It’s the first Friday of a new month and that means only one thing – it’s non-farm payroll (NFP). All eyes will be front and center when January’s U.S monthly jobs report is released in a few hours.

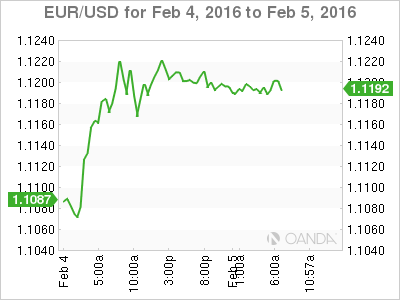

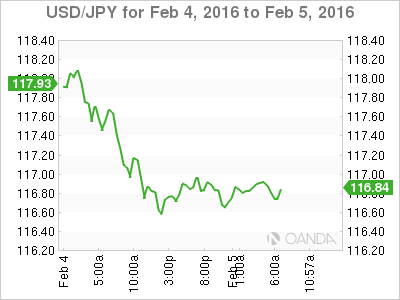

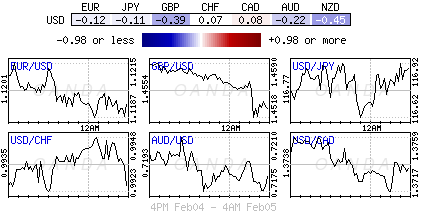

The NFP headline print will round off a week that has seen the USD come under considerable pressure-Wednesday was the worst trading day for the ‘mighty’ buck in seven-years with the dollar index falling just under -2%.

Every employment report is touted for various reasons as being important and this one is no different. Today’s payroll is being released amidst unsettling market volatility that is increasing financial insecurity that could potentially derail the U.S economy’s efforts to date.

As per usual, investors and dealers will be searching for clues for any re-pricing of Fed policy expectations.

Capital markets needs a boost in confidence. It requires a solid report that indicates that the U.S economy remains healthy.

This week alone, a couple of U.S “growth scare” indicators (weaker inflation expectations) has the market questioning Fed policy. A percentage of the market believes that Ms. Yellen and company is being too aggressive in their monetary tightening expectations.

From a utopia perspective, today’s report requires three specific “prints” to convince the market that the U.S recovery, albeit tepid, remains on track. Any healthy combination of the three would go a along way to reduce the current market speculation that the Fed is about to do a U-turn and change monetary policy and join the NIRP brigade. If nothing else, a healthy read will keep the door ajar for a Fed rate increase next month – something that the market disagrees with.

When it comes to the report do not just look at the headline print – the details and backwardation is just as important.

1. Headline: An NFP with a headline print of +180k or more will indicate that the Fed does not need to worry too much about the U.S’s labor market conditions just yet. A ‘big’ miss either side of expectations will only heighten market volatility. Anything close to expectations and this market may want to close up ‘shop’ for the week early.

2. Wage Growth: The U.S needs to move the needle on wages. Long-term inflation expectations are the lowest since the 2008 (U.S 2/10’s is the flattest it has been since 2007). Average hourly earnings need to show a monthly gain of +0.2% and then some. December’s reading was flat. Anything positive will have the fixed income dealers repricing current yield curves rather quickly. (Several U.S states increased wages in January)

3. Participation rate: It still hovers near historical lows – 62.6%. It’s healthy to see it edge higher, even if it does happen to push the unemployment rate up (+5%). It would be considered a positive indicator for the U.S economy.

Ideally, all three or a strong combination, would suggest that the U.S economy is not in danger of derailing any time soon, well at least until next month. A healthy print would instill some much needed market confidence, confidence that has so far taken a massive hit in 2016.

Any optimistic data will obviously favor the dollar – the surprise support for the EUR, GBP or JPY will come from a much weaker headline or deeper revisions. Anything close to expectations and we will have a market keen to shut up shop early.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.