- BOJ Defends Its Assessment of the Japanese Economy

Bank of Japan Governor Haruhiko Kuroda defended the bank’s positive assessment of the economy on Friday. Data release out of Japan have been weak and prompted an assurance from the BOJ that they will act if needed. They just don’t think its needed right now. Exports continue their decline and not even the eventual US Economic recovery and a weaker JPY might be enough to get the Japanese economy back on track. Industrial output fell at the fastest pace since the aftermath of the 2011 earthquake.

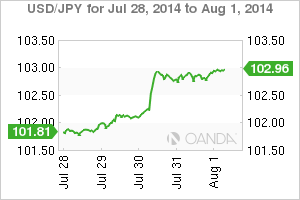

The JPY had strengthened on the back of safe haven flows that resulted after the current geopolitical turmoil around the globe. Strong figures out of the US had given the Yen much needed breathing room. The impressive 4% GDP growth in the second quarter and the steady hand of the Fed allowed the USD/JPY to break through the 102 barrier with ease. A positive NFP (over 200,000 new jobs) is on track to push the Yen to above the 103 level which can buy some time for the BOJ as they await the ECB. The BOJ and the ECB are the most likely candidates to introduce new QE measures to boost their lagging economies.

The sales tax hike that was introduced in April is still considered to be a temporary effect by the central bank, but consumers have begun to pare back their spending. Fiscal responsibility urged the higher tax as Japan is the most indebted of the major economies. The balancing act of the BOJ which will need to inject further stimulus into the economy while at the same time the government introduces fiscal measures to cut debt might result in lower growth which is not what PM Shinzo Abe has promised.

Next Week For Asia:

Central Banks take center stage again in the coming week. The RBA, BOE and ECB will release their monetary policy statements.

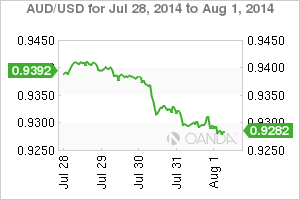

The Reserve Bank of Australia will announce its interest rate decision on Tuesday. There is no change expected in the benchmark rate after statements in mid July from the RBA’s Governor. Glenn Stevens said that he is content with the current monetary policy, although he did add the usual central bank disclaimer that the CB is ready to act if needed. The RBA will probably wait for Fed to give more guidance regarding rates before acting. Later in the week Australia will release its employment figures on Thursday and will close out the week with its Monetary Policy statement on Friday.

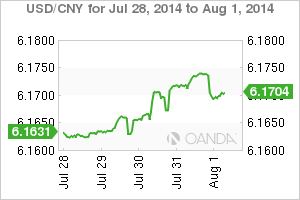

China’s Consumer Price Index will be released on Saturday. After a slight decrease last month the inflation figures will be monitored to see if the Chinese economy continues its over 2% inflation trend.

Fore more market moving events visit the MarketPulse Economic Calendar

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.