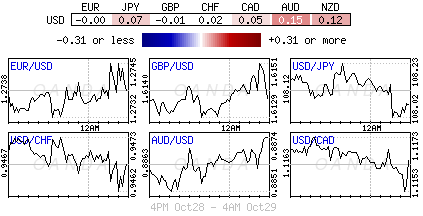

Investors are content to sit on the sidelines, waiting for the Fed to wrap up its two-day FOMC meet. The dollar is mostly unchanged against the major pairs in a narrow overnight trading range. To many, there is no incentive to trade aggressively ahead of FOMC rate decision later this afternoon – the risk/reward is just not appealing. Investors would prefer to take their cue from policy makers, rather than from speculative punts so late in the game.

What is the FOMC to do?

The majority is anticipating that US policy makers will err on the side of caution in this afternoon’s policy statement. In translation, the impact of the FOMC on the currency market could be rather small as the Fed is not likely to mention a specific timeline for “normalcy” rates. The Fed is expected to finally exit the stage in term of asset purchases – end of QE. More importantly, the language from the statement will be the closely scrutinized as there will be no press conference from Yellen to give further insights. The market will naturally want to know when rates will rise, but with global growth looking vulnerable and volatility again on the rise, the Fed will be tempted to a “dovish” message. This would imply that the “considerable time” language is likely to remain.

Policy makers will likely prefer to keep a close eye on economic data before making that decision. Do not expect US policy makers to overtly focus on Europe and its growth concerns either – they should be mentioned. Just as important will be any shift in the Fed’s language around inflation or inflation expectations.

EUR shorts apply a strategy

With so much on the line it’s not a surprise that the forex market prefers its current holding patter, unlike global equities and bonds. Stocks have managed to reclaim a lot of lost ground over the past couple of trading sessions, helped somewhat by yesterday’s seven-year high U.S consumer confidence print (94.5), while the fixed income market (specifically bunds +0.85%, and treasury’s +2.26%) remain rather resilient. Investors probably feel more confident that CBanks are still willing to lend support – just listen to some of the recent rhetoric from the ECB and Fed members of late.

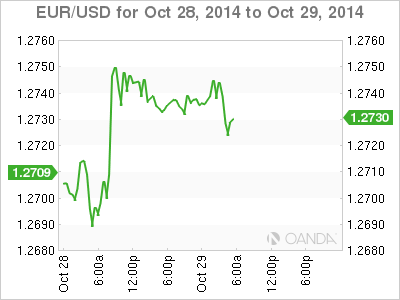

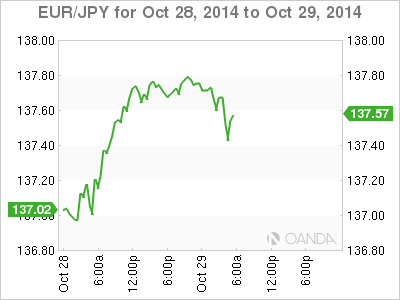

For the 18-member single currency, it continues to gyrate within its current holding pattern (€1.2715-40), at least until this afternoon’s announcement. Any ‘dovish’ tweak to the Fed’s message and the majority of the “short” EUR positions will be vulnerable to further short covering trading (EUR higher). An unchanged statement and the market could be exposed to the EUR coming under pressure again. Nevertheless, a plethora of option strikes (€4billion) located between the psychological €1.2700 handle and early €1.2720’s coming off in the next 24-hours could be capable of bullying the EUR towards strike prices.

BoJ on the horizon

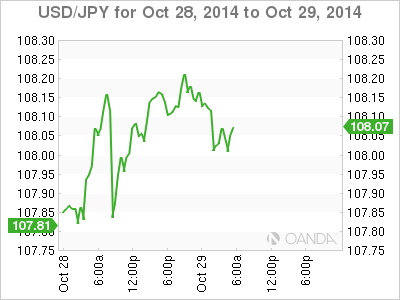

In Asia, JPY initially started out better bid across the board, mostly on the back of some risk being applied following equity gains on the various global bourses. Nevertheless, Yen gains have been limited ahead of the FOMC policy announcement and, to an extent, the BoJ policy announcement Friday. Japanese retail sales out yesterday (+2.3% y/y) and output data released overnight (+2.7%, m/m) have mostly beat expectations and will certainly dampen the markets expectations of an imminent ease by the BoJ.

The BoJ is expected to cut both near-term growth and inflation forecasts. For now, USD/JPY offers are located in the high 20’s ¥108.25, with more seen trailing higher towards ¥108.50. While on the downside Japanese importer bids are located atop of the recent lows, just shy of the ¥108 handle. Once the FOMC is out of the way and the market digests the outcome there will be no let up from CBanks over the coming seven trading days – RBNZ (Oct 29), BoJ (Oct 30), RBA (Nov 3) BoE & EUR (Nov 6).

Rouble continues to bleed

A slight recovery in oil prices over the last 24-hours is not helping the Russian rouble (RUB) – it has managed to fall to new record lows outright and against the EUR. Despite the EUR/US sanctions, and an already sluggish Russian domestic economy, speculators are again applying outright pressure to the currency. Already this morning the RUB has managed to print new lows against the EUR/USD basket (47.89) and against the dollar outright 42.72. Year-to-date the RUB has lost -23% against the dollar, while depreciating only -17% vs. the EUR (54.39). All the CBR can do is to continue to shift its trading bands – so far this month it has moved the bands 70 times!

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.