The forex space continues to play second fiddle to plummeting equity markets. Despite a plethora of U.S policy makers on tap this week, any FX moves to date remain relatively contained, but driven by risk aversion trading strategies. The market is very much at odds with the Fed’s timetable on rate normalization. Investors are been told year-end, but the U.S curve would suggest that they do not hear this.

Fed “needle” stuck on repeat rhetoric: NY Fed Governor Dudley repeated his boss’s pledge that rates would still rise this year (Yellen is due to deliver opening remarks at the Fed’s annual community banking conference, in St. Louis tomorrow afternoon). Dudley yesterday reiterated familiar talking points about the transitory nature of low inflation, China and other international developments as the main source of concern for the U.S outlook. Currently, Fed-funds futures are indicating a +14% probability of a rate increase in October, up from +11.5% on Friday, and a +41% chance of a hike in December, up from +39%. Expect the market to begin to shift its focus to the leadership transition in the House. Fixed income dealers are tentatively beginning to price in the issues of the U.S debt ceiling or potential government shutdown later this fall to tie the Feds rate hands.

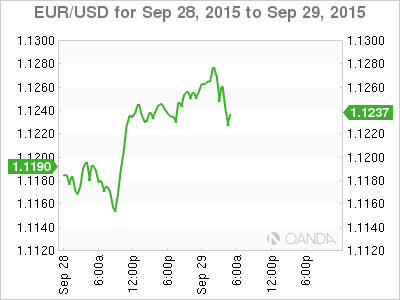

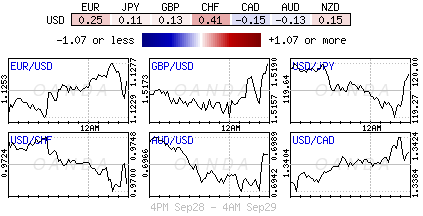

Feds limited impact: The USD’s boost off a ‘hawkish’ Fed Dudley yesterday (a U.S Fed rate hike this year was very much on the cards) was relatively short lived and quickly trumped by risk-off trading strategies that favor the Euro, Swiss and Yen safe-haven buying. With short-term euro resistance near €1.1275/80, a break with momentum topside will clear a technical route to €1.1300-30. The markets do not expect a broader breakdown of €1.1085-1.1450 range ahead of Friday’s non-farm payroll (NFP).

An array of Fed opinions: Fed talk continued late in yesterday’s U.S session. Evans (Chicago) remarked that the Fed should do three +25bp moves by the end of next year, while moderate voter Williams (San Francisco) reiterated liftoff would still be appropriate this year. Williams did acknowledge that inflation is still below preferred levels, though unemployment would fall below +5% later this year and remain there through 2016. Similar to Dudley, the market reaction was non-eventful.

Buck cannot buy a break on data: Mixed U.S data growth yesterday did little for the dollar. U.S personal income and spending data was relatively good, with the latter supported by a strong month of auto and back-to-school buying. The Fed’s go to inflation gauge, the PCE price index, again is offering no evidence that inflation stateside is about to surge close to the Fed’s +2% target. It was unchanged last month – +0.3% m/m and core PCE +1.3% y/y.

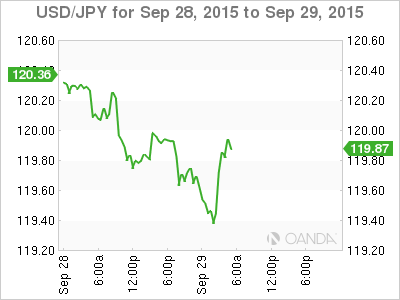

Chinese data this week is crucial for risk appetite: Unsettling Chinese data points yesterday (August industrial profits down -8.8% y/y, for the biggest monthly decline since 2011) continues to put pressure on global equities. Dealers are now looking to Thursday’s China Caixin PMI for guidance. Any further negative repercussions will lend weight to further JPY, CHF and EUR buying.

September wipeout: In Europe, shares of Volkswagen and Glencore (Anglo-Swiss mining company) remain in free fall, and adding negative weight to the broader equity market September meltdown. Glencore is down -30% this week, as a few analysts note that persistent, weak commodity prices could wipe out all of the company’s equity value. For the German auto industry, things are only getting worse – Audi has apparently +2m cars fitted with similar VW emission deceptive devices.

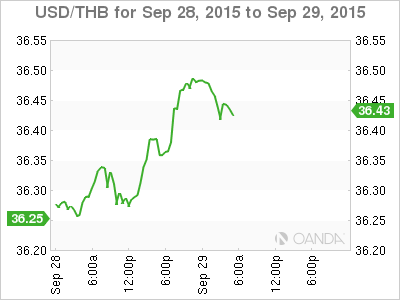

The EM rout has investors worried about capital controls: Recent moves by Nigeria and China authorities to clamp down on currency and equity markets is certainly raising some market fear that other struggling emerging economies may follow suit and curb capital movement as a way to stem the exodus of money from their domestic system. Already, a number of governments are restricting citizens’ ability to move cash. Foreign investors fear they are next. Chinese authorities have been manipulating their own currency rate higher ever since the yuan devaluation in August for fear of mass exodus of foreign capital. Outflows from emerging stock and bond funds near +$100b year-to-date, and if the Fed does stick to its rate normalization time table then capital flight is again expected to pick up momentum. In overnight trading MYR slid -1% to reaches its lowest level ($4.4770) in 17-years. The SGD hit a six-year low ($1.4335) while THB printed an eight-year low ($36.50).

India feels Chinese pressure: The Reserve Bank of India (RBI) lowered interest rates more than expected to bolster the economy as China’s slowdown threatens global growth and a commodity rout contains inflation. Governor Rajan cut the benchmark repurchase rate by -50bps to +6.75% (the market had been expecting a -25bps cut).

Beware of month-end shenanigans: Some dealers are expecting a number of intraday price moves to go unexplained. Expect a number of the distorted currency moves to be chalked to month-end pent up demand.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.