Rate divergence trade trends again

ECB in direct conflict to “trade of a lifetime”

FOMC minutes to provide direction for dollar supporters

BoE not worried about deflation

The rule of thumb is that central banks prefer not to be seen as interfering with markets unless they are out of sync with fundamentals or preventing policies from being effective.

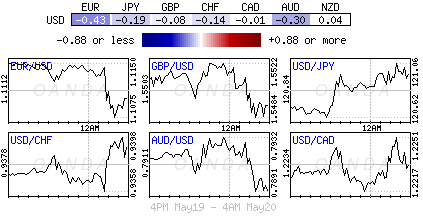

The recent global bond rout would suggest that both investors and dealers were in direct conflict to the Federal Reserve and European Central Bank’s (ECB) monetary policy objectives. Basically, the rate divergence-trading theme that had been supporting the USD was systematically being broken down as German Bund yields rallied aggressively (from +0.05% to +0.80%) and the Treasury-Bund spread narrowed (+183 basis points to +154 basis points).

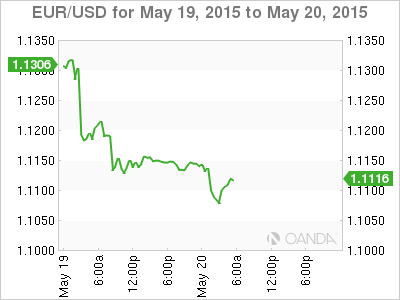

EUR Seeks “Fair Value”

The comments yesterday from ECB’s Benoit Coeure could be considered as a well-timed intervention that will help stabilize the Eurobond market, and stop the tightening financial conditions that were becoming more of a market mainstay of late. The EUR plummeted (€1.1423 to €1.1083), while euro stocks and bonds surged on the prospect that the ECB will ramp up asset purchases in May and June. In effect, the ECB wants to keep short-term yields lower and it will do this by being flexible along the curve. The bank will likely absorb sufficient supply from governments and the market to allow 10-year Bund yields to fall all the way back to around +0.40/0.45% (spiked to a high of +0.80% early last week from +0.05% six weeks ago). The 10-year Treasury-Bund yield is also sharply higher this morning (+168 basis points) having bounced from +150 basis points last week.

This is seen as a proactive move by the ECB, confirming again that it is willing to do anything to keep rates lower. It’s effectively an increase in the size of quantitative easing (QE), even if it’s only for a short period of time. The fact that Coeure also mentioned the ECB’s intention to fully complete QE to achieve its inflation mandate has some hedge funds backing away from the “trade of a lifetime” (shorting European sovereign debt at or close to zero interest return in direct contrast to the ECB’s QE purchase program) for the time being.

Greece Robs “Peter to Pay Peter”

The 19-member single unit continues to lean on the back foot, straddling the psychological €1.1100 handle this morning, with pressure again being applied from Greece’s payment schedule. The EUR hit fresh monthly lows at €1.1062 as Greece hardens its negotiating stance by threatening to withhold its next IMF payment. Nevertheless, the key support area has held for now, with the pair remaining locked into the lower end of its recent weekly range.

To the market, it’s not a surprise that the Greek government is warning again that they could miss a payment – the June 5 IMF one. Last week their actions highlighted the precarious nature of their financial situation. Greece raided their reserve accounts at the IMF to keep to its current payment schedule. Basically the Greek authorities are applying not so subtle pressure to get their international creditors to bulge from current demands.

Nonetheless, the IMF does not scare easily, they, like anyone else, want a permanent deal to ensure sustainability, and the ECB will not be drawn into a political battle. Neither entity can afford to be the instigator that pushes Greece to trigger Grexit, but the cash has run out.

FOMC Minutes to Drive Dollar Direction

Fed officials are open but not necessarily transparent when it comes to discussing the timing of the first rate hike — they are leaving that decision to economic data. U.S. policymakers have warned that a summer rate increase is not off the table. However, many investors seem to be betting that the central bank will not tighten until very late this year or possibly early 2016. Fed funds futures show investors and traders continue to see zero chance the Fed will tighten in June, with the likelihood for September standing at +22% versus 20% on Monday. December’s odds have risen to +55% from +52%, meaning market players essentially see a 50-50 chance of a liftoff in U.S. rates, waiting until next year. This afternoon’s Federal Open Market Committee (FOMC) minutes may give further insight into what Fed officials think with respect to the soft U.S. data of late. The market expects the minutes to attribute the majority of the slowdown to transitory factors, including unseasonably cold weather. The Fed will be expected to call for a near term pick up in U.S consumption. Last month’s FOMC report showed a more optimistic Fed and that gave the dollar an immediate lift.

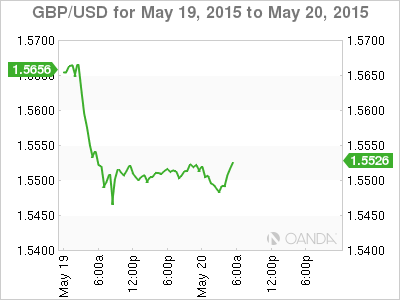

BoE Minutes: MPC Not Worried about Deflation

Sterling has gained almost half a cent this morning to a fresh euro session day high of £1.5541 after the BoE MPC’s May minutes came in on the hawkish side. Two members of the MPC made a finely balanced decision not to vote for a rate hike. The MPC voted 9-0 (expected) to keep rates and monthly asset purchases unchanged. The minutes reiterate the MPC’s view that the current weakness in inflation will be temporary and that inflation will pick up notably towards the end of the year (do not be surprised that today’s finely balanced voters will be voting for a rate rise before the end of the year).

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.