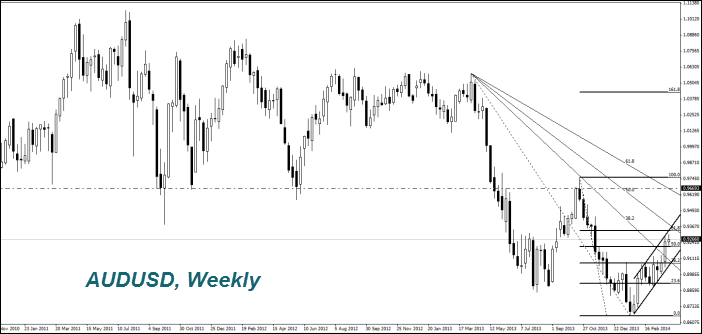

The RBA kept the interest rates at 2.5% today, as expected. However, its representatives said that the Australian Dollar (AUDUSD) is too much appreciated (increased) lately. Market participants do not pay much attention to it. They expect important economic data from Australia. On Wednesday at 5:30 CET, the real estate market figures are expected to come out. On Thursday at 2-30 CET, we expect more important indicators: Retail Sales and the Trade Balanc . In our opinion, the preliminary forecasts are moderately negative for the Australian Dollar and may cause a downward correction.

As it was expected, the Japanese Tankan economic indicators were worse than the preliminary forecasts. Today, the sales tax in Japan gets increased from 5% to 8%. All of it may cause a further weakening of the Yen (it looks like growth on the USDJPY chart). The next important economic data will be released in Japan on Wednesday.

The Canadian Dollar strengthened yesterday (fall on the USDCAD chart) after Canadian GDP growth in January that exceeded forecasts and compensated the decline in December. Today at 14-30 CET in Canada we will see the Industry Price Index and the Manufacturing PMI at 15-30 CET. We believe that the predictions are in favor of the Canadian dollar attenuation (increase in the chart).

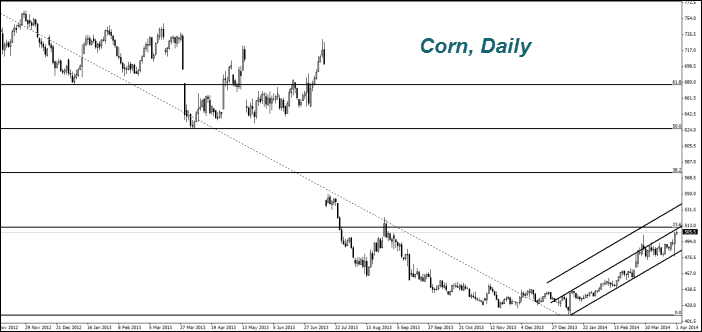

Yesterday, the USDA released a quarterly report. The ( Corn ) prices rose to a 6- months maximum. Its reserves in the United States amount to 7,006 B tons - less than expected. Corn acreage this year are at the lowest level since 2010 and amount to 91.7 million acres. Inventories of soybean (Soyb) were minimal in 2004 and amounted to 992.3 million tons, more than expected. Its quotes have also increased. The stocks are significantly less than last year level, 998 million tons. Probably some of the market participants did not expect a rise in the Soyb price. Several negative forecasts from major companies appeared today. In particular it is noted that the crops of soybeans in the U.S. increased to 81.5 million acres from 76.533 million last year and there will be no lack of beans. The Wheat prices fell yesterday. Its reserves were 1.056 billion bushels. This is more than the expected 1.042 billion bushels. The Wheat crops in the U.S. decreased by 1% compared to the previous year and amounted to 55.815 million acres. Overall, the first quarter of this year was the best for the commodity futures market over the past six quarters.

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.