Key Highlights

Aussie Dollar moved higher against the US Dollar, and traded above the 0.7220 resistance area.

There is a support trend line formed on the hourly chart, which might help buyers if the AUDUSD pair moves lower.

Australian Home Loans released by the Australian Bureau of Statistics posted a gain of 2.9% in August 2015, which was lower compared with the forecast of a 5% increase.

Australian investment lending for homes declined by 0.4% in August 2015.

AUDUSD Technical Analysis

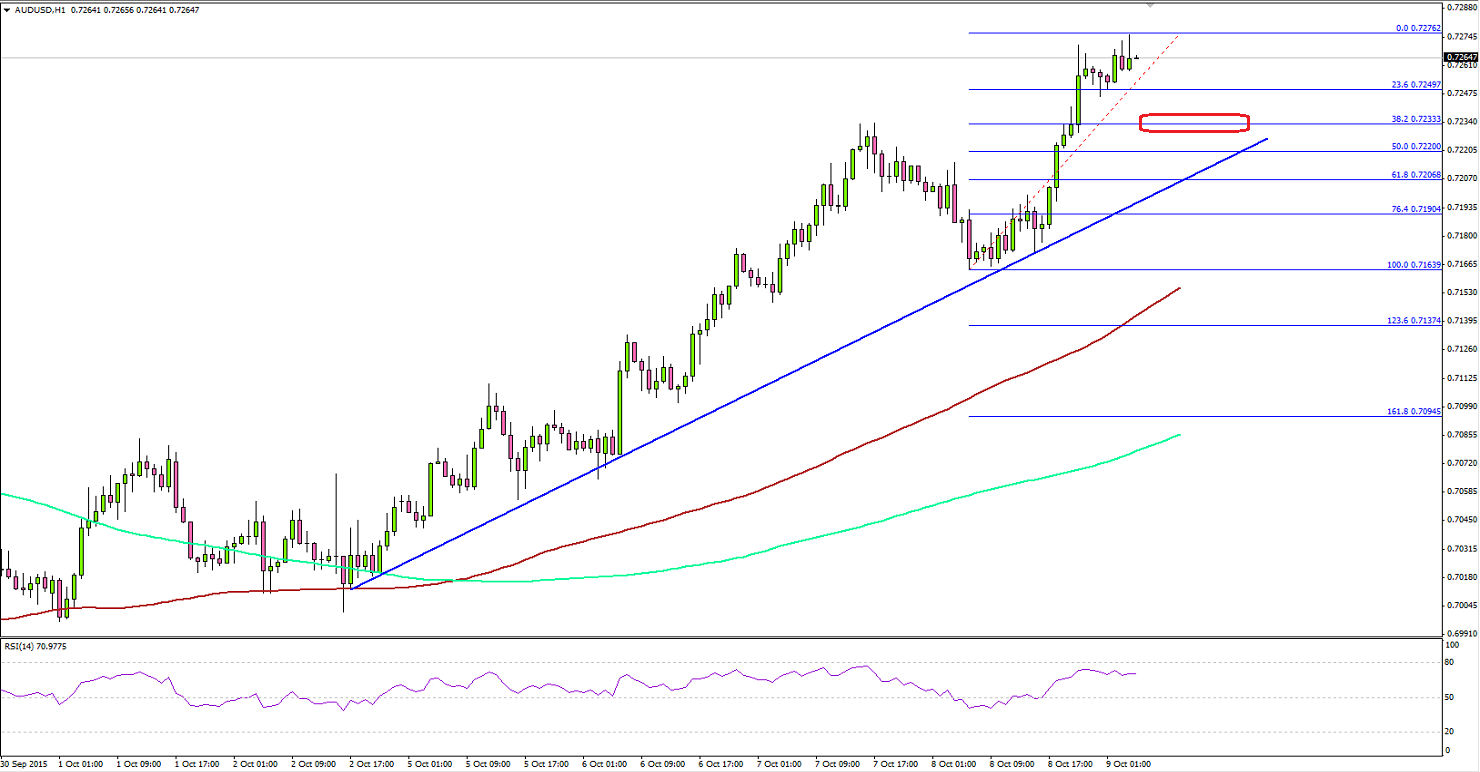

The Aussie Dollar enjoyed a good run against the US dollar recently to trade above a major resistance area of 0.7220. The AUDUSD pair is following a nice bullish path for a move higher, and it looks set for more gains in the near term.

There is a bullish trend line formed on the hourly chart, which might act as a support area if the pair corrects lower from the current levels. An initial support is around the 23.6% Fib retracement level of the last move from the 0.7163 low to 0.7276 high.

On the upside, the recent high of 0.7276 can act as a minor resistance. A break above it could easily push the pair higher in the short term.

Australian Home Loans

Earlier during the Asian session, the Australian Home Loans that present the number of home loans and which indicates the housing market trend in Australia was released by the Australian Bureau of Statistics. The forecast was lined up for an increase of 5% in August 2015, compared with the last reading of -0.3% (revised). However, the outcome was on the lower side, as the Home Loans increased by only 2.9%.

Titan FX is registered and regulated in New Zealand under FSP388647. Our global headquarters and operational hub is located in Auckland, New Zealand.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.