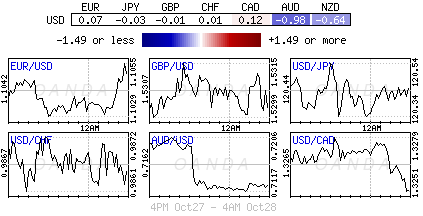

Central banks are making it rather boring for speculators at the moment. The majority of G7 policy makers have upped the dovish rhetoric by talking their own books and successfully walking their respective currencies lower. However, most of these underperforming currencies are trading in a confined range, and certainly in an orderly fashion that is making it rather boring. Many of these central banks have been reluctant to preempt the Fed, who, under Ms. Yellen’s guidance, has managed to successfully send out mixed messages about the Fed’s first-rate hike in nearly a decade.

Will that all change today? Later this afternoon (Wednesday 2pm EST) the Federal Open Market Committee (FOMC) will announce its latest monetary policy update. It’s expected that U.S policy makers will put out a statement that will once again not include a rate hike. Nevertheless, investors will be looking ahead to any new hints of rate liftoff from the FOMC decision. The lack of press conference and staff targets does not make it any easier for Ms. Yellen and company to make any bold moves, and this despite all members insisting that all meetings are “live”. The Fed has only their statement to guide markets. Assuming rates on hold, the best-case scenario for the investor is that the Fed will clarify how close it is to tightening after last months surprise hold. It’s unlikely that much will be change from the September statement, maybe a tweak or two on developing international factors.

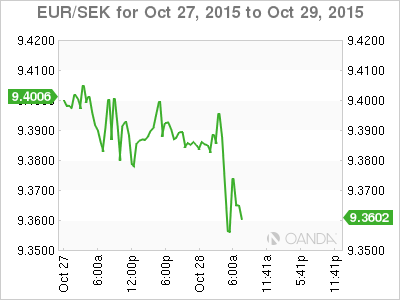

Sweden’s Riksbank expands its QE bond-buying program by SEK65B: Nowadays, its inflation and outside variables that are the go to phrases for central bankers. So its not a surprise that Sweden’s Central Bank has cited risks to their inflation and “considerable uncertainty” about the global economy that has warranted a change to their QE program. Mind you, a dovish European Central Bank (ECB) and the imminent risk for SEK (€9.3632) appreciation require the Riksbank to be proactive. Governor Stefan Ingves reiterated that they could cut the Repo Rate further (-0.35% which they kept on hold this time around, but instead extended their QE program further out-Q2 2016) and would maintain a high level of “preparedness to act quickly”. The governor also stressed that they could intervene in FX market if necessary. Fixed income is pricing in another -10bps cut to the RR in December. EUR/SEK was +0.5% higher near €9.44 level on the announcement, but has since reversed.

New Zealand: Despite the significance of the Fed’s decision today, Australasian central banks have been front and center in the overnight session. The NZD (N$0.6732) is slightly weaker, but remains range bound ahead of the Reserve Bank of New Zealand (RBNZ) rate decision two-hours after today’s FOMC announcement. Median market expectations are for Governor Wheeler to remain on hold (+2.75%), but with a +16% chance of a rate cut. Despite New Zealand inflation remaining very subdued, which certainly justifies a lower rate policy, the significant recovery in global diary prices recently would suggest that the RBNZ has time on its side. (All Blacks by 12 on Sat)

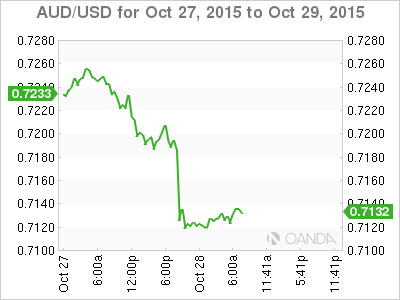

Asian data opens the door for more possible easing: Other data overnight would suggest that policy implications for both the Bank of Japan (BoJ) and the Reserve Bank of Australia (RBA) have been tilted in favor of further easing. In Japan, retail sales disappointed (+ 0.7% vs. +1.1%e, y/y), while down-under it was softer than expected Q3 CPI data (+0.5% vs. +0.7% q/q, +1.5% vs. +1.7% y/y) that has fixed income dealers adjusting their rate curves. The probability of the RBA easing next week is now trading above +50%. USD/JPY managed to print its best levels on their retail sales release (¥120.50), while the Aussie fell to a new three-week low (A$0.7115) before consolidating ahead of the Fed decision. There are a number of independent reports out of Japan that are speculating that the BoJ will likely have to push back the date of achieving its +2% CPI target beyond the H1 of 2016 currently expected.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.