ECB members deliver single currency a massive blow

Bund curve flattens on front loaded comments

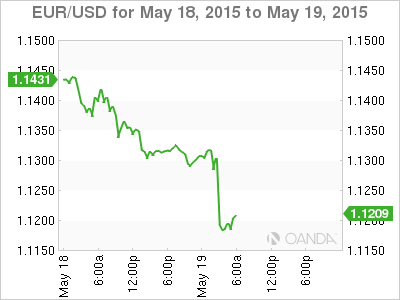

EUR breaks through psychological €1.1200 handle

BoE’s Carney not worried about deflation

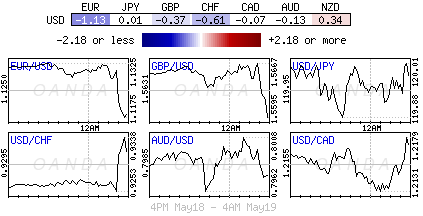

Last month’s Bund rout that caused yields to spike and Treasury-Bund spreads to tighten supported the EUR. Any comments that would flatten the Bund yield curve would have an immediate negative impact on the common currency. Last week, European Central Bank (ECB) President Mario Draghi fired the first warning shot across the EUR bulls’ bow, temporarily capping the single currency’s rise by reiterating that the ECB’s vast stimulus efforts will remain in place for “as long as needed.” Today, two other members have managed to deliver the euro a massive blow with more dovish comments concerning the recent reversal in bond prices and inflation expectations.

More ECB Warning Shots

Earlier this morning, ECB’s Coeure was able to deliver another hammer blow that has the EUR bull scuttling for the exits. He said that the central bank would moderately front-load its QE purchases because of less market liquidity in the summer, and that this move were not due to market conditions, despite the weakness in bonds being worrying. In effect, the ECB wants to keep short-term yields lower and they will do this by being flexible along the curve. They will likely absorb sufficient supply from governments and the market to allow 10-year Bund yields to fall all the way back to around +0.40/0.45% (spiked to a high of +0.80% early last week from +0.05% six weeks ago). The 10-year US/Bund is also sharply higher this morning (+168bps) having bounced from +150bps last week.

This is seen as a proactive move by the central bank, confirming again that they are willing to do anything to keep rates lower. It’s effectively an increase in the size of quantitative easing; even it’s just for a short period of time (May and June). QE is usually negative for currencies as it drives rates lower and reason why the EUR has managed to fall so aggressively this morning (€1.1438 to €1.1173). The fact that the ECB is willing to be so flexible within their own framework has investors wondering how much further the ECB will go to achieve their growth and inflation objectives.

Separately, and providing the U.S dollar a boost was ECB’s board member Noyer stating that the ECB was ready to go further if needed to meet its mandate of maintaining inflation close to but below +2%. He indicated that the ECB’s purchase program would continue until the end of September 2016 and beyond if the central bank does not see a sustained adjustment in the path of inflation. Effectively, activity slack remains an issue with the ECB.

The EUR’s subsequent break below €1.1314 uptrend line has opened the risk to test the 20DMA at €1.1160 and a break here will favor the EUR bear’s to once again test €1.1050 region rather quickly.

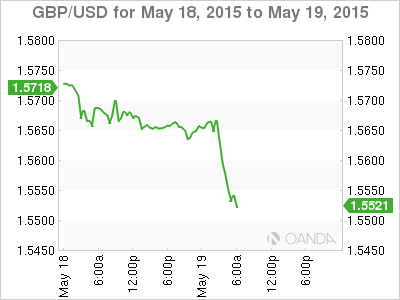

U.K: No Deflation Fears

The pounds post U.K conservative election relief rally win (£1.5816) seems to have come to a temporary halt, weighed down further by this morning’s negative U.K annualized CPI inflation number (-0.1% y/y). Sterling bears were squeezed after the surprise election results (market was pricing in a hung government), and now the bull is being squeezed on the way down. The pound has managed to breach its 200DMA (£1.5596), triggering further stop losses, and according to technical charts, a close below here would open up the downside for further losses (£1.5458 short-term target).

Nevertheless, the weakness of British inflation is expected to pass. Last week, the BoE indicated that they are doubtful that the U.K is at risk of experiencing “deflation.” Governor Carney expects the U.K inflation rate to rise back to its +2% target by early 2017, as wage growth accelerates and oil prices recover from recent lows. Note, the recent rise in crude prices, which are hovering close to this year’s high, is mostly on the back of a cut in production and a weaker U.S dollar, and not on traction in global growth.

Yesterday, the mighty dollar found its initial support when a published San Francisco Fed white paper argued that that issues with seasonal adjustments in the U.S’s official growth statistics had depressed winter figures, and that U.S Q1 GDP was actually much higher than initially estimated. This has managed to put the USD on the front foot against G10 currencies. Obviously, any dovish rhetoric from central bankers would only support the mighty dollar further.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.