Will Mario change markets assessment of QE?

Draghi to stand and deliver in QE

When will QE kick off?

EUR positioning pushes currency to new lows

Markets are waiting to scrutinize Mario Draghi’s every word in a couple of hours. Investors and dealers want to know if he will say anything to change everyone’s assessment of the quantitative easing program. The market already knows the size, the pace and area of bond purchases. What we do not know is the actual timing and the ECB’s way of bidding on the bonds. Are we expected to discover these along the way or will Draghi clarify the uncertainties in his news conference?

It’s true; the ECB did leave many questions unanswered when it announced its QE plans in January. Basically Draghi was more concerned about getting a majority to agree before trying to fill in the “gaps.” Even at todays meeting the ECB may not be able to deliver much in the way of detail, given the fragmented nature of the 19-markets in terms of size, liquidity and average maturity.

As the expanded Asset Purchase Program (APP) will be conducted through the National Central Banks (NCB’s), perhaps investors and dealers may have to wait until actual purchases begin to gain greater insight. If that is the case, it does not necessarily mean keeping an eye on 19 different NCB’s and their bond own markets. There will be differences, and differences will create greater divergence between the various markets. This will help keeping tabs on proceedings a tad easier for interested parties.

When will everything kick off?

The market is betting on three possible dates for QE to begin:

Straight after the conclusion of today’s meeting

March 9 as reported in the Italian press

After the March 18 non-policy meeting due to legal hurdles

What could surprise investors, if anything?

Consumer spending and economic growth in the eurozone seems to be on a healthier trajectory of late. For some it certainly raise doubts about the need for the ECB to buy eurozone debt to fight deflation risks, particularly given the difficulties the Central Bank faces in sourcing the bonds. Basic economics indicates that falling prices can lead to lower inflation expectations and on to deferring consumer expenditures – deflation. But on the plus side, falling prices, like in energy, is a tax saving to any household, and it has the potential boost a family’s income, confidence and eventually spending. This is the typical equation that ECB staff looks at and take into consideration when considering any forecasting. New staff projections later today are likely to reveal more upbeat growth and inflation forecasts.

EUR remains on the back foot

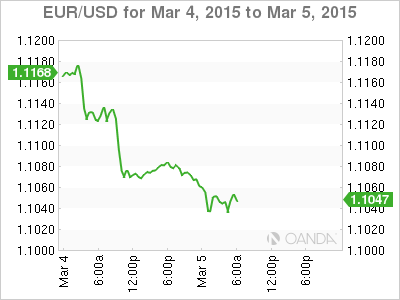

The 19-member single currency is still on the slide as traders position themselves ahead of the ECB decision and possible looming details of its €1.1b QE program. The EUR has managed to print new pre-ECB meet lows in the Euro session this morning (€1.1026). Some dealers are wondering whether the EUR/USD might bounce in the aftermath of the formal announcement under the appearance of profit taking. The currency has not been this low in 11-years when it based out at €1.0762.

What about fixed income? So far since January, investors’ anticipation of the QE program has driven eurozone-borrowing costs down to record lows. Any threat of currency fall extension could suggest further outperformance of the likes of Bunds vs. UST’s. Perhaps when investors are given a bit more clarity on proceedings, then like the potential for EUR profit taking, the market may see some dealers wishing to take some profit in the bond market and begin pushing up Bund yields again.

Hopefully all will be made clearer in a couple of hours!

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.