Key Highlights

Japanese yen was seen consolidating against major currencies after the industrial production report.

Japanese Industrial Production released by the Ministry of Economy, Trade and Industry posted a decline of 3.4% in February 2014, which is lower than the last gain of 3.7%.

USDJPY trading above the all-important 119.00 support area where sellers might struggle if the pair moves lower.

Japanese Industrial Production

Earlier today, the Japanese Industrial Production, which gauges the outputs of the Japanese factories and mines and is a major indicator of strength in the manufacturing sector was released by the Ministry of Economy, Trade and Industry. The outcome was on the disappointing side, as the Japanese industrial production registered a decline of 3.4% in February 2014, which was negative when compared to the preceding increase of 3.7%.

Technical Analysis

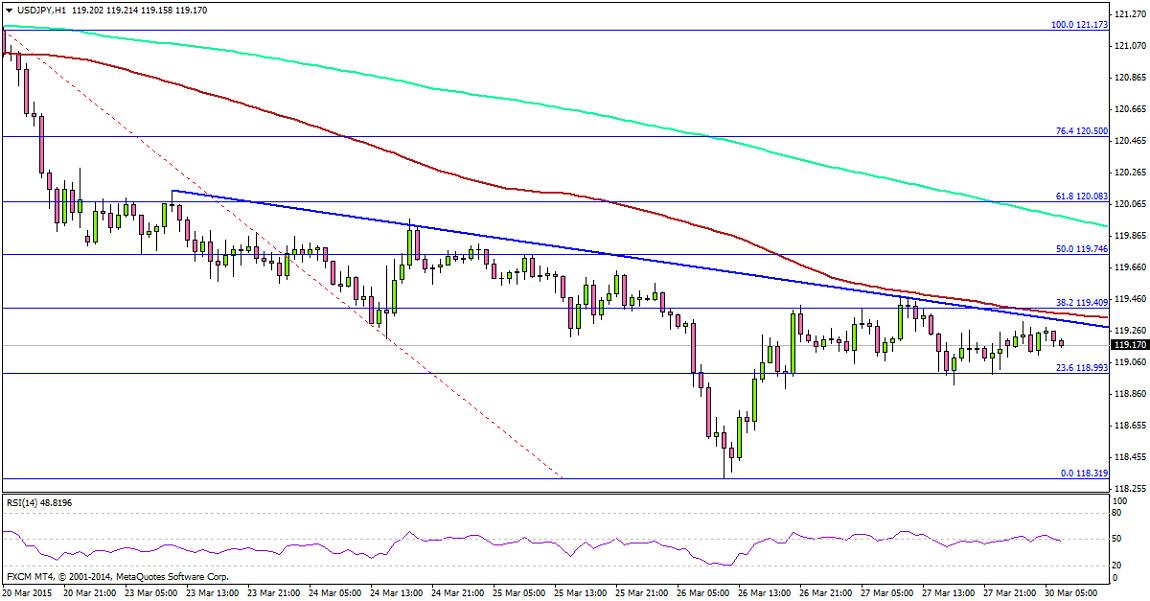

The US dollar buyers continued to gain strength against the Japanese yen, but every time the USDJPY pair trades higher it finds sellers. There is a critical bearish trend line formed on the hourly chart of the USDJPY pair, which is acting as a resistance for the pair on the upside. Moreover, the 100 hour simple moving average is also aligned around with the same trend line.

Furthermore, the 38.2% fib retracement level of the last leg from the 121.17 high to 118.31 low is also positioned just above the highlighted trend line. So, we might say that there is a major barrier forming around the 119.40 area where the US dollar buyers might struggle and the pair could find it tough to break higher as long as the trend line is intact. Only a break and close above the same might take the pair towards the 50% fib retracement level.

Titan FX is registered and regulated in New Zealand under FSP388647. Our global headquarters and operational hub is located in Auckland, New Zealand.

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Ethereum continues hinting at rally following reduced long liquidations

Ethereum has continued showing signs of a potential rally on Tuesday as most coins in the crypto market are also posting gains. This comes amid speculation of a potential decline following FTX ETH sales and normalizing ETH risk reversals.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.