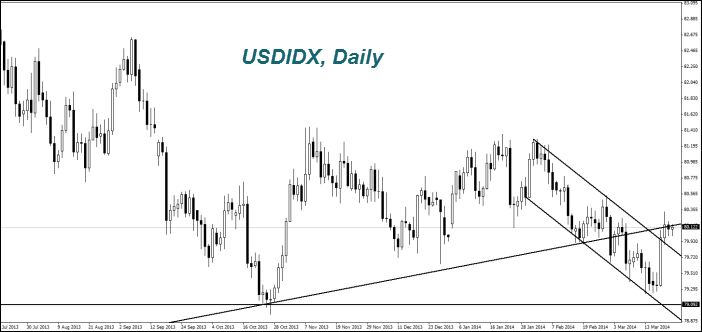

The U.S. Dollar Index (USDIDX) was almost unchanged on Friday. Now it is near three-week high. Investors expect the new data on the U.S. economy. Today we do not expect any critical indicators. They will come out in the U.S. starting from Tuesday. According to the U.S. Commission on Commodity Futures Trading (CFTC), net long positions on the U.S. Dollar have doubled over the week to $19.91 billion. Thus, net long lasts for twenty consecutive weeks. This means that most of investors expect further strengthening of the U.S. Dollar.

The European Council Chairman, Herman Van Rompuy said on Saturday that the Euro (EURUSD) is too strong for exporters. The ECB Governing Council member, Erki Liikanen, said that the ECB could cut interest rates from the current 0.25% to zero. Market participants have not responded to these allegations yet. Today at 9-00 UTC, we will find out about purchasing managers (PMI) for the EZ in March. Preliminary forecast, in our opinion, is neutral.

Early this morning we saw Chinese Markit / HSBC PMI for March which was worse than the preliminary forecasts, being declined for five months and amounted to 48.1 points. This can have a negative impact on the Australian Dollar (AUDUSD) and commodity futures. We believe that Aussie will not fall right away, because according to CFTC, a lot of long positions were opened last week. In addition, investors play back the increased likelihood of rate hike in Australia until the end of the year after its growth in New Zealand.

Inflation in Canada for February rose to 1.1% in annual terms. Retail sales for January exceeded the forecast and made 1.3%. These figures came out on Friday and helped slightly strengthen the Canadian Dollar (USDCAD) (fall on the chart). Inflation remained within the target zone of the Bank of Canada from 1% to 3%. According to market participants, the data has reduced the likelihood of further rate cuts. The following important information for Canada will be released only on March 31st, (the GDP in January). We believe that until that time, the Canadian Dollar movement can be predicted by using the technical analysis methods.

The Japanese Yen weakened (growth on the USDJPY chart) after the Bank of Japan deputy announcement that the deflation risk is the main threat to Japanese economy, and it occurs because of too strong Yen. Now most of investors expect the Bank of Japan to boost quantitative easing after April 1st, when the sales taxes get increased.

Chinese authorities are considering various options of the domestic credit market liberalization. We believe that this information will cause a strong fall in copper prices (Copper) by 13% since the beginning of the year. Up to 30% of the copper is used as collateral in credit schemes in China. Now the necessity of it may be reduced. Most likely, the two-week consolidation of the Copper quotations on the world market is due to the fact that the financial component of its use was revised by investors. Now pricing cannot obey the fundamental factors any longer.

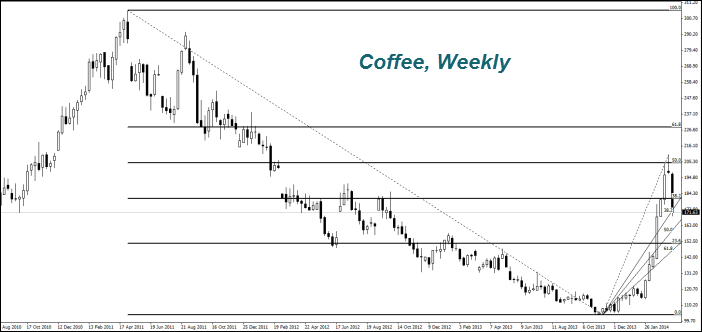

The (Coffee) prices are corrected down after the rapid growth. According to the National Coffee Association of the USA there will be a global Coffee deficit in the amount of 612 thousand bags observed for the first time in five years due to forecasts of reducing its harvest in Brazil to 51.1 million bags. This is better than a pessimistic forecast from the International Coffee Organization with a deficit of 2 million bags, which was released earlier this month. The crop forecasts in Brazil are also weaker being about 49 million bags. Recall that there was the world Coffee surplus of $5.6 million bags observed in the previous agricultural season. As the forecast for the current season still envisages a deficit, we can not exclude the resumption of growth in the Coffee quotations after the downward correction.

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

EUR/USD comes under pressure near 1.0630

Further gains in the Greenback encourage sellers to maintain their control over the risk complex, forcing EUR/USD to retreat further and revisit the 1.0630 region as the US session draws to a close.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.