EUR bulls need a €1.1000 close for confidence

U.S inflation remains benign

German growth solid in Q1 on QE

HUF Central Bank Surprises

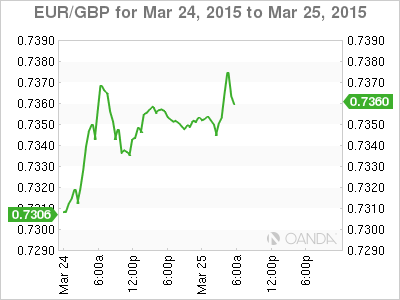

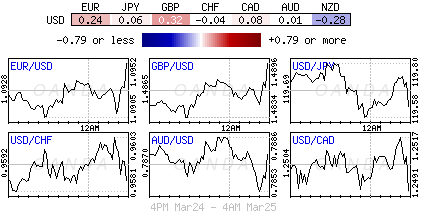

The Euro is doing its best to shake that ‘bad boy’ image as it again attempts to climb higher outright versus the dollar. Given the forex markets current run of unpredictable moves, only time will tell if the single unit is capable of taking on yesterday’s key resistance points. From a market positional standpoint, long U.S dollars against almost anything, still remains the dominant reason for the EUR to squeeze higher on its own.

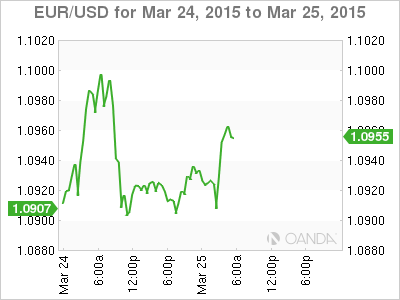

Currency moves have been rather erratic since the Fed surprised investors by indicating that it’s in no rush to hike U.S rates anytime soon. Over the past few sessions, the EUR has managed to record some sharp swings and is currently well clear of its 12-low print recorded last week (€1.0464). The 19-member unit is within striking distance of the psychological handle of €1.1000. This is a massive level for any EUR bull. The failure to settle decisively above €1.1000 would suggest that investors remain nervous that immediate further declines are ‘in the cards’. However, it seems that Euro dollar investors prefer course of action is to wait and see new data confirming that the positive momentum for the U.S remains unaffected.

Inflation pressures remain modest

Yesterday, U.S CPI returned to growth in February, delivering the first positive growth in headline CPI in six-months and the first gain in energy prices since June. Fed Chair Yellen and many Fed officials have reiterated that the declines in energy prices are “transitory”, and this is the first hard economic data to support their contention. Last month, domestic U.S gas prices rose +2.4%, the largest increase in nearly two years. Despite the modest climb in the headline print, underline inflation remains relatively benign and well below the Fed’s target that would help to justify hiking rates sooner rather than later. The dollar weakened through the CPI release until the open of cash equity trading, with EUR/USD peaking at €1.1030, then retracing all of the gains seen over the previous session fell back to €1.0905 – its first line of support in today’s contained range.

Germany Show Signs of Solid Growth

The EUR’s rebound has come amid some improving economic data in the eurozone. Yesterday’s Euro regional (Germany and France) and composite business activity numbers happened to expand more than expected for March. While today’s German Ifo index print (107.9 vs. 106.8) provides further evidence that the recovery in the eurozone’s largest economy continues in Q1. It seems that German firms have managed to shrug off fears over Greece, and a weaker EUR supported by QE, which is having a net positive effect as it helps to boost export expectations.

The index reports that businesses expectations for the next six-months improved, while the current conditions indicator has also picked up, reversing last month’s fall. The reports details suggest that the pickup is broad based with manufacturing rising strongly. Perhaps the only concern for Germany is underestimating a potential Greek exit. There is a clear risk that if the crisis intensifies it will weigh heavily on German and Euro business activity.

It’s not just the upbeat Euro data that is pushing the dollar lower or pulling the EUR higher, market participants continue to adjust their positions accordingly. The huge EUR/USD fall (down to €1.0464 last week as ECB quantitative easing got underway) has EUR bulls eyeing scope for a larger correction. The €1.1062 (March 18) high is seen as too small. However, it’s low (€1.1098) after the Syriza Party’s win in Greece that put Alexis Tsipras in power could be a tough hurdle to overcome.

The euro bull is looking to the €1.1200-1.1300 handle for midterm relief. However, they will require further easing of pressure from the rates market to fuel further EUR gains. So far this month, fixed-income traders have managed to shave -12 basis points off the two-year Treasury/bund spread. It seems that EUR speculators are happy to set up buying dips below €1.0900 and €1.0875.

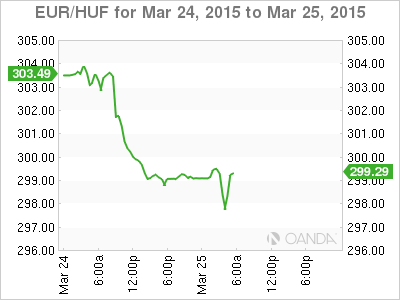

Central Banks Continue to Surprise

Hungary’s smaller than expected rate cut yesterday has proved a buy signal for HUF, pushing the forint to a 14-month high against the EUR (from €304 to current level €298.93). The -15bps cut (market expected a minimum of -20bps) and the Central Banks widening of its inflation target to a +2% to +4% tolerance band while maintaining the +3% goal would suggest a “moderate” easing cycle.

However, the HUF’s strength, if it proves unrelenting, may warrant interest rate cuts bigger than currently being priced in by the fixed income market. With an export driven economy, a persistent strengthening HUF will be detrimental to growth. The markets next major resistance level for the pair is €295.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD regains 1.2350 ahead of UK PMIs

GBP/USD is recovering ground above 1.2350 in the European session, as the US Dollar comes under fresh selling pressure on improving risk sentiment. The further upside in the pair could be capped, as traders await the UK PMI reports for fresh trading impetus.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.