India’s RBI implements a surprise cut

BoC expected to be dovish

EUR sits atop of January lows

Eurozone sales data prevents EUR freefall

So far this year the easing programs of the world’s biggest Central Banks are pushing the smaller national banks to new policy extremes. Nearly every other week investors are left to figure out the effects to Capital Markets of a surprise cut here and there. Investors should be blaming the Swiss National Bank who abandoned its tightly defended franc floor in January. The SNB has managed to single handedly change the rules to today’s new currency war.

Over the past two months Central Bankers from Singapore to Australia have been surprising markets by cutting already low rates, while other have implemented negative rates (Sweden, Denmark and even Switzerland to name a few) to try and manhandle the real threat of lower inflation or deflation, sliding commodity prices, and softening growth expectations. It’s now become a guessing game every time a Central Bank meeting convenes, and in some cases an intra-meeting decision. Already this week Australia surprised and skipped on a rate moves, while China sideswiped market over the weekend and eased for the second time in as many months. In China’s case, it could be just the beginning of a new rate cut cycle as the world’s second largest economy reshapes itself towards a more sustainable long-term growth model.

India’s turn to surprise investors

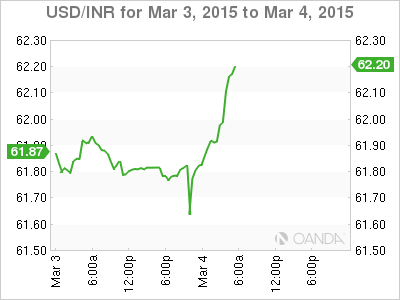

In the overnight session, it was the RBI’s turn to flat foot the market. It announced another intra-meeting decision to cut interest rates by -25bps, lowering the repurchase rate to +7.50% and marginal standing facility rate to +8.50%. It is the second consecutive easing unveiled by the RBI in this surprise fashion, following the mid-January unexpected -25bps easing and a rate hold in early February. India’s policy makers noted softer inflation readings might persist in H1 before firming slightly in H2, adding that the INR currency has remained strong relative to colleague nations, which is undesirable in that it boosts disinflation. This seems to be the common theme amongst Tier I & II Central Banks. The problem with ad-hoc or pressured monetary policy moves is that if they do not yield results, it could erode trust in the global Central Bank monetary regime. This would only dissuade market participation and stoke further investor fear.

Can we expect fireworks from the ECB?

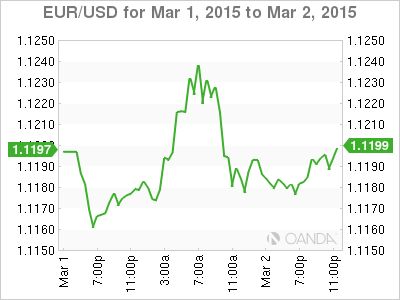

There are a couple more rate announcements on the agenda for this week with the most important being tomorrows ECB monetary policy meet. No fireworks are expected at either the ECB or the BoE’s rate announcement, but investors are expecting further details on the ECB’s QE plan in the Q&A portion. Plans to buy eurozone government bonds have already been announced. All that is needed are further details on how the plan will be executed. ECB staff projections for growth and inflation should also be interesting. Lower oil prices mean inflation forecasts could be revised down, while growth should be boosted by lower energy. Nevertheless, this is the script that is currently being used by all Central Bankers – markets just want to see sustainable rewards.

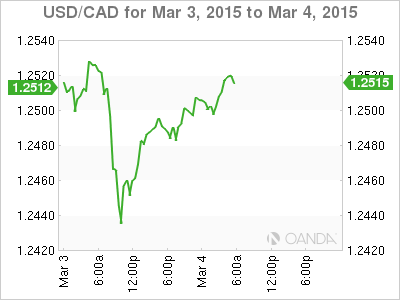

BoC’s Poloz expected to be dovish

Later this morning, it’s the Bank of Canada’s turn to take center stage. Last time out Governor Poloz surprised the market by implementing an insurance premium -25bps cut. Up until a week ago, and before a surprise pause from the RBA this week, the market majority had assumed it was a slam-dunk that the BoC would be easing today. Poloz reiterated that collapsing oil prices are a “net negative” and a setback for a Canadian economy trying to get back to full capacity and full employment.

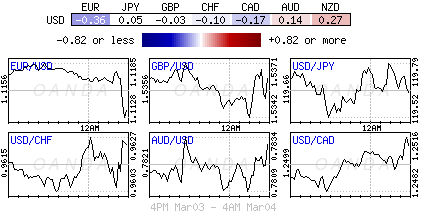

Currently market consensus is expecting a “no” change from the BoC in a few hours, yesterday’s Q4 GDP numbers beat forecast and do not necessitate an immediate change to policy. Nevertheless, the Central Bank is expected to be ‘dovish’ in its rhetoric. The loonie sits atop of CAD$1.2500 compared to the CAD$1.2360-$1.2800 range traded since January’s cut. With U.S yields having rallied strongly of late, the rate divergence argument between the Fed and the BoC is expected to continue supporting USD/CAD on pullbacks. The market is looking for any signs that the BoC will express its favor for a lower loonie.

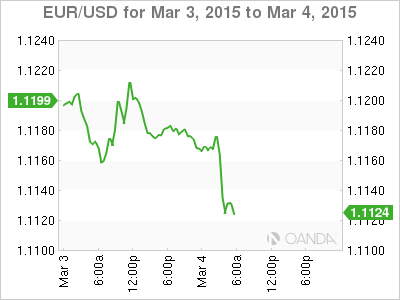

EUR struggles ahead of ECB meet

The mighty U.S dollar continues to maintain a firm tone against most currencies with the USD Index hitting fresh 11-year highs in the overnight session. Some dealers are noting that the USD Index is approaching the +50% retracement level of its global crisis moves from its 2001 highs to the 2008 lows (95.85). Owning the dollar has been a one directional trade for many months. Tight trading ranges are the relative norm ever since crude prices seemed to have found a temporary bottom over the past few weeks. Already this morning the lower revisions in numerous European PMI Services (Spain and Italy) have been adding to the EUR’s downward pressure. The 19-member single currency is again probing the lower end of the €1.1100 region seen in January. Better eurozone retail sales data (+1.1% m/m) is helping the currency to avoid the retreat from worsening. Dollar owners will be looking for fresh impetus from Draghi tomorrow and from the U.S payroll print on Friday.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.