EUR knockout options triggered topside

Durable goods miss could pressure dollar bulls further

Eurogroup talks to yield no progress

German sentiment keeps on ticking over

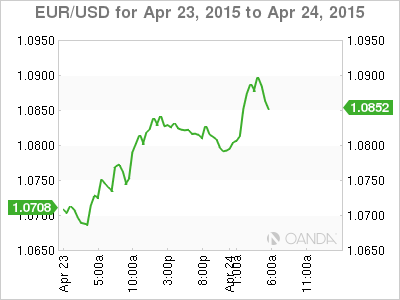

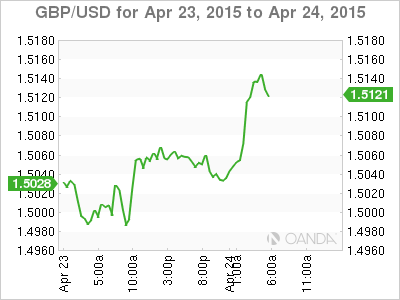

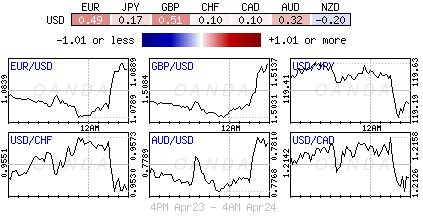

It’s easy come and quickly gone for the dollar bull this month. The mighty buck is closing out this week slumping to a new two-week low against the EUR (€1.0900), pressured by softer U.S data released yesterday (new home sales -11.4% m/m) that seems to have knocked a number of fixed income dealers confidence in a U.S rate hike likely happening any time this year.

The one direction long dollar trade has been on a blistering pace the past few months. The USD’s rise across the board is being fueled by rate differentials – the markets expectation that the Fed will begin their rate ‘normalization’ process while other central banks will continue to aggressively ease. The dollar has rallied more than +11% against the EUR so far this year, but a slew of recent downbeat data has the market asking some awkward questions that have the overcrowded long dollar trade under pressure.

Fed Hawks and Doves to Battle it out

The Fed meets next week and must judge the U.S economy’s recent mixed signals alongside an economic slowdown in China and other parts of the globe. With the market now pushing the Fed’s first rate hike further out the curve (58% expect a September hike, down from +73% last week) is not helping any long-term USD bull’s positions.

While the markets waits for the usual set of headlines related to Greece from the Eurogroup meeting in Latvia, there is data out later this morning in the form of U.S durable goods (core +0.2% vs. -0.6% m/m) to focus on that could weigh on exceptions of the Fed tightening. Any disappoints will only cause the USD to consolidate further as we close out this week. U.S durable goods tends to be a volatile series, but it will be used to fine-tune forecasts for Q1 GDP (+1.1% e.) that is due for release next Wednesday (April 29). A weaker Q1 is expected by the data dependent Fed and should be explained away on weather impacted weakness. It’s the potential growth expectations and how aggressive an anticipated rebound will be in Q2 that will have the Fed hawks shouter loudest next week.

German Sentiment keeps ticking over

Although expectations are quite low of any agreement on Greece’s bailout extension and reform plans, there is optimism that one could be hammered out by end of June. The rumor that Greece seems to have secured +€450m from local authorities makes it unlikely of any near-term default in May and has given the EUR a lease of life.

Helping the single unit this morning is this months rise in the Ifo German Business Climate Indicator. It suggests that economic conditions in the eurozone’s largest economy continue to tick over despite the Greek crisis. This is a welcome relief for the EUR bull especially after falls in the ZEW (53.3) and PMI (51.9 manufacturing, 54.4 services) surveys this week.

The increase in the headline index, from 107.9 to 108.6, was stronger than the consensus forecast of a rise to 108.2 and left the index at its highest level in ten-months. On the face of it, the index points to German annual GDP growth rising from Q4’s +1.5% to about +2%. Business sentiment still seems to be responding to a weaker EUR and the decline in the oil price. Nevertheless, the weaker surveys and the potential event risk fallout from Greece should be capable of limiting the EUR’s rise.

For the weaker dollar longs there are too many balls in the air at the moment. Current market intraday price actions indicate how nervous some investors are as the weekend approaches. Over the past few sessions the best of the forex market moves have occurred throughout the European session. Once appearing stateside, market interest seems to have dried up. However, today’s U.S durable goods number could cause a bit or reaction, especially if it comes in below expectations.

Investors should be wary of headline news from the Eurogroup meeting underway in Latvia. The “he said, she said” headlines will have markets a tad jumpy. However, the general consensus is that the talks will not be yielding any major progress, but again end up attempting to kick the “can further down the road.”

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.