This Friday cannot come soon enough for some forex market participants. So far this week, investors have been starved of fundamental data to back their currency positioning. Many have had to make do with last week's Central Bank rhetoric for direction. The currency positioning play has been agonizingly slow to watch and the current market grind requires more fundamentals to confirm investor's opinion. By the end of this week, there is sure to be some month-end portfolio rebalancing shenanigans that will put some of the weaker currency positions under pressure. In recent months, it has been predominately a net-buying dollar event by US corps.

Excluding tomorrow's German inflation data, there is a plethora of Japanese economic numbers to be released on Friday and likely to influence expectations on whether Governor Kuroda at the BoJ will "top up" the country's stimulus program. Japanese data is predicted to show that the world's third-largest economy is once again floundering after hiking the sales consumption tax in April (from +5% to +8%). The market will be focusing on Japanese core-consumer price index (ex-food and energy). It's forecasted to rise +3.3% on the year in July - or +1.3% ex-impact of the tax increase. These numbers are well below the BoJ's +2% inflation target. Last weekend's rallying cry by BoJ's Kuroda indicated that Japanese authorities "remain committed to its accommodative stance until the +2% inflation target is met and maintained in a sustainable manner." Will Japan try and inflate progress with more "hot-air" or will they add to their aggressive easing program?

Euro confidence waning

European reports again miss expectations, as the region continues to report deterioration in economic data. This morning's session saw misses in German import prices (-0.4%), and a slight miss in the German GFK Consumer Survey (8.6 vs. 8.9). Even Italian and French confidences misses has managed to pause the Euro's two-day equity rally. It's all about the investor weighing up the weak Euro data with the timing of a possible ECB QE introduction.

Confidence amongst French manufacturing fell slightly this month (96 vs. 100) as they become less optimistic about the future outlook. Of note, this morning's report was conducted before President Hollande dissolved his government. Nevertheless, there is little global confidence in Europe's second largest economy as it pursues an austerity measured approach to fixing all woes.

Italy is faring no better, consumer confidence has fallen for a third consecutive month, and has reached its lowest level since April (101.9 vs. 104.4 - no World Cup performance correlation). It's not a surprise to see that the drop was led by deterioration in general sentiment and "lower expectations to the economic situation." Already this month, Italy, Europe's third-largest economy, has slipped back into a technical recession. Both of these surveys' indicated that there are ongoing concerns over falling prices - currently and for the future - highlighting the ECB's dreaded "deflation trap." It's no wonder that market is betting that the ECB is edging closer to QE.

Euro Periphery bonds in demand

Despite geopolitical threats (Russia and Ukraine talks fail to produce a breakthrough), the risk of implementing Euro QE is supporting Euro-zone bond prices. German 10-year Bunds (+0.93%) are again trading close to their record low yields. Even overseas buying is lifting peripheral debt, with yields in France, Italy, Spain and Portugal all sinking to fresh record lows this morning.

As noted throughout the week, long-dated Bonos (Portugal debt paper) are faring best, where 30-year spreads are about -6bps tighter to Bunds, while 10-year product lags just behind at -5bps. Italian BTP's will continue to lag ahead of tomorrows supply. Before a bond auction, its the traders intent to try and 'back up' their benchmark interest rate curve to allow some room to take down supply at a more favorable rate (higher yields=lower prices, hence cheaper).

Over interpreting the ECB's intentions

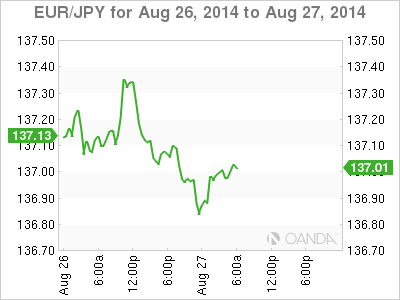

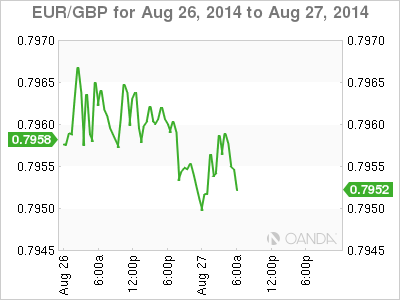

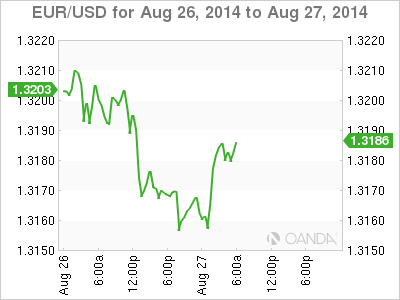

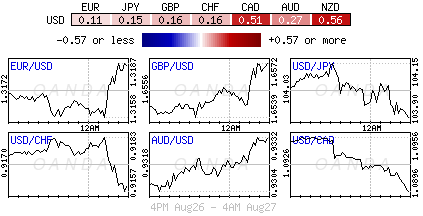

The trend remains the market's friend. The EUR's new trend lower is keeping the long-term bearish outlook intact. Any market fear will be about the currency being oversold. The EUR popped earlier this morning, threatening to take out psychological €1.3200 handle with conviction, after Germany's Economic Minister said that ECB's Draghi had been "over interpreted when he suggested that fiscal policy could play a greater role in promoting growth." The single unit's gains have been aggressively capped, somewhat indicating the strength of the bearish nature of the currency. The EUR currently resides just ahead of its yearly lows, and somewhat handcuffed to a plethora of option barriers and month-end requests.

In the short term, the selling of EUR/Crosses will determine the currency's direction. Month-end speculation supposedly rests with USD sellers, and it's worth noting that today is spot-value month-end - historically of late, this has attracted a decent US corp bid for dollars in recent months. Some prices moves will not be explained from here to week's end. Expect month-end demand to be held accountable.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.