Concerns regarding Chinese growth are looking most likely to dominate capital markets this week, especially now that the Scottish issue appears to be on hiatus for the immediate future. Already, both global equities and commodities have been put on the back foot as China's Finance Minister sees limited policy response to his country's current slowdown.

The major indices in Asia are down by about -1%, while metals are slumping to multi-month lows despite the stronger dollar. The current risk aversion currency trading strategies is being attributed to the weekend comments from China's Finance Minister Lou indicating that Beijing will not amend economic policies despite some softening to last month's economic indicators. Instead, he indicated that policy makers would be focusing on job creation and stable inflation.

All eyes on China's PMI

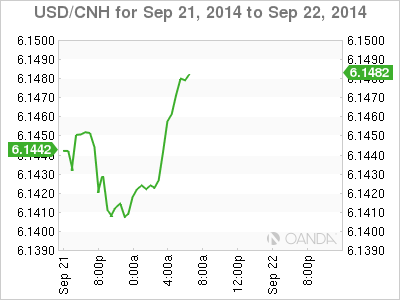

The first look at economic performance for China in September will come with this evening's release of HSBC flash manufacturing PMI. It will be a closely watched indicator, particularly as concerns about the economy are continuing to grow. China's growth has stumbled this year as a slowdown in the housing market further weighs on domestic demand. The current surplus of weaker data from the world's second largest economy continues to feed market speculation that Chinese policy makers will have to further loosen both fiscal and monetary policy to promote growth. Expectations for this evenings print are to "straddle" the boom-bust line of 50, down from the final August reading of 50.2. As long as China continues to play down any large-scale stimulus, risk aversion trading strategies are most likely to dominate. For now, the Yuan continues to trade in a directionless manner and this despite the PBoC guiding it weaker via its daily reference rate. The currency is down just under -1.5% against the dollar this year, with most of the losses being recorded within the first half of the year.

Euro Peripheries under perform

Not surprisingly last weekend's G20 summit yielded little of interest. The finance minister's communiqué pledged to proceed with measures that aim to raise collective members GDP by an additional +1.8% through 2018. Members also promised to "identify a series of additional measures" to meet their growth aspirations. It was not a market surprise to see ECB member and the head of German Bundesbank Weidmann, express his hesitancy toward the latest central bank measures. He noted that the ECB policy response has gone beyond "encouraging banks to make loans and amounted to pumping money directly into the real economy."

So far this morning, Euro-zone government bond yields have opened generally lower ahead of Draghi's testimony. He kicks starts this week off testifying on monetary policy before the European Parliament's Economic and Monetary Committee in Brussels. Euro periphery spreads continue to underperform led by Spain (amid Catalonia concerns). Investors should be expecting a pick up in further volatility for peripheral product given the uncertainty and timing of when government bond purchases will be included in the existing purchases. The Euro bond market requires political backing, especially from Mr. Weidmann and company. Nevertheless, ECB's Draghi will insist that his voting members will most likely want to see Decembers LTRO results before committing themselves to adding product to their balance sheet. The market can expect the ECB to talk about QE, but the ECB will not be rushing QE until they have mitigated "credit" proof.

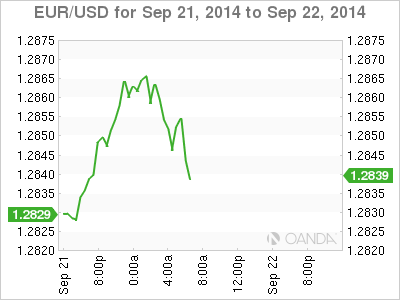

Options to curtail EUR's demise

So far this morning, the 18-member 'single' currency has committed itself to a tightly contained range. The market continues to run into some resistance just north of €1.2870-75 with leveraged and real money sellers on the offer. While touted bids, once again, appear south of €1.2840-45 with speculative accounts said to be active on the buy-side. Market whispers have large options appearing throughout this week, rumored to total +€11b, if true, there is a strong possibility that the EUR's range will be very much contained.

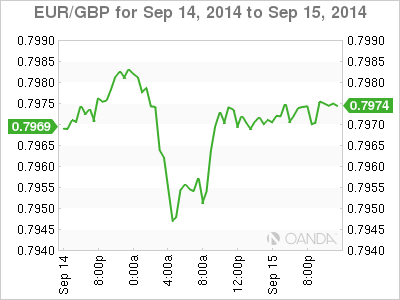

Whatever happens, the market will miss the Scots. Their national sovereignty debate on its own brought back some much needed volume and volatility to the forex space. In a matter of 10 days, the pound has been trading robustly within the £1.6052-£1.6645 range. Maybe the Catalonia's call for independence will shake things up a tad?

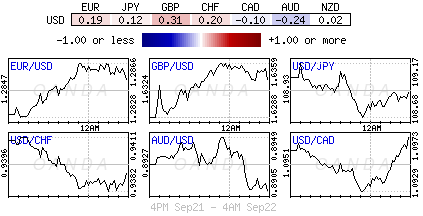

For the remainder of this week, investors will be focusing on flash manufacturing data from France and Germany. The Germans will also release their latest Ifo business climate results - the market will be interested to see if activity picked up. Meanwhile Down Under, traders will be listening to Reserve Bank of Australia Governor Glenn Stevens speak at the Melbourne Economic Forum. The week will end with U.S. durable goods orders and weekly jobless claims on Thursday.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.