The Fed ended QE3 as expected, but has caught the market off guard with a definite “hawkish” tint in the statement delivered yesterday. Technically, the FOMC has finally closed the door on QE with the $15b taper; however, never say never as bookies are already making odds that the central bank could crank up a new bond-buying program to take its place if the US economy happens to turn south once again.

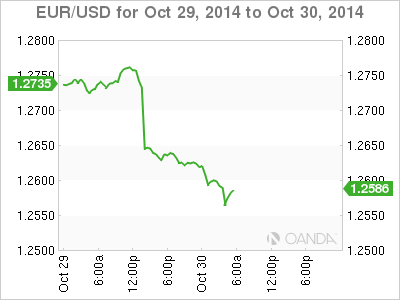

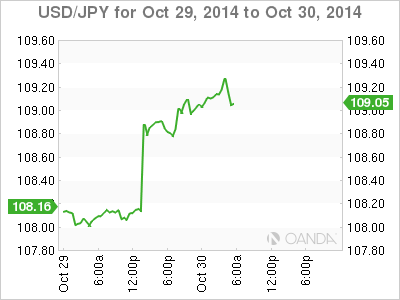

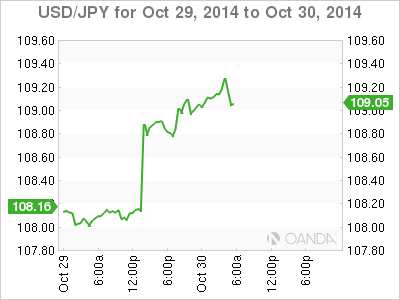

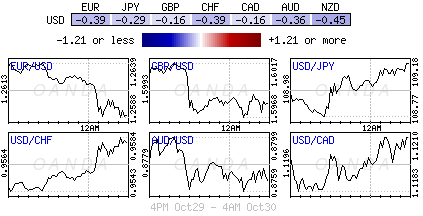

Despite US policy makers retaining the “considerable time” language, the statement released was deemed increasingly “less” dovish by the market, as it noted further improvement in “labor market conditions and diminishing underutilization of labor resources.” This has allowed the dollar to rally (¥109.03, €1.2581, £1.5988), US yields to spike (US 10’s at three week highs 2.34%), commodity prices to fall (gold down $21 to $1,203, Crude WTI $81.25) and US stocks to flounder for the moment. Higher equity futures this morning would suggest that the market would prefer to focus on the upbeat status of the US economy rather than the potential of higher US rates.

Fed focus on labor market

The fact that the Fed has somewhat dismissed the recent turmoil in global financial markets and has focused on the US labor market could indicate that the FOMC is perhaps prepping the market for a ‘bigger’ change in December? One of the responsible roles for any Central Banker is to ease any significant policy change. This helps policy makers to eliminate any surprise shock moves that could potentially harm an economy. The Fed needs to get the market primed and ready for an “eventual rate hike.” With the FOMC focusing on the labor market would suggest that the market has probably pushed back the “first” US rate hike too far. Expect to see fixed income traders bring rate hike expectations further forward – mid-2015 perhaps, rather that Q3 or Q4 2015.

Investors to shift focus to ECB

Interestingly, the previous two Fed dissenters (Fisher and Plosser) voted with the rest of the FOMC while a new lone dissenter (Kocherlakota) called to commit to keeping the current target range for the federal funds rate. With the deepest prices so far occurring on North America watch early Euro-session action this morning would suggest that the market remains somewhat hesitant which way to fully commit. This would suggest that it’s going to take a few trading sessions for investors to adjust now that the FOMC has finally begun limiting investors “carry friendly conditions.” Expect investors again to be shifting their focus back to the ECB – Euro policy makers know that they have to pick up the slack as they continue to face a serious deflation threat.

RBNZ’s dovish rant

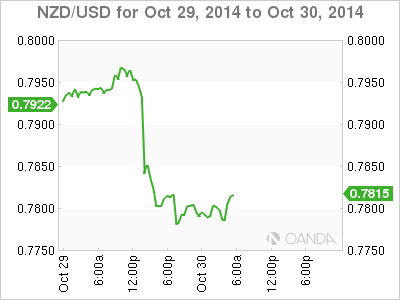

The Fed was not the only Central Banker ‘applying their wares’ overnight. Down under, the Reserve Bank of New Zealand hogged some of the limelight. Kiwi policy makers kept their rates on hold at +3.5% for the second consecutive meet, but also removed its bias in favor of more tightening in light of the softer than anticipated inflation pressure. New Zealand inflation has slowed more than expected in Q3, hovering close to the bottom of the RBNZ’s +1-3% desired range.

Governor Wheeler indicated “a period of assessment remains appropriate before considering further policy adjustment.” What he left out in his statement this time around was the comment was that the central bank “expected some further policy tightening would be necessary to contain future inflation.” It was only natural that the NZD would come under pressure with the dovish tone (NZD$0.7816). With the RBNZ stating that the NZD rate “has yet to adjust materially to the lower commodity prices” has given fixed income traders a green light to price in a +94% chance that Kiwi rates would not change over the next eight-months.

Where to now?

It’s back to North America where markets attention now shifts to the advanced release of Q3 GDP data (expected: +3.1%). Being atop of U.S dollar highs it’s difficult to anticipate how much more momentum the dollar as at these levels. GDP is not expected to be much of a game changer this morning – mind you the market has been caught flat-footed already. Investors may need to wait for next weeks US employment numbers to support the USD’s next leg higher.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.