Market awaiting Greek rhetoric

Aussie capital expenditure disappoints

Fonterra optimism aids Kiwi farmers

No Japanese comment on dollar’s rise

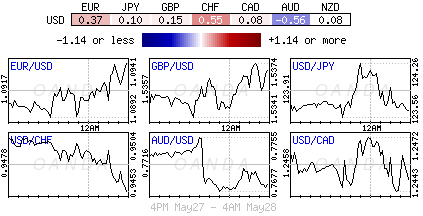

Currently, capital markets are beholden to any rhetoric from Greece, albeit rumor or hard fact. Any instrumental headway on Greek creditor talks has pushed sovereign bond yields higher, given the equity markets a nudge, and the EUR some life. That was the immediate reaction to yesterday’s agreement rumor between Greece and its creditors. From a fundamental standpoint, there are very few economic touch points to rely on to sway currency moves at the moment. The relatively contained intraday dollar moves are more about positioning, a few option expiries, and the market questioning the sustainability of multiyear technical support and resistance levels for the yen outright.

Most of this week’s focus thus far has been on euro-related product moves, but in the overnight session, the Aussie, Kiwi, and yen certainly kept rate and currency traders busy.

Aussie Growth Projections Questioned

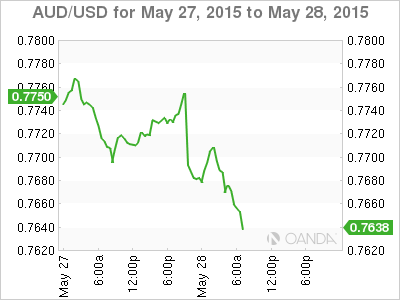

Heading stateside, the AUD (A$0.7670) is trading much lower this morning on overnight news of a sharp fall in projected business investment in the coming fiscal year. First-quarter capital expenditure (capex) contracted for the second straight quarter and at a much faster pace than had been anticipated. The data showed that companies are expected to cut investments in the fiscal year starting July 1 by -24.6%, year-over-year. Any reduced expenditure will be expected to have a material impact on economic growth forecasts, and in turn, have an impact on overnight rates. The weakness in investment is due to the dramatic downturn in the resource industry. Like other commodity-sensitive economies, the Aussie’s resource boom has petered out, and is sapping investor confidence. This will make the Reserve Bank of Australia’s (RBA) job more difficult and its next move most important. To date, the RBA has slashed rates to a record low (+2%) to counter the impact of a crumbling mining industry, and the impact thus far has been rather limited.

Poor capex data is a boost for rate doves advocating another RBA cut. Governor Glenn Stevens cut rates earlier this month to follow last February’s cut, however next week’s rate meeting probably comes too early for most, and policymakers are expected to stand pat on rates. The RBA has to move with caution because of an overheating housing market. However, the fixed-income market is pricing in another -25 basis point rate cut by year-end, with August being month of choice. Yet, it’s anticipated that Aussie policymakers will need to reintroduce an explicit easing bias, maybe as soon as next week, and this will keep the AUD on the back foot for some time.

Under an easing bias, technical analysts expect to see a full retrace by the AUD to its six-year low at A$0.7534 (last touched in early April). Nevertheless, the currency has a lot of wood to chop before that — strong support levels technically appear at A$0.7650 and $0.7625. Still, there is a very large option expiry this Friday. The size of the strike is estimated at A$1.7 billion, and the market will be expected to gravitate toward it.

Kiwi Dairy Farmers Aid currency

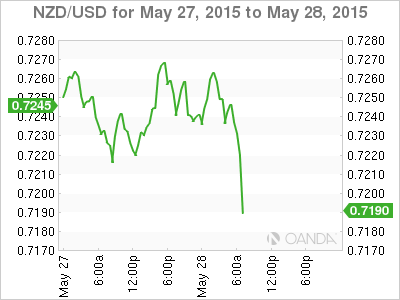

Across the Tasman Sea, the Kiwi dollar is being driven mostly by moves made by Fonterra, the world’s largest dairy cooperative, which cut the price it will pay New Zealand’s dairy farmers for milk.

Fonterra reduced its milk payout forecast for the current year by NZ10-cents to NZ$4.40 per kilogram, but announced its 2015/16 payout target at NZ$5.25 per kilogram. The result of this news has Kiwi dollar suffering from whiplash price moves.

The NZD/USD initially fell -30 pips on the announcement to NZ$0.7215 but then reversed all of those losses to trade as high as NZ$0.7270 on forward-looking optimism. Fonterra’s chairman said a “rebalancing of supply and demand should take place over the season, leading to sustained price improvement.” The upbeat forecast, coupled with a potential easing bias from the RBA, should support the NZD on the AUD/NZD cross ($1.0583). However, like most Group of 10 currencies, the Kiwi’s outright gains should be tempered by the positive “big” dollar sentiment and Federal Reserve rate expectations.

Yen: A Move Too Far?

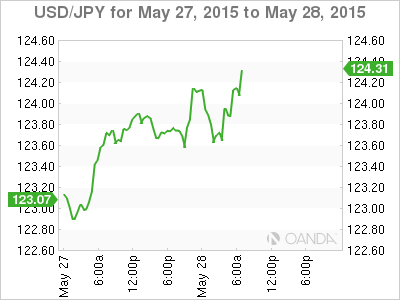

The USD hit its highest level against the yen in a dozen years this morning (¥124.24). This week’s move has been rather impressive and has the market is taking note. For months, JPY has been trading in a contained and rather boring range against the dollar. From a rate divergence play, the JPY has underperformed the go-to currency play, the EUR/USD (€1.0934). The single unit has lost almost -10% year-to-date, while JPY has lost only -2.5% outright, with most of that loss occurring in the past two weeks.

This week’s USD/JPY acceleration higher is significant — now that the market has broken through its psychological ¥124, the currency pair is now encroaching on some important multiyear resistance levels. The pace of the gains is putting the market on alert for any signs of discomfort from either U.S. or Japanese officials. Any verbal rhetoric, especially at such lofty heights, could have a swift and material impact. So far, any USD pullbacks have been well bid for by the market (¥123.55-65). The concern is that the dollar’s rapid gain this week has come despite the lack of fresh trading clues from fundamental releases. The move higher has been pushed mostly by the rate divergence trading strategy — confidence in future U.S. growth.

Overnight, Bank of Japan Governor Haruhiko Kuroda reiterated that Japan is on track to achieve its +2% inflation target in the first half of this year. Regarding the yen, he noted that the market reflects fundamentals of the U.S. being the most robust economy at this time, but he made no comments on the buck’s rapid rise.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.