Rate divergence to continue

European Central Bank Credibility on the Line

Inflation Stymies the Bank of Russia

The Fed’s Game of Show and Tell

Some of the main central banks continue to eye handcuffing investors to a low rate environment throughout the first half of 2015. The current exception to the loose monetary policy regime will be the Federal Reserve and the Bank of England (BoE) in that order; however, a precarious economic environment will continue to bring forth varying results.

The People’s Bank of China’s Cautious Approach

The coming year is shaping up to be a challenging one for Asian central bankers. They are confronted with a balancing act of supporting economic growth whilst guarding against potential volatility arising from the normalization of U.S. interest rates.

There is a popular fear that growth in the world’s second-largest economy could slow to as little as +5% in the near term. Currently, the market is expecting China’s central bank to wait until fourth-quarter economic data is out, as Beijing monitors U.S. and Japanese monetary policy before considering any more rate cuts or easing.

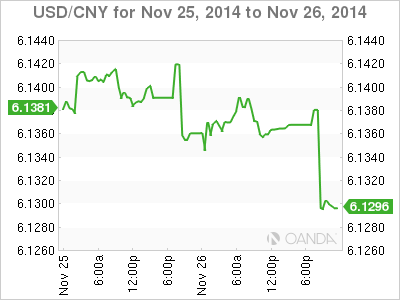

Last week, the People’s Bank of China (PBoC) surprised the markets by cutting rates for the first time in more than two years to help stabilize its domestic economy. It was an unexpected departure from a central bank that has maintained a relative neutral stance for the last few years. The PBoC’s policymakers have already indicated they need to look at the fourth quarter’s macroeconomic index before implementing the next move. Friday’s interest rate cut is expected to bring some stability into the all-important property sector next year.

The Bank of Japan’s Shock and Awe Play

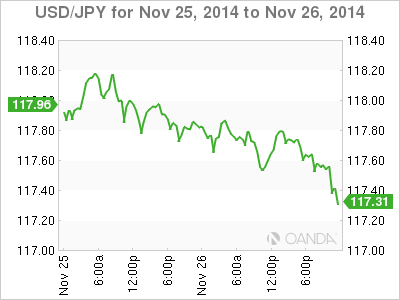

Tuesday’s meeting minutes from the Bank of Japan (BoJ) revealed that the central bank’s surprise move last month to expand its already massive stimulus program was about sending the message that it will do whatever it takes to “conquer deflation.” Clearly, Governor Haruhiko Kuroda wanted to send a strong message to shock the wider economy. Both Japanese consumers and business leaders remain unmoved by the BoJ’s monetary policy. Even the benefits of a much weaker yen (¥117.75) are not being filtered through to the Japanese exporter. Inflation looks set to straddle +1%, well below the BoJ’s stated target (+2%), despite capital investments continuing to pick up but not by enough to boost economic growth. The BoJ seems more optimistic than Prime Minister Shinzo Abe. With Japan now mired in another recession, pushed there in part by the first consumption sales tax hike, Abe needed to go to the electorate to gain consensus. Japan’s snap general election over the coming weeks will keep markets moving.

The Reserve Bank of India Feels the Heat

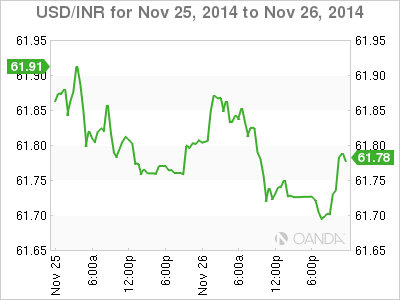

India’s economic growth is expected to have slipped to around +5% in the third quarter from +5.7% in the previous quarter. This will undoubtedly be putting pressure on the central bank to cut interest rates. Markets should expect Prime Minister Narendra Modi to press Reserve Bank of India Governor Raghuram Rajan to lower borrowing costs when the two meet ahead of a decision on interest rates next Tuesday. It has been six months since Modi swept to power with a promise that “better days are coming.” The growth of +5% is considered a major setback from the previous quarter, and it falls well short of the desired +8% that Asia’s third-largest economy requires creating enough jobs for its growing workforce.

