IMF applies the pressure: Not a surprise to many, Ms. Lagarde and co. have again cut their outlook for global economic growth. They have trimmed their July forecasts to +3.1% from +3.3%, mentioning falling commodity prices, tumbling EM currencies and global financial instability as the reason for the downgrade. The IMF officials (along with the World Bank) continue to be vocal in advocating that the Fed should not consider raising rates until growth picks up. Hence the odds for a 2015 Fed hike continue to fall (Oct. +3% and Dec. +22%).

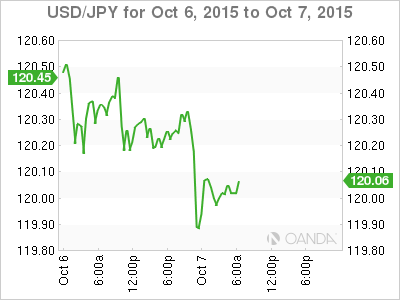

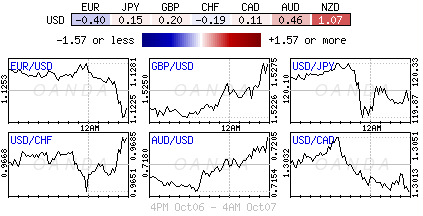

BoJ takes a stand, but does not deliver: The yen is on the rise (¥120.04) across the board after the Bank of Japan (BoJ) kept monetary policy unchanged overnight and Governor Kuroda struck an optimistic note about their economy despite recent weakness. The BoJ declined to offer any additional monetary policy easing hints and surprisingly maintained its economic assessment on the broader economy. Few were expecting expanded QE, however the market was leaning towards further monetary easing happening in late October, pressured by weak economic data and flagging inflation. The no-change outlook in all sectors would suggest that fixed income would need to pare back QE timing. Former MoF official Sakakibara has suggested QE may actually arrive in December.

Commodity currencies find much needed support: Commodity and interest rate sensitive currencies have been some of the hardest hit pairs over the summer. If it has not been global growth concerns, it’s been the price of crude that has pushed the pairs to test their multi year lows. However, so far in the month of October that cycle seems to be have been broken. With WTI crude oil prices rallying to their best levels since late August yesterday (+6% $49.50) has the loonie bulls testing the psychological $1.3000 handle. Geopolitical concerns, a weaker USD, short covering positions, and API crude inventories shrinking by -1.2M have all been cited as factors for crude support. But, with the IMF cutting global GDP are oil prices sustainable?

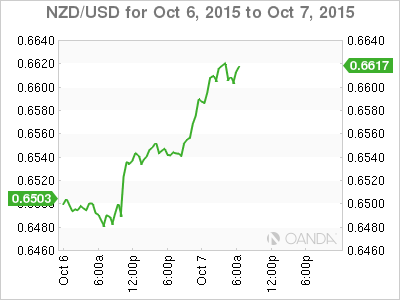

Milk is good for NZD: The Kiwi (N$0.6606) is finding its support on the farms. NZD has rallied to a two-month high boosted by a solid rise in dairy prices. In the overnight GlobalDairyTrade auction (GTD Index) prices rose +10%. With global dairy demand somewhat subdued and “El Nino” drought of only ‘moderate severity,’ the continued dairy support will be a longer-term issue. The Kiwi’s regional partner in crime, the AUD (A$0.7202) has found support this week from two sources, one a “neutral” Reserve Bank of Australia (RBA) decision on Monday and two, a softer yen is helping the AUD to stay near its three-week peak.

What was all the fuss about? Data overnight revealed that China’s forex reserves dropped at a slower rate last month (to $3.514T, down only -$43b m/m from -$93b previously). This would suggest that China’s capital outflows (hot money) problems might have somewhat stabilized. Foreign investment fleeing EM will require aggressive Central Bank policing and People’s Bank of China (PBoC) in particular has been required to inflate the yuan aggressively ever since it devalued their currency in August. The market will take this as a positive signal that China’s economy is stabilizing.

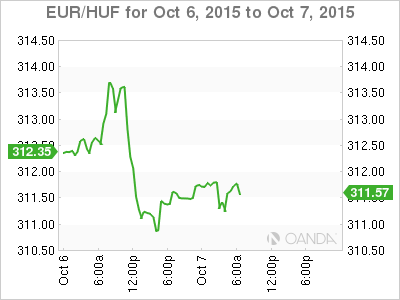

Being proactive and innovative is a prerequisite: The Hungarian central bank (MNB) will set a flat +2% mandatory reserve ratio for retail banks beginning in December. Previously, retail banks adhered to an optional 2-5% ratio. This will force banks to shift liquidity out of CB instruments and into Hungarian government bonds. It would be considered a quasi-QE initiative. By changing up the balance sheet, policy makers will be artificially manipulating the HUF yield curve – higher bond prices, lower rates. With lower Hungarian yields would be considered forint negative (EUR/HUF €311.56).

Range bound pitfalls: With the lack of new trading cues, the EUR is in danger of being stuck in a tightly contained trading range for most of Q4. So far, €1.1100 and €1.1500 are not under threat. The single unit movements have more to do with risk-on or -off trading strategies (directionless trades) rather than CB influence or fundamentals. Just look at its recent display as a safe haven asset – the EUR advanced to €1.1279 after the downward revisions to global growth by the IMF. EUR bulls should perhaps focus on Volkswagen. Whatever penalty and costs they will have to burden will have a material impact on Europe’s largest economy and eventually the EUR.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.