Key Highlights

There was a major even this weekend in Greece, as the Greek government rejected Euro group proposal, which ignited a downside pressure on the Euro.

Euro tumbled against a basket of currencies, including the US Dollar, Swiss Franc and the British Pound.

There are gaps for almost each Euro pair, which says all about the amount of pressure on the shared currency.

Today, the German consumer price index will be released by the Statistiches Bundesamt Deutschland, which is expected to increase by 0.1% in June 2015.

EURUSD Technical Analysis

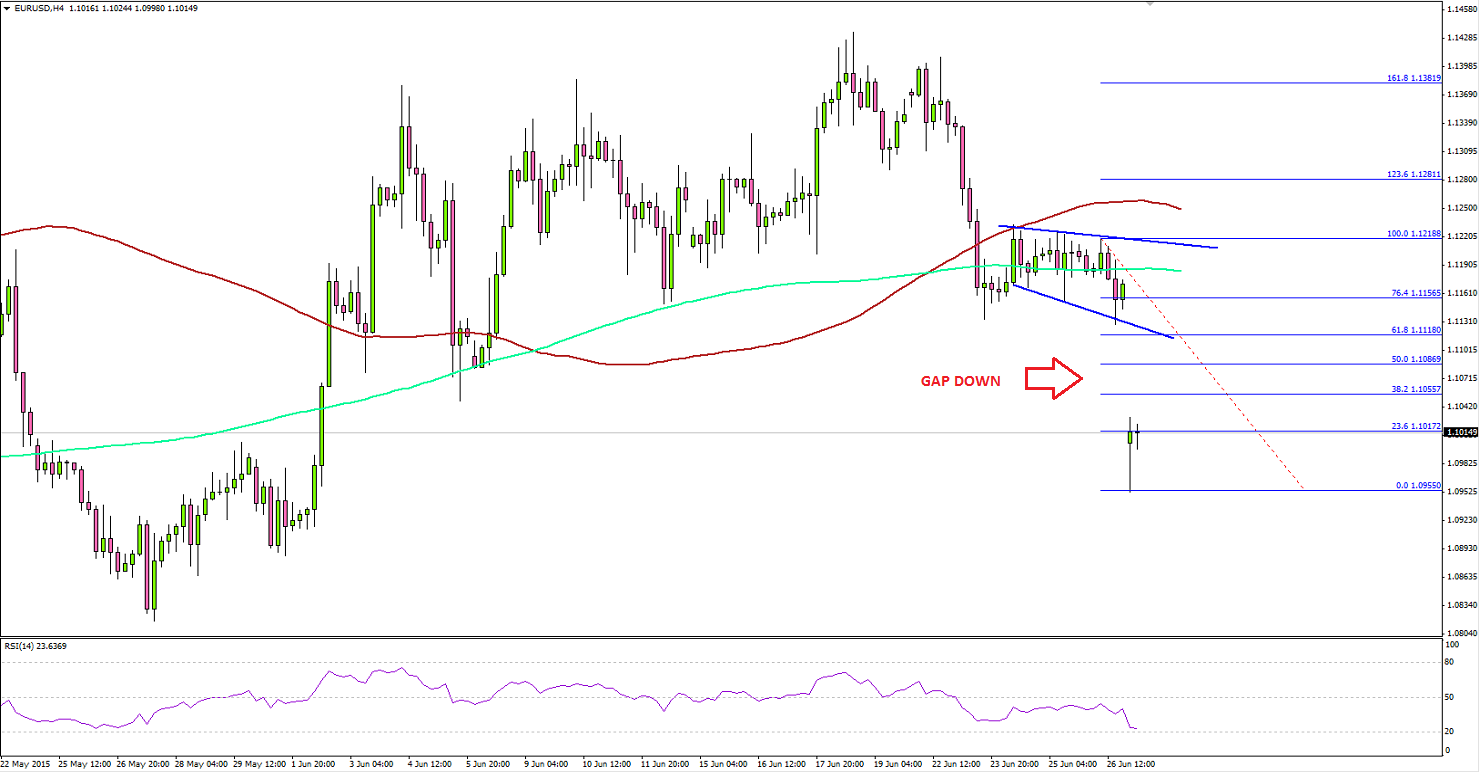

The Euro suffered heavy losses during the Asian session, as the Greek government rejected Euro group proposal, which poses a great threat. The EURUSD opened the week with a major gap lower and traded as low as 1.0955 where there were buyers. The pair is currently correcting higher, but finding sellers around the 23.6% Fib retracement level of the last leg from the 1.1218 high to 1.0955 low.

It would be very difficult for the Euro buyers to take the price higher in the short term. There was an expanding triangle formed on the 4-hour chart, which was broken recently to clear the way for more downsides. Moreover, the pair is below the 100 and 200 simple moving averages, which may perhaps act as a resistance later. Let us see how far the pair can correct, as the next level of selling interest could be around the 38.2% Fib retracement level, followed by the 50% Fib level.

On the downside, the recent low of 1.0955 is a support area, followed by the 1.0920 level. Any more losses might depend on how the things shape up in the Euro zone.

Titan FX is registered and regulated in New Zealand under FSP388647. Our global headquarters and operational hub is located in Auckland, New Zealand.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.