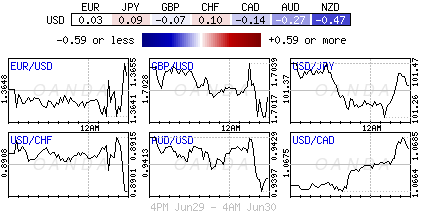

Month-end and quarter-end considerations are making for quiet trading conditions. This is not new for the forex class: for the first half of this year, investors have been contained to tight trading ranges. To date, the Group of 10 central banks’ monetary policies has successfully handcuffed the market to a low volatility-trading environment that tends to favor the 'carry' trade. Until sustainable rate divergences appear, dealers and investors will be committed to more of the same for the balance of 2014. Nonetheless, certain intraday volatility, promoted by geopolitical risk factors, does indeed provide opportunities even in this holiday shortened trading week stateside. Investors are required to be "fleet of foot" to avail of such situations.

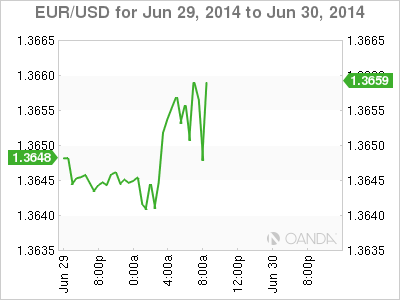

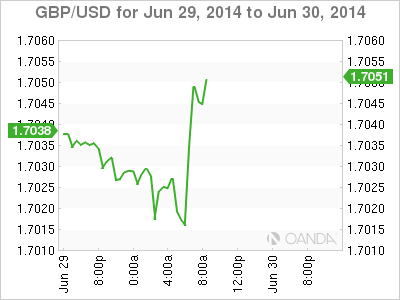

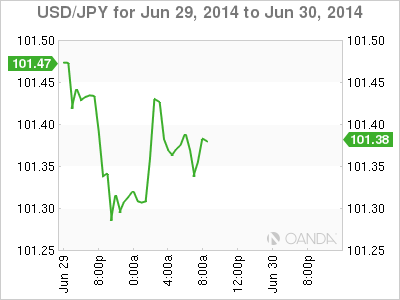

The forex market is coming off a week that saw U.S. bond yields remaining on the back foot and allowing the U.S. yield curve to continue its bullish steepening (short rates drop faster than long). Under this scenario, the greenback should stay offered, pushing volatility even lower and keeping the carry trade in play. Last week saw volatility in the EUR/USD pair match all-time lows at +4.55%. The pound has seen a little profit taking since failing to close above the pivotal £1.7050 weekly chart point on Friday. Meanwhile, USD/JPY continues to slide lower, dropping below its 200-day moving average to a new seven-week low around ¥101.34 largely due to U.S. rates. A stronger yen makes it difficult for the Bank of Japan, and in particular, the island nation’s export-driven economy.

Data-Intensive Week on Tap

It's natural to see risk appetite erode, especially with the market closing out another month. Continuous mixed economic data has managed to dampen investor spirits and send many equity indexes down, aided also by geopolitical concerns in Iraq and Ukraine. The dollar’s slide can be blamed on traders willing to delay the inevitable and push the possibility of a Federal Reserve interest rate hike further out, given the disappointing economic data. Nevertheless, this is a "big" week on the economic front. It will be a short one in the U.S. where markets are closed Friday for the Independence Day holiday. Both the Reserve Bank of Australia and the European Central Bank (ECB) will hold monetary policy meetings this week. Anyone invested in the crowded carry-trade of choice (long AUD funded by borrowing EURs) will certainly want to know what the respected governors are thinking. A plethora of key economic data are expected globally, including June's purchasing managers’ index readings, May international trade data in the U.S. and Canada, Japan's quarterly Tankan report, and most importantly, ending on a high note on Thursday (not the usual Friday) investors will get the U.S. employment situation report, the nonfarm payrolls. All in all, it will be a tightly packed and important week for the various asset classes.

Wise Investors will Watch U.S. Yields

The flight of the EUR has confounded many ever since the last ECB meet. An outwardly "dovish" central bank would have expected more lasting results for its currency. Most of the market has been positioning themselves for a weaker unit (€1.3650), however, that has yet to consistently transpire. This morning's eurozone’s flash harmonized index for consumer prices report for June stayed at +0.5%, year-over-year. The increase in German inflation had many expecting an upward revision, but disinflation outside of Germany is proving much stronger (Italy -- +0.2% versus +0.4%, Spain -- +0.9% versus +0.2%). Low inflation certainly keeps alive the expectations of further ECB action, however, the divergence between Germany and the periphery is key. The Bundesbank will find it difficult to support more radical steps to increase the money supply. Mario Draghi and company at the ECB is currently in a wait-and-see mode for the foreseeable future, and unless German inflation begins to slow, the ECB is unlikely to deliver anything as radical as quantitative easing. For now the EUR short positions are being squeezed, pressured by large option expiries, which tend to be more magnetic in dull trading conditions. With little volume to impede upward trajectory, €1.3600-30 could be vulnerable. The story remains follow U.S. yields for clues.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.