Key Highlights

Euro traded higher against the US Dollar, and looks set for more gains in the near term.

A couple of recent economic releases in the US were on the negative side, which increased the bearish pressure on the greenback.

Japanese Retail Trade released by the Ministry of Economy, Trade and Industry posted an increase of 0.9% in June 2015, compared with June 2014.

EURUSD Technical Analysis

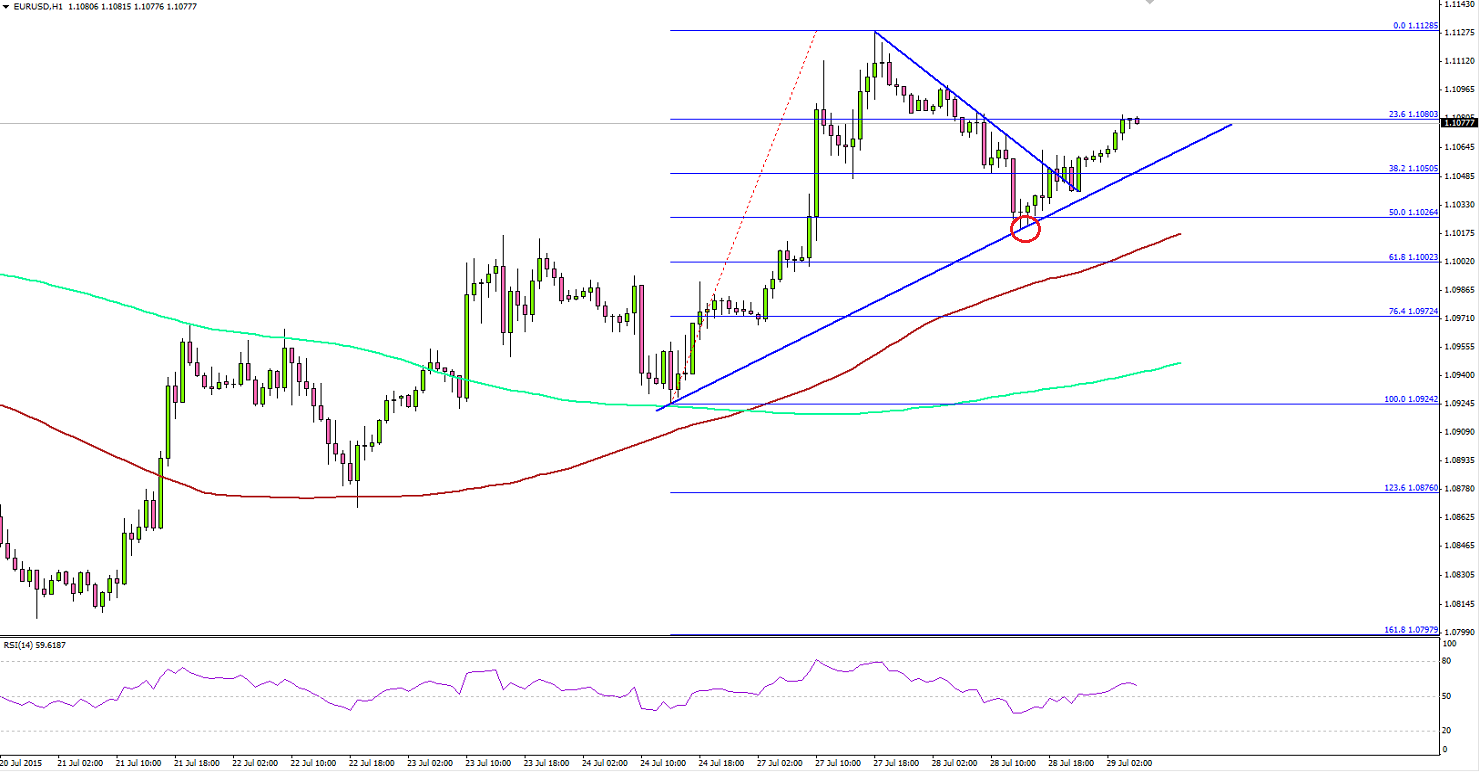

The Euro after setting a bottom around 1.0950 against the US Dollar traded higher and moved towards the 1.1100 resistance area. The EURUSD pair after topping around 1.1120 corrected lower, but found support around an important bullish trend line on the hourly chart. There was a bearish trend line formed as well, which was breached recently to set the pair for more gains in the near term.

There was a perfect rejection around the bullish trend line, as the pair bounced from the 50% Fib retracement level of the last wave from the 1.0924 low to 1.1128 high. So, we may assume that the pair completed a short-term wave and it is likely to continue trading higher in the near term.

The EURUSD pair has started to move higher once again, and it looks like the pair might trade higher and create a new weekly higher moving ahead. On the downside, the highlighted trend line may continue to act as a support and could push the pair higher. A break below the trend line might take the pair towards the 100 hourly simple moving average.

Titan FX is registered and regulated in New Zealand under FSP388647. Our global headquarters and operational hub is located in Auckland, New Zealand.

Recommended Content

Editors’ Picks

EUR/USD flirts with 1.0700 post-US PMIs

EUR/USD maintains its daily gains and climbs to fresh highs near the 1.0700 mark against the backdrop of the resumption of the selling pressure in the Greenback, in the wake of weaker-than-expected flash US PMIs for the month of April.

GBP/USD surpasses 1.2400 on further Dollar selling

Persistent bearish tone in the US Dollar lends support to the broad risk complex and bolsters the recovery in GBP/USD, which manages well to rise to fresh highs north of 1.2400 the figure post-US PMIs.

Gold trims losses on disappointing US PMIs

Gold (XAU/USD) reclaims part of the ground lost and pares initial losses on the back of further weakness in the Greenback following disheartening US PMIs prints.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.