Dollar longs again squeezed

Greece running out of funds

Berlin meet needs clarity

Peripheral spreads trade orderly

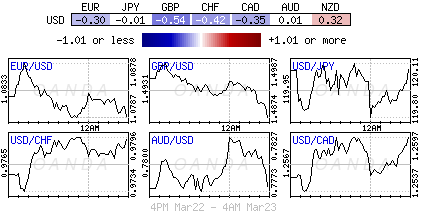

Forex intraday volatility is back with a vengeance. Now that the Federal Reserve is trying to wean investors off the dependency of the central bank it’s making trading currencies are a lot more interesting.

The one-way directional dollar move is not telegraphed, and as before, one has to work a tad harder for their returns. Last week’s Federal Open Market Committee meeting has managed to inject a lot of uncertainty into currency traders’ thinking. Naturally, those doubts will be hardest felt in the most populated of forex trades: euro shorts and dollar longs. They have been the biggest of one-directional bets for many months. A likely consolidation is expected to favor further EUR/USD (€1.1865) short covering.

Fed Talk and Greek Worries Strike Back

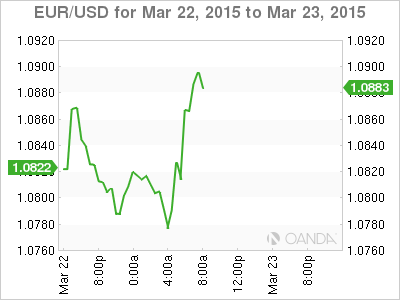

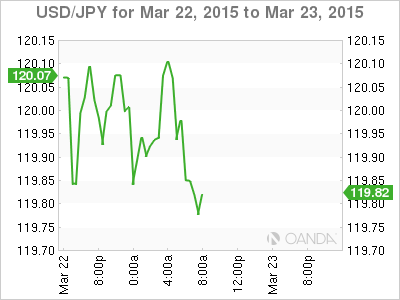

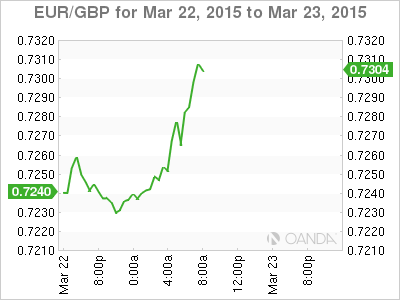

So far on this early Monday morning, the 19-member single currency has seen some fairly whippy trade in the European session (€1.0768-€1.0874). The EUR buying was most likely short covering. St. Louis Federal Reserve President James Bullard’s assumption that the dollar is nearing “fair value” dragged the EUR off its intraday lows. The move to the high end of the range followed Cleveland Federal Reserve President Loretta Mester’s comment that there is room to ease more if the U.S. economy warrants it. From here on in, most investors will be eyeing Greek Prime Minister Alexis Tsipras’s visit to Berlin later today for directional play, as talks on the future of Greece’s bailout continue. Over the weekend, he warned that Greece might not be able to meet impending debt payments without financing help from the European Union.

The EUR, which has been under pressure since quantitative easing was implemented, suffered from a massive cash outflow from the eurozone into U.S. assets. The common currency has since staged a strong recovery from last week’s EUR/USD lows (€1.1464) when the Fed flatfooted the market by indicating that it may not raise interest rates as soon as investors had been expecting. For a considerable period of time the market has been so tightly wound long U.S. dollars, some sort of correction was certainly overdue. The Street got last week’s Fed’s ‘patient’ omission call correct, but was completely surprised that policymakers were not more impressed by the improvements in the U.S. labor market.

Time Ticks Away on Greek Deal

The possibility of a Grexit is the eurozone’s immediate concern. Since Fed Chair Janet Yellen muddied the rate differential argument for the time being, investors have been gravitating back to the amateur theatrics of the Greek government. Athens has led ministerial summits and Eurogroup meetings to fail and now it’s up to the leaders and not the finance ministers to reach an agreement. However, time is running out as Greece is in danger of becoming insolvent. The European Central Bank is unwilling to lift the limit on the T-bill issuance, leaving Greece to raid funds from other domestic sources such as its welfare system and other public funds. It’s reported that Athens may have enough liquidity for roughly two more weeks (April 8), and that Greek finances would be deemed “critical” if the government fails to submit viable reform plans. However, this will not be easy especially with Greece having walked away from the last meeting with a different interpretation to German Chancellor Angela Merkel’s on what was agreed.

Merkel and Tsipras Need to Set Record Straight

This is obviously a priority for both leaders — nothing should be lost in translation. Germany will most likely insist that Greece is to stick to what was agreed to at the end of February. But the Greek government’s humming and hawing is infuriating Europe’s leaders. What is most evident is that the Greek government is severely testing European patience, especially since everyone is still talking about the extension of the original bailout. If the market were talking about the possibility of a third package, capital markets would be trading Grexit risks with a lot more volatility. So far, that is not evident in peripheral spreads despite their being off to a soft start this morning largely just to unwind Friday’s bounce, and also to take some profit ahead of today’s meeting (German bunds/Italian BTP fixed-rate Treasury notes +2.8 points and Spanish bonos +2.5 points).

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.