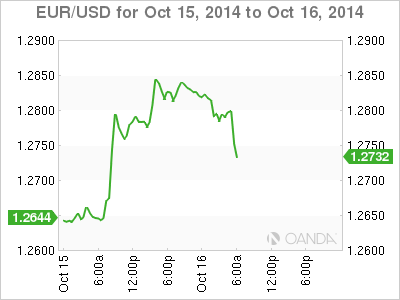

In the current global growth slow down environment the US continues to be the brightest light. The market found out what happens when that light dims slightly. There was an expectation that the US Retail numbers published yesterday where going to come in lower, and indeed they did. The global markets fired off a sell off that put all major indices in red and saw the USD lose against all major pairs. The USD started to recover in the Asian market open and has now advanced against 31 major pairs ahead of the US Industrial Production numbers later this morning.

Complicating matters for the USD is the fact that today two Federal Reserve members will speak. Plosser and Kocherlakota will take the stage at two different events but given they are on opposite sides of the hawk/dove spectrum their comments could net each other out or spark a major move in either direction. The global market turmoil is great example of the fragility of market conditions and could further delay the much awaited exit plans from the Fed and further down the line the Bank of England.

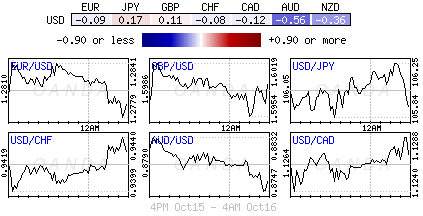

FX volatility was the highest since February 6 as measured by JP Morgan Chase. It touched 8.20% yesterday. For comparison the lowest on record was this year in July with a reading of 5.29%. Morgan Stanley maintains its forecast of the EUR/USD at the end of the year when the pair will end at $1.2400. Interest rate divergence as the Fed is moving forward, albeit slowly, towards raising rates versus the ECB who has to come up with a way to stimulate an economy sick with deflation justifies those forecasts.

Uncertainty about the US recovery is the most damaging to the dollar as witnessed by the damage done by the retail sales figures. The effect of bad data on interest rate expectation had some analyst pushing back their timeline of the Fed’s rate hike to 2016.

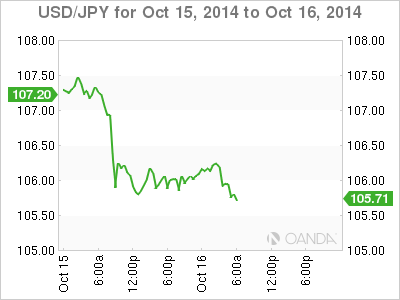

The JPY continues to appreciates versus the dollar as it is now below 106 at a monthly high given the fact that the Japanese currency has been gained strength due to safe haven flows. Currently it sits close to a strong support level of 104.50 where buy orders might be trigged given investors also anticipate further action from the Bank of Japan not only to insure the currency doesn’t damage exporters, but it could reignite deflation fears if the trend continues.

Commodities continue on a downward trend wight he exception of Gold that has been boosted as a safe haven destination by investors. Weak global demand and excess supply have hit the energy markets with crude at $82.7. Gold continues to target the monthly high of $1,249 and now sits $10 below at $1,239.60 an ounce.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.