Inflation Stymies the Bank of Russia

The Bank of Russia’s (BoR) Chair Elvira Nabiullina indicated this week that Russian policymakers would consider easing monetary policy in the second half of 2015 if inflation can be brought to heel. When a steady trend of lower inflation does transpire, the BoR is expected to establish a looser monetary policy cycle. Riding the trading bands is a priority to stabilize the ruble (RUB). It allows the central bank to be more proactive to protect the currency while it’s under threat. Currently, consumer inflation is exceeding the bank’s ceiling of +6.5%, and critics say it may reach +9% by the end of the year. Already the BoR has raised interest rates four times this year in an attempt to preempt rising inflation.

A weak ruble and Moscow’s ban on food imports from has any nation that imposed sanctions on the country due to the ongoing Ukraine crisis are supporting Russian inflation.

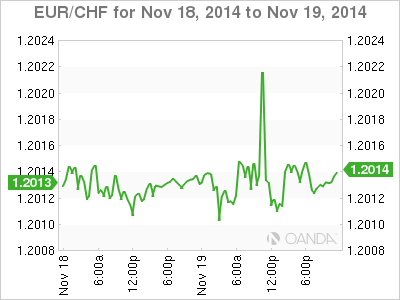

The Swiss National Bank’s Golden Moment Is at Hand

The Swiss Central Bank (SNB) is on a mission. Not surprisingly, EUR/CHF has managed to climb to a one-week high (€1.2032) on thoughts of lower European Central Bank (ECB) funding. European/U.S. rate divergence is lending the SNB a helping hand ahead of the Swiss gold referendum on November 30, currently allowing the EUR/CHF to be supported and gradually move away from the SNB’s well-publicized floor (€1.2000).

The Swiss go to the polls on Sunday to vote on whether the SNB should be holding +20% of its reserves in gold. The proposal is to ban SNB from selling gold reserves below this threshold. More than +50% of the electorate needs to vote in favor. The current polls indicate that +38% support the proposal, +47% are opposed, and +15% undecided. Support for the initiative was +44% in October. The SNB is worried that the proposal could curb its ability to set monetary policy.

The bank’s “line in the sand stance,” reassured for another three weeks, complicates the SNB’s policy of buying EURs whenever the currency weakens “too quickly or too far.”

New rules (if voted in), would require the SNB to buy gold to balance any EUR purchases. This would tie policymakers’ hands when trying to conduct standard monetary policy. The pressure on the SNB to defend the franc, especially with the ECB is expanding its balance sheet and looking at other assets it can purchase. The downward pressure should be expected to increase. A “yes” vote would only invite more aggressive speculation — the SNB would be left with few tools to weaken the CHF.

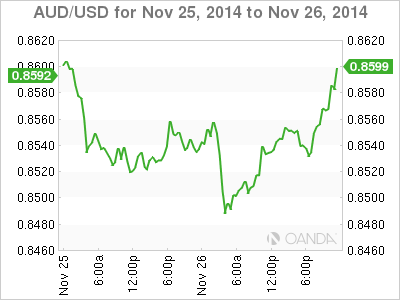

The Reserve Bank of Australia Ponders a Rate Cut

Aussie policymakers expect the AUD (A$0.8516) to drop in line with commodity export prices just as the currency plunged to a four-year low on November 25. Part of the reason for the AUD’s fall can be attributed to Reserve Bank of Australia (RBA) Deputy Governor Philip Lowe’s suggestion the RBA could cut interest rates next year if need be. The RBA believes that “if the exchange rate is to play its important stabilizing role, it needs to go down when the terms of trade and investment are declining.”

The central bank has gone to great lengths to tell the market that it has seen “some adjustment, but if the assessment of the fundamentals are correct, it would expect to see more in time.” Despite the AUD declining more than -8% over the past three months, it remains elevated as the nation’s key interest rate of +2.5% attracts investors away from the U.S., Japan, and Europe where benchmarks are at or near zero (further supporting the carry trade). Yield differentials have helped the Aussies resist a fall in the terms of trade, or export prices relative to import prices.

