Beware of Short Trading Week Moves

BoE on Two month hiatus

Look to U.S jobs for rate clue

Beware of weather related anomalies in NFP

With Good Friday making it a holiday-shortened trading week for most Eurozone participants and commonwealth members, investors would prefer to escape relatively unscathed to begin Q2 proper next week. However, with U.S non-farm payrolls rounding off the week in their absence, it may not be such an easy task to complete without experiencing some collateral damage.

Investors should be thankful that G10 central bank activity does actually slow down considerably this week heading into the Easter break. In the U.K, the BoE policy members make it easy for investors; they have to undertake ‘self-exile’ during the U.K’s two-month election season that has now officially gotten under way. In the U.S, Fed members are very active on the talking circuit this week (Fisher-Monday, Yellen-Thursday). Neither is expected to give any clues away, as both are giving the introductory remarks for conferences. On Tuesday, Richmond Fed’s Lacker talks on the economic outlook. However, this ‘hawk’ is unlikely to challenge consensus of a patient Fed waiting until September or even further out the U.S curve. By the end of this week’s Fed’s speech circuit, investors will probably be non-the wiser on the Fed’s “when and how aggressive” with respect to interest rates.

Look to U.S jobs for rate clue

Capital Markets will probably need to take their interest rate timing clues from this Friday’s U.S NFP report. Ever since Ms. Yellen began the process of weaning investors off Central Bank dependence, and nudging the market towards fundamental data reliance, the U.S jobs report will be taking on much more significance. Especially since the U.S economy has of late been exhibiting signs of a slowdown, seemingly due to excessive cold weather. Many are looking for this past winter’s cold snap to have finally taken a modest bite out of NFP (Expected +247k vs. +295k, unemployment rate unchanged at +5.5%). If that does not happen, it could reinforce how strong the underlying U.S labor market truly is, and will have money-market traders pricing in an earlier rate hike. Investors should remain weary of any weather related anomalies. For a more accurate rate guidance, look to the wage growth proponent of the report. Until now, there has been very little sign that a tighter labor market condition is supporting wage growth.

Contained single unit looking for clues

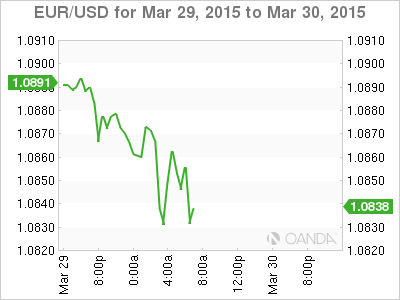

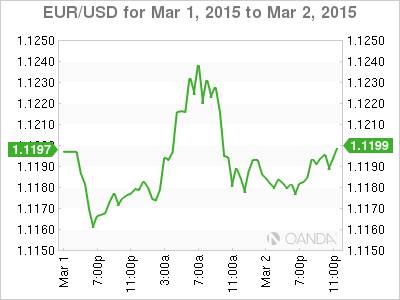

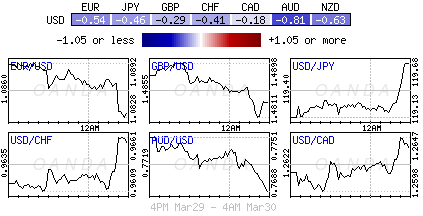

Over the past week, the EUR has been bouncing around in a contained range, twice threatening to break through resistance €1.1052, before falling back to this morning EUR/USD lows just ahead of the psychological €1.0805 handle. On the IMM, speculative EUR short positions hit new records, suggesting more covering is likely. However, there is a clear market willingness to add or establish more EUR short positions on any U.S dollar pullbacks. The EUR bear must be feeling fairly confident with their short positions, especially with the lack of EUR bounce follow through considering the depth of the record “short” positions.

Negative Yields are an Investor Turn Off

The “big” dollar requires a significant boost to provide the momentum to bring the world’s dominant reserve currency to the next level. Friday’s NFP is capable of providing that spark. But before then, there is always tomorrow’s IMF’s figures on global foreign exchange holdings (Cofer for Currency Composition of Official Foreign Exchange Reserves) for Q4, 2014. Despite the report looking backwards, it does give a fresh perspective to investors how the world’s biggest currency traders (Central Banks) are embracing the dollar. In the past 11-months, the USD has appreciated +28% versus the EUR. In Q3, the report showed a vast outflow out of EUR’s (down -1.5% to +22.5%) and into U.S dollars (up +1.6%, the largest in 10-years) from Central Banks. The record shift out of EUR’s was brought about after the ECB lowered the interest rate on deposits held. Europeans were “paying away” (negative rates) to deposit funds. Because of the U.S yield differentials argument, investors want to purchase U.S assets because of their returns. The pace of the “big” dollars rally has been the fastest in over +40-years. For some, the danger is that the dollars move has been too rapid and could be overdone in the short term. Reports like tomorrow’s IMF’s Central Banks currency balances could provide a spark, one way or another.

Global Bourses on firmer footing

Over the weekend, Chinese policy makers were out in full force supporting their economy. PBoC Governor Zhou expressed some concerns over the risk of deflation, potentially paving the way to another easing move as soon as next month. An orchestrated easing cycle in the world’s second largest economy is helping global equities. Zhou also noted China may update laws on currency controls and that there is still room for more rate cuts. Separately, PBoC researcher Chen warned that Q1 GDP could fall below +7%. President Xi also spoke, downplaying the threat of economic slowdown and reiterating the new normal in China justifies emphasis on “quality of growth over the size of expansion.”

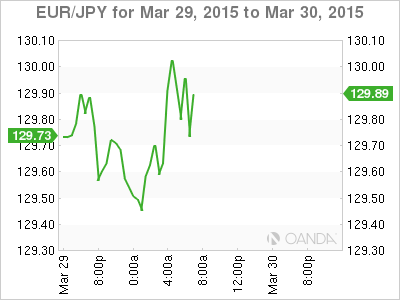

Japan so not lucky

In the eyes of the BoJ, industrial output has always been one of the brighter parts of the Japanese economy. Japanese policy makers only recently made consecutive upgrades in their assessment. However, in the overnight session, industrial production for February marks another instance of disappointing economic data, making this Wednesday’s release of quarterly Tankan survey particularly significant for the BoJ as they begin to enter the new fiscal year in Japan. Governor Kuroda, speaking over the weekend, said he expects inflation to begin accelerating starting in early fall. This would suggest that may be some reluctance by the BoJ to add to its already unprecedented stimulus measures.

If the IMF’s figures on global foreign exchange holdings or NFP do not provide that market spark this week, then investors could always look towards Greece to provide the unusual. Over the weekend, Greek PM Tsipras said he was confident there will be a happy ending to this week’s negotiation, however other EU sources said to have indicated the latest Greek proposals are still missing sufficient detail, making it difficult to disburse new aid. The German press is speculating that “the institutions” (troika) see Greece missing its primary surplus target this year even though the new government promised a +1.5% surplus. The country is supposed to run out of cash by April 20.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.