Historically, the first trading session after a U.S jobs report tends to be the quietest trading session of the month. Yet, watching intraday asset price moves for 2016, no one could speculate with confidence that any trading session would be relatively tame.

Overnight, Asian equity markets are modestly higher with limited participation, as China/Hong Kong indices were closed for a holiday. Nevertheless, expect investors to be digesting Friday’s solid U.S jobs – one that saw the change in non-farm payroll (NFP) beat expectations and hourly wages recover February’s poor showing. The unemployment rate did tick a tad higher to +5% on an expansion in labor force.

Despite this week threatening to settle down to ‘range’ trading, there are a number of worthwhile events that investors should circles on their calendar over the next five days.

The Reserve Bank of Australia (RBA) and Reserve Bank of India (RBI) will announce their respective monetary policy decisions. Governor Stevens is expected to leave the Aussie policy unchanged while the RBI is expected to cut rates.

Stateside and in Europe, the main events will be the Fed and the ECB respectively publish their minutes from their most recent policy meetings. Also from Europe, merchandise trade and industrial production data will be released along with services and composite PMI’s for March.

1. Aussie hit by a string of weak data

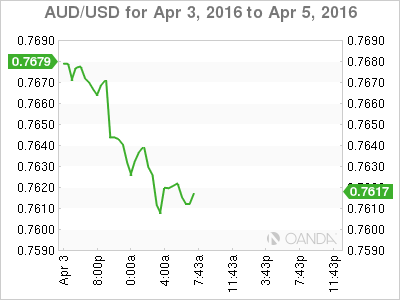

A number of softer economic Aussie releases overnight had the AUD (A$0.7623) on the back foot for most of the session and revived talk of an interest rate cut this year.

Domestic retail sales figures came in flat m/m (0.0% vs. +0.4% e), and up +3.7% y/y – the weakest annual growth rate in three-years. Other Aussie data was more kind; building approvals growth topped consensus, but it did not offset the January big drop, while ANZ jobs ads returned to positive territory (+0.2%).

The policy-making board of the RBA meets Tuesday, with traders putting close to zero expectation on a cut. However, the next meeting in May will take in reviewed forecasts for inflation, growth and employment. Another month of soft data, coupled with more gains by AUD, could bring the RBA “off the sidelines” for the first time in a year.

2. Japanese inflation expectations fall

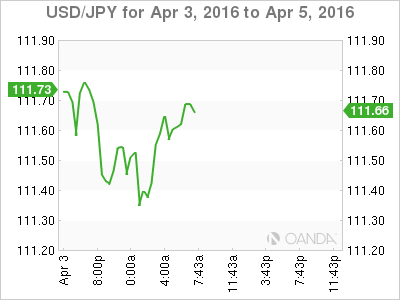

More data from the Bank of Japan’s (BoJ) Tankan survey revealed that Japanese corporates are reducing their expectations for inflation with a 1-year time horizon to just +0.8% from +1.0%. Their three-year outlook was cut to +1.1% from +1.3% and their five-year to +1.2% from +1.4%.

Government spokesperson Suga reiterated that only a “catastrophe on the scale of global financial crisis or a natural disaster” would lead to postponing the governments second round of consumption tax increase and this despite a Yomiuri poll indicating that +65% of respondents do not support the sales hike to +10% scheduled for April of next year.

There is talk that PM Abe is preparing to outline the specifics of frontloading FY2016 budget at a cabinet meeting tomorrow.

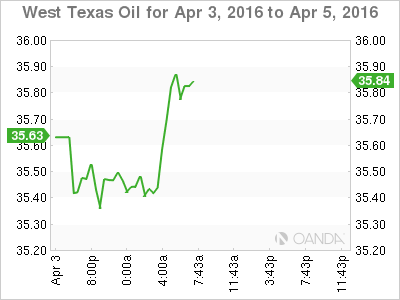

3. Crude in trouble over doubts on output freezes

Dealers and investors again are losing faith in crudes recent rally. Global fundamentals just do not support oil prices. Perhaps more importantly, doubts are growing over whether the major producers will be able to agree on an output freeze in Doha on April 17.

Both WTI and Brent retreated last week (-4%) for the first time since mid-February and remain on the back foot starting this week.

Crude had rallied (+44%) from its thirteen year low on a proposal by the Saudi’s, Russia, Venezuela and Qatar to cap oil output and reduce a global surplus.

Not helping the oil ‘bulls’ is Iran indicating that they would attend the talks, but have ruled cutting production – they want to continue to produce until they can restore pre-sanction levels. While the Saudi’s Crown Prince Mohammed bin Salman said that his country would freeze their output only if “Iran and other major producers do as well.”

It seems that if an agreement could be reached to freeze output without Iran in Doha, it would not amount to anything.

Futures positions indicate that speculators are again adding to their ‘short’ positions and this after the liquidation of record ‘shorts’ position that were squeezed in the +44% rally over the past two-months.

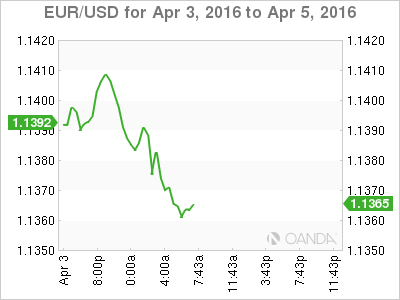

4. Eurozone jobless rate continues its slow decline

The EU’s unemployment rate fell in February to +10.3% from +10.4% in January, hitting its lowest level in five years. January print was revised higher from +10.3%.

Today’s release reflects a very modest -39k fall in the number of people without jobs to +16.6m across the 19 member countries. Analysts note that despite the steady drop in the headline print since it peak at +12% three-years ago, the eurozone jobs market remains “very weak by international standards.” Last Friday’s non-farm payroll (NFP) showed an unemployment rate of just +5%.

5. Emerging market strength persists

In the overnight session, the Malaysia’s ringgit (MYR) rallied for a sixth consecutive day, hitting an eight-month high of MYR3.8700 vs. the U.S. dollar.

Asia’s top performing currency this year (+10.9% outright) continues to show strength despite a drop in crude oil prices. Historically, lower oil prices tend to provide pressure to MYR due to its impact on Malaysia’s oil export revenues.

For the time being, the general bearish-USD theme is providing emerging market support as speculators continue to unwind the dollars rate differential premium.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.