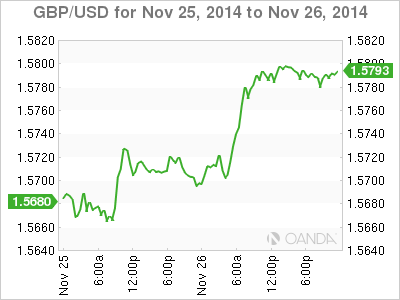

A Bank of England Rate Hike Will Come next Year

The BoE was the original frontrunner to reignite a normal rate policy until the Fed has deposed them. Governor Mark Carney continues to speak of “heightened” external risks menacing the U.K. as weakening global economies and political tensions weigh on the BoE’s outlook. In recent months, global economic conditions have deteriorated in two of the major economies, Europe and Japan, coupled with a difficult geopolitical situation, Carney is not as bullish as the market had perceived earlier in the year. The BoE policymakers cut their economic forecasts earlier this month because of meager global expansion and the threat of stagnation in Europe. U.K. citizens go to the polls next May, and event risk related to the election outcome is as great a threat to the U.K.’s fortunes as was last September’s Scottish referendum.

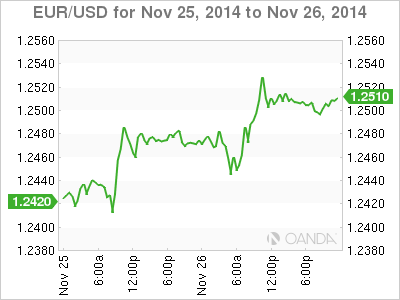

European Central Bank Credibility on the Line

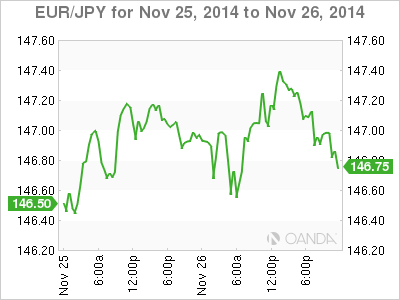

Already this November, ECB President Mario Draghi pointed to European flash purchasing managers’ index results to indicate that a strong recovery is unlikely in the coming months. His sense of urgency to lift inflation expectations “as soon as possible,” has a percentage of the market already anticipating the ECB will sweeten the terms of the TLTRO (targeted long-term refinancing operation) in December, while leaving the debate over balance sheet expectations until January.

Draghi needs to get a real “bang for his buck” before hot air whistles away and the ECB loses street credibility. Eurozone policymakers will need to make sure that they have exhausted all existing balance sheet avenues before they begin to charge down the route of no return: sovereign bond purchases. To date, the ECB has had the minimum of success in expanding its balance sheet. In fact, it has actually declined –€11B since the beginning of September. The EUR will remain very sensitive to short interest rate trends, with further downside very much on the cards.

The Organization for Economic Cooperation and Development (OECD) is ahead of the curve on the eurozone’s limitations. The OECD thinks the region poses a serious danger for global growth, with the world’s economy already “in low gear,” as unemployment remains high and inflation persistently far from the ECB’s target. The next two months could make or break the ECB’s remaining credibility starting with its December 4 meeting.

The Fed’s Game of Show and Tell

The Fed is in its own class and well ahead of the remaining Group of Seven pack.

Fed Chair Janet Yellen and company are weighing whether they should communicate more of their views about the probable pace of interest rate increases after they lift off zero next year. The transparency question is a hot topic among the central bank’s rate-setting committee. Some members think it would be helpful to clarify its likely approach to the pace of increases – fixed-income dealers are currently pricing in a second-quarter 2015 hike. The discussion at the Fed’s last meeting in October highlighted how much officials will rely on forward guidance in the future. After bond purchases ended last month, language may be the most practical option left to assure investors that policy won’t become overly restrictive if officials decide to take a stand against inflation seen as too low.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD keeps the red below 0.6400 as Middle East war fears mount

AUD/USD is keeping heavy losses below 0.6400, as risk-aversion persists following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY recovers above 154.00 despite Israel-Iran escalation

USD/JPY is recovering ground above 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price pares gains below $2,400, geopolitical risks lend support

Gold price is paring gains to trade back below $2,400 early Friday, Iran's downplaying of Israel's attack has paused the Gold price rally but the upside remains supported amid mounting fears over a potential wider Middle East regional conflict.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.