It has been a long time coming, but Scottish nationalists finally get to vote for independent statehood today. A "Yes" or "No" win cannot be guaranteed, but rest assured, the market will need to brace itself for some sharp sterling swings no matter the outcome. Rumor, innuendo, and early exit polls will be keeping global capital markets jumping throughout the day. Depending on the percentage outcome (smart money has heavily backed a "No" vote), the current tension will either subside a tad, or find fresh legs similar to Canada's awfully close Quebec referendum in 1995 that saw the separatists narrowly defeated by a mere 50.58% of the popular vote.

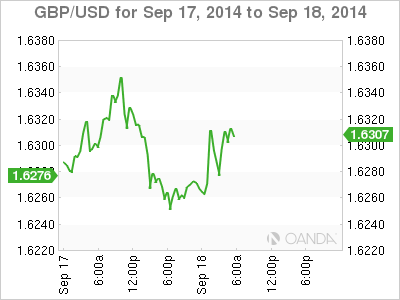

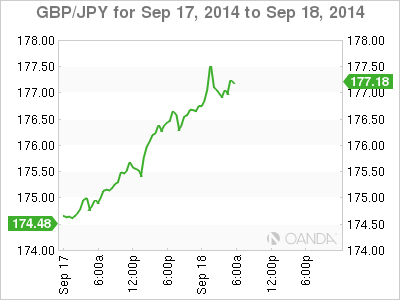

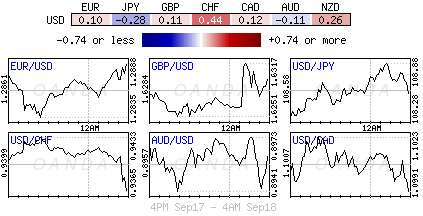

A resurgent U.S. dollar, and fear of the unknown in the U.K., has produced significant market volume and volatility. On that note, the trading of the pound picked up considerably in the first half of September. Last week, GBP plummeted to a new 10-month low (£1.6035) after a sudden surge in support for Scottish independence. However, with the unionist "No" side gaining a narrow edge in the polls this week, it has supported sterling and squeezed some of the weaker GBP short positions before the polls opened earlier today.

Whiplash Trading Styles Abound

No matter what, there remains a distinct uneasiness in the market. Those opposing separation are quietly confident, but it’s the spread between the "Yes" and "No" vote that will drive future volatility. Of course, even a sovereignty win will cause havoc, politically, socially, and economically for a long time to come, and with that, anywhere from 4.5% to 8% pound depreciation is conceivable. In all likelihood, a "No" vote will cause sterling to bounce; how far will depend on the result spread. Current consensus estimates that the referendum has hurt the pound by about -2% outright, and in the very least, a "No" vote will unwind most of the damage done as GBP remains fundamentally a strong currency that has been unsettled by a nationalist situation.

There are many ifs, ands, and buts for a currency that may or may not be Scotland’s legal tender whatever the final outcome. For many, it has been an easy bet to sell the pound to wager on a sovereign outcome. Using the fixed-income or equity market to express similar thoughts has been inconclusive. Currently, U.K. interest rates are more beholden to the Federal Reserve's lower-for-longer pledge and the European Central Bank's whatever it takes analogy. Meanwhile, U.K stocks are focusing on financial equities that may or may not be based in Scotland in the foreseeable future. An inconclusive decision will only heighten future volatility. Investors require a resounding "No" vote to allow GBP to be fundamentally driven again, otherwise it's back to following the Quebec route: the issue gets to be repeated on every political agenda until it’s done to death.

A Braveheart Vote

Some Unionists fret many Scots will vote with their hearts and not their heads. Yet even the optimists believe that without a Scottish Central Bank or independent financial system which will take time to implement, owning sterling is a safer bet in the medium- to longer-term, as GBP will eventually be recycled throughout the U.K. economy. However, many will also be wary of a surprise outcome. The U.K. has one of the biggest current-account deficits in Europe and it certainly requires capital inflow. Any small surprises will push the pound quickly toward a £1.50 handle.

The techies have a slightly different take on the potential outcome. Since August 25 the maximum "No" vote suggested by opinion polls was 54%. They anticipate that the scope for the initial pound gains is roughly to £1.6645 (September 1 high) if the "No" vote is 55% or higher. An unexpected "Yes" will hit the pound hard and could easily depress cable to that psychological £1.50 range as highlighted above.

EU regulations supports U.K sales

A small distraction to today's sovereignty vote has been the release of the U.K's retail sales report this morning. The headline did manage to pick up last month (+0.4% vs. +0.0% m/m and +3.9% y/y), driven by strong household spending, which confirms the positive growth aspects for the economy in Q3. Electrical appliance stores were the main contributors to the increase in household goods sales. New energy saving regulations that became law at the end of last month encouraged shoppers to start "hoarding high-powered vacuum cleaners." Sterling reaction was relatively muted as the market again focuses on any Scottish referendum tidbits.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.