Investors around the globe continue to look for signs about the economic health of major economies. Preliminary factory and service output started being reported by Markit and HSBC yesterday night.

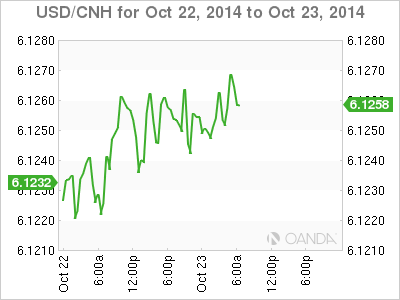

The flash Purchasing Managers Index (PMI) in China beat expectations yesterday as it rose above its September reading 50.2 to 50.4. The preliminary data points to the resilience of the world’s second largest economy as labor market and export demand remain strong despite other economic pressures.

There is a lot to be optimistic about China with output, new local and export orders rising. The Flash PMI is based on 85% to 90% or respondents so there is a chance it might change for final number in November 3, but the preliminary figures give the market a solid data point to use for setting expectations.

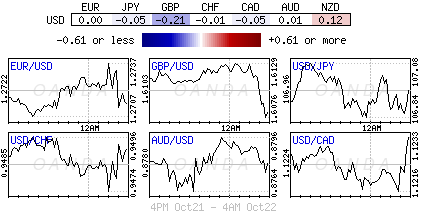

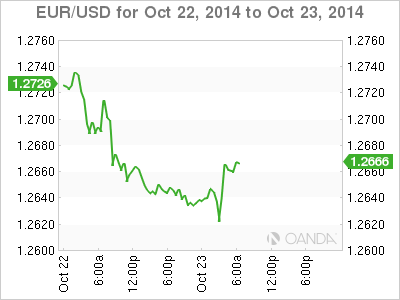

European PMIs continue to be mixed. German manufacturing figures beat expectations with a 51.8 factory output preliminary result after a disappointing 49.9 reading last month. The fact that Germany’s flash PMI is above 50 is a sign that the contraction was transitory. In contrast French flash PMI came in lower this month than last. October figures are 47.3 coming in below expectations that the factory output from France would be close to that reported last month of 48.8. It seems that the reduction of the speed of contraction in French manufacturing was also transitory.

The European flash PMI had a net positive gain thanks to the German growth. The PMI rose to 50.7 in October beating expectations that the eurozone would show contraction. The expectations were heavily influenced by the surprise decline in German manufacturing in September.

The results shine a positive light on Europe’s chances of avoiding a recession although a lot of work needs to be done on the political arena to unlock the quagmire that has prevented the European Central Bank from deploying a more direct quantitative stimulus package. The situation is so delicate than even the rumours of corporate bond buying had a deep and lasting effect on the EUR/USD even though the ECB later denied that there was a clear plan on such purchases.

Spanish unemployment was released today and it also beat expectations with a reduction to 23.7%, this is the lowest since 2011. There have been reforms implemented to coax employers to speed up their hiring, but while mildly successful Spain remains the second-highest unemployment country in Europe after Greece.

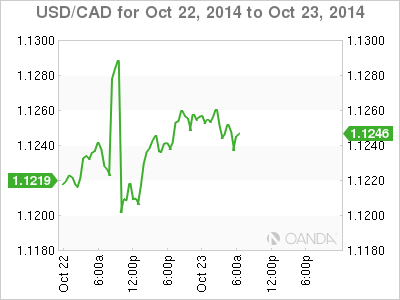

A gunman opened fired inside the parliament building in Ottawa in what is believed to be a terrorist attack that claimed the lives of a soldier guarding a war memorial and the intruder who was shot down. This is the second terror related attack in the week for Canada who until now had so far escaped being the target of this type of attacks. Financial markets reacted downward as a flight to safety was triggered awaiting word from the Canadian government and further developments.

Recommended Content

Editors’ Picks

AUD/USD keeps the red below 0.6400 as Middle East war fears mount

AUD/USD is keeping heavy losses below 0.6400, as risk-aversion persists following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY recovers above 154.00 despite Israel-Iran escalation

USD/JPY is recovering ground above 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price pares gains below $2,400, geopolitical risks lend support

Gold price is paring gains to trade back below $2,400 early Friday, Iran's downplaying of Israel's attack has paused the Gold price rally but the upside remains supported amid mounting fears over a potential wider Middle East regional conflict.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.