Global stock markets rebounded slightly after a dreadful week. There are signs of risk appetite creeping back into the market. The uncertainty created by negative economic data out of the US compounded with global growth forecast cuts earlier in the month drove the market into a tailspin. Aggravating factors such as the ebola health crisis, armed conflicts, political protests kept investors busy deciding their next steps. European markets show signs of life and the USD has rebounded as volatility subsides. All eyes on the market will be following Federal Reserve Chair Janet Yellen as she takes the stage later this morning.

The Federal Reserve was present in the markets with three members delivering speeches yesterday: Dennis Lockhart, the president of the Atlanta Fed, Charles Plosser, president of the Philadelphia Fed and Narayana Kocherlakota president of the Minneapolis Fed. Lockhart focused on the labor market and stressed that is is far from normal as employers are using more part-time workers due to low sales and higher cost of full-time staff. Lockhart is not a voting member of the FOMC, but will become one next year. Plosser was the more hawkish member yesterday calling for a sooner rate hike as there can be risks by being too patient. “Waiting too long to begin raising rates – especially waiting until we have fully met our goals for maximum employment – is risky because we cannot know when we have arrived,” said Plosser in his speech. Kocherlakota for his part gave a Central Banking 101 talk outlining the constitutional role of the Federal Reserve and his goal of average citizens being aware of the what Fed is doing for the economy and not just people involved in finance.

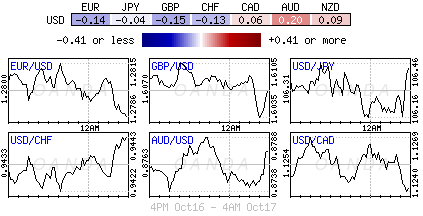

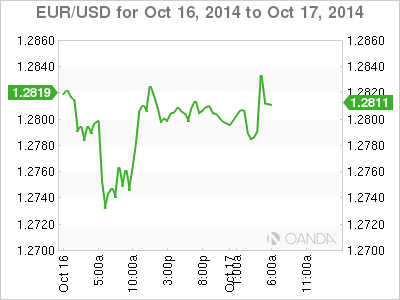

US jobless claims came in at a 14 year low with 264,000 filed for unemployment insurance last week. Industrial production in the US also outperformed expectations with a 1.0% gain in September. Both indicators calmed the nerves of the market that the US economic recovery was losing steam. The USD continues to rise versus major pairs but Fed Chair Yellen will have the final word on the fate of the dollar. Some analysts have begun pushing out the rate hike well into 2015 and some have even suggested it could start in 2016 given the global and domestic environments. Fed member speeches are divided clearly into the hawk and dove camps.

Earlier in the week, US retail sales and inflation numbers sagged, and the euro took full advantage, gaining over 100 points against the dollar. Core Retail Sales dipped 0.2%, its first decline since April 2013. It was a similar story with Core Retail Sales, which posted a decline of 0.3%, its first loss since January. This points to a decrease in consumer spending, a key component of economic growth. Meanwhile, PPI fell by 0.1%, after a reading of 0.0% a month earlier. All three events missed their estimates.

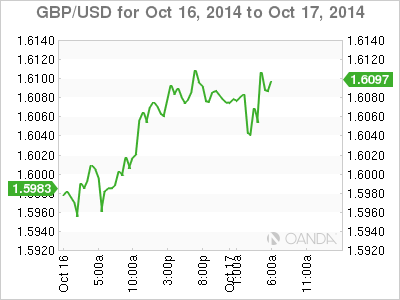

Central bankers have begun their soothing of the markets with chief economics for the Bank of England Andrew Haldane delivering a dovish statement. He is “gloomier” on the economy than he was three months ago with direct implications to interest rate hike expectations. Lower for longer seems to the message that will be also pushed out by Fed Chair Yellen. The European Central Bank has nothing else to add as it awaits for its real policy decisions to be cleared by the European Commission.

The GBP dropped against the USD as Haldane’s speech was published, but has recovered lost ground ahead of US releases and Yellen’s words to the market.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.