SNB rumors hurts EUR

Currency pairs trying to take a breather

Recycle EUR’s to improve portfolio average

Stateside weather postpones debt issues

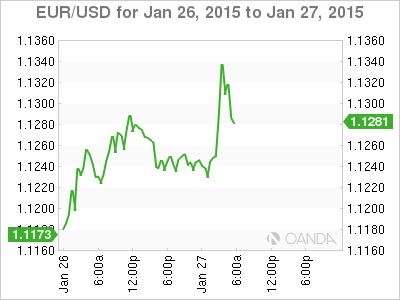

As most of the east coast of the U.S focuses on the “historic” snowstorm of all proportions, rumored Swiss National Bank action during the European session this morning has taken a swipe at the EUR bear. After the Greek election results yesterday, investors were able to quickly price the last of the imminent “bad” expected from Greece. The single unit managed to register a new 11-year record low outright (€1.1098) in the aftermath of the Greek parliamentary results. Once completed, the most vulnerable side for the EUR ‘bear’ was always going to be the weaker “short” EUR positions. The longer that the market was unable to break through key EUR support levels (€1.1000) the more vulnerable the EUR topside was going to become.

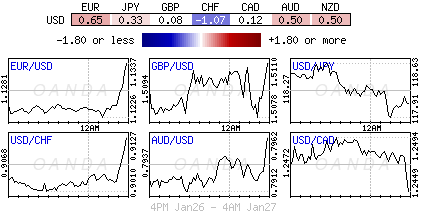

Of late, Capital Markets have not seen too much asset class price consolidation. The various asset price moves have been mostly fueled by fundamental and event risk, accumulating in one directional and over crowded positions. Currency pairs like the EUR/USD, GBP/USD and AUD/CAD seem to trying to take a breather from their recent downtrends. Not helping the EUR bear is the combination of stabilizing equity markets and U.S and German bond yields holding above recent lows – it’s managed to lift market risk appetite and weighed on the USD, for a short period at least.

Pros happy to recycle EUR’s

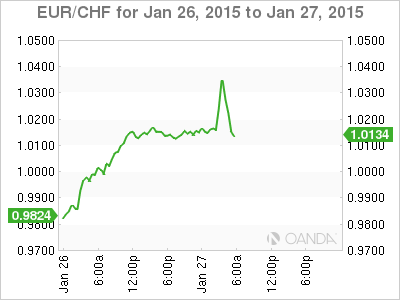

A large percentage of pro-traders would have taken yesterday’s EUR fall as an opportunity to lighten up their EUR short positions. Many have been hoping to recycle these EUR’s at higher levels to improve their portfolio average while maintaining their core short views. The mention of the SNB rumors this morning has only helped their cause. Despite the SNB credibility in policy setting having been tarnished after the franc flash crash, the Central Banks reputation in aggressively acting on FX and interest rates will always be feared by the market. The very fact that intervention was even though or uttered had the Swiss franc on the immediate move this morning. The key is whether it’s sustainable.

The CHF weakened ($1.0340) throughout most of the Euro session after SNB’s Danthine noted that it still was prepared to intervene in FX markets as they have yet to stabilize. Dealers have been suggesting that the weak rise in ‘Sight Deposits’ could be seen as an indication that the SNB has been in the market already this week after its de-pegging announcement two-week’s ago. As the market heads stateside, where trading is expected to be lighter, the CHF was well off its worst levels.

Commodity price divergence

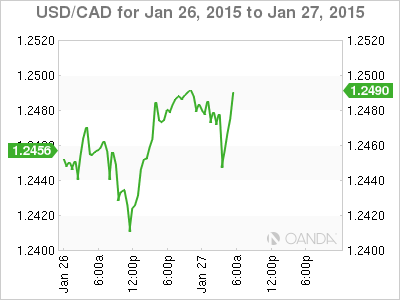

The CAD or loonie is trying desperately to bounce of its six-year lows as crude prices attempt to reverse some of this year’s recent losses. The temporary rise in crude prices have been supported by a report that OPEC’s top officials believe that they may have hit a bottom. In other words, crude officials are trying to walk the commodity’s prices higher. The problem is that the official’s argument does not trump the reality of a product glut.

Oil prices have been the loonies’ biggest driver year-to-date. If crude prices do happen to stabilize (down -55% over the past six-months) then the CAD is expected to find some much needed help. Last week, the BoC’s Governor Poloz tried to play catch up with weaker commodity prices, especially crude, by slashing overnight interest rates (-0.25bps to +0.75%), citing his actions as an insurance policy against a collapse in crude prices.

With Canada being a commodity sensitive exporter, any negative longer-term fluctuations in commodity prices will have a massive impact on Canadian growth and inflation and so too do yield spreads. Wider US/CAD bond yield spreads will always hurt the loonie. Technically, the USD has found resistance at the key $1.25 level. Nevertheless, the majority of investors remain better buyers of USD’s on pullbacks, believing that the USD bull market and weaker commodity trend remains intact. Through $1.25 will have the CAD ‘bear’ honing in on the next major CAD support level at $1.30 rather quickly.

Yellow metal looks for consistent momentum

Crude is not the only commodity making waves, yesterday gold futures fell the most this year on speculation that Greece’s anti-austerity party victory would not result in the country leaving the euro currency bloc, pressing demand for the safer “haven” asset. The EUR has managed to rebound from it’s fresh 11-year low recoded in Asian trading on Monday after the Greek election results (€1.1098) as Greek Prime Minister-elect Tsipras has pledged to keep the nation within the euro-zone. For the month of January, the yellow metals rise was being supported by investors as Europe’s flagging economy drove demand for a “store-of-value.” The commodity is finding it difficult to hold a trend intact, remaining at the “big” dollar’s mercy and the markets whim towards risk or not.

East-coast weather fallout

Investors who want to buy new U.S 2-year paper will have to wait until tomorrow. The U.S treasury has rescheduled this week’s debt offerings due the current east coast weather conditions. The $26b 2’s and $15b floating rate maturities will take place same time tomorrow. The 5-year $35b auction gets pushed to Thursday, ahead of the on-schedule $29b 7-year note sale.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.