Sweden’s Riksbank relies on QE, no rate cut

Dollar bulls feel the pressure

Investors look to FOMC statement for rate timing clues

BoJ and RBNZ no rate change expected

Today’s forex action will be dominated by Central Bank monetary policy announcements. The Fed, the RBNZ and the BoJ are expected to deliver a “no” change in interest rates, but as ever the accompanying statements will be the key for investors.

Earlier this morning, Sweden’s Riksbank decided to ease policy further. This time around the central bank is relying more on QE rather than a lower rate path – they prefer not to take the repo rate further into negative territory.

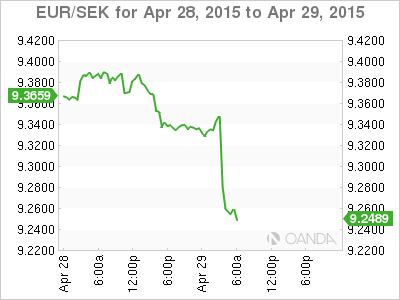

Swedish policy makers left its main policy rate unchanged at -0.25% (contrary to the consensus expectation of a cut), but more than doubled its government bond purchase programme, from a total size of SEK40b to SEK80-90b. They also lowered its forecast path for the repo rate to show rates unchanged until late 2016.

The option of moving between meetings has been kept open and after the surprise decision to ease policy in March the probability that the Riksbank could cut interest rates again in July should continue to seem very high to investors.

Currency Strength a No

The Swedish Krona (SEK) is again one of the key variables that have been a trigger for this morning’s easing (similar situation for the AUD and the RBA) – it’s deemed too strong for the Riksbank. They expect that expansionary monetary policy will contribute to the SEK “remaining at a weaker level for a longer period of time.” Therefor, expect traders to be anticipating further easing measures (rate cuts, QE, loans to companies and even forex intervention) to be linked to the SEK’s strength. Currently, EUR/SEK (€9.2570) is modestly stronger as the market had been biased towards a rate cut already.

Dollar Squeeze remains intact

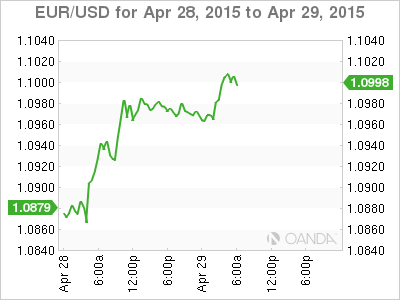

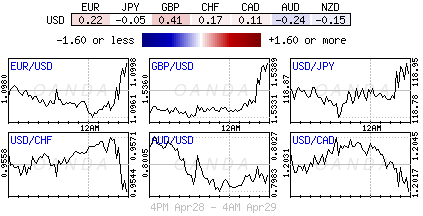

U.S dollar bears have found some momentum as U.S. data continues to disappoint ahead of this afternoon’s Fed policy statement. Yesterday, consumers reported feeling less upbeat this month (CB consumer confidence 95.2 vs. 102.6e), adding to the array of downbeat indicators, ranging from weak factory activity, business investing, industrial production and new-home sales. Collectively, softer U.S data has managed to take the wind out the dollars sails over the past few weeks and stall the USD’s strong rally earlier this year.

Investors will be keeping a close eye on today’s FOMC monetary policy statement for clues on how U.S policy makers view the economic recovery, especially after the plethora of weaker data lately. Consensus expects the Fed to adhere to a low rate policy well into the summer, as it waits for the U.S. economy to bounce back from its recent soft patch.

So far, both the forex and fixed income markets are at risk of a sharper adjustment of USD longs and bond longs as the lack of upside on these trades has seen a modest reversal in the last couple of trading sessions. Uncertainty has some investors diligently trying to protect their profits or limit their losses, by cutting these positions. This has contributed to the dollar underperforming and some U.S longer term yields to back up.

For many, USD longs and bond longs continue to be an attractive “core” position. But central bank event risk and market momentum is persuading many to consider trimming theses positions even further. This morning, the EUR has managed to penetrate the psychological €1.10 handle, which now allows the EUR bull investor to focus on the important €1.1062 target. However, for the EUR bull there is a lot of wood to chop through topside, as the majority of the market prefers to own new dollars on EUR rallies. For the fixed income enthusiast, U.S Treasurys are trading in tandem with the weakness in the eurozone bonds. Their core (bunds), semi-core and peripheral debt yields have risen by +5-6bps partially on the back of Greek negotiations hopes.

Australasia to deliver no surprises

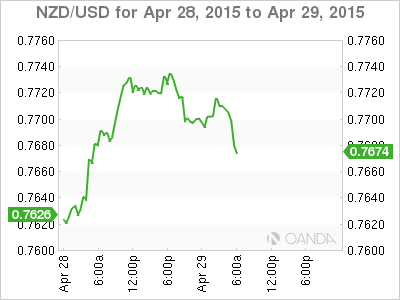

For both the RBNZ and BoJ, the market does not expect anything new. The BoJ is unlikely to loosen its monetary policy despite some speculation to do so among some investors. Couple with the fact that the Fed is also unlikely to raise rates soon is the biggest factor preventing a stronger USD/JPY (¥119.32) and why the market has been confined to such a tight trading range for some time.

Some fixed income traders have priced in only a very “slim” chance of a rate cut by the RBNZ later this afternoon. The majority seems to favor the central bank to be more dovish, triggered by last week’s speech on inflation by the Reserve Bank Assistant Governor. Down under more economists are pricing in an eventual rate cut in New Zealand, but today’s meeting comes too soon (NZD$0.7676).

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.