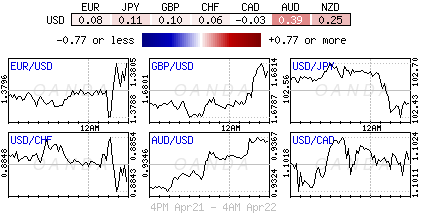

Global equities have managed a small rebound from last weeks lows as markets reopen after a four-day holiday break. It would seem that some investors are growing less concerned about tensions in the Ukraine and are confident with US Q1 earnings season so far. For the majority of investor's, geopolitical issues in Ukraine will continue to cast a shadow on sentiment - hence the lack of forex movement in the overnight session, apart from the yen recovering some of previous day's loss against the dollar.

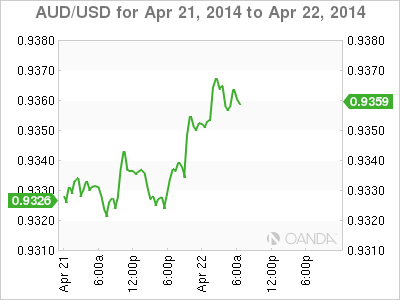

Forex investors seek confirmation of direction, going out on limb or hunch has not been rewarding. For many, the FX theme has been to look towards Central Bankers, see what they say and what they want to do - that is all that is normally required. Be wary, relying on Central Bank talk alone is not having the dominating effect it's had in times past. For instance, verbal intervention had no effect on the AUD during the Asian session. Treasurer Hockey stated that the Australian government was not happy with RBA's neutral policy bias and that upward pressure in Aussie made it more difficult to manage the economy - the result? AUD continues to trade near the top of its range $0.9365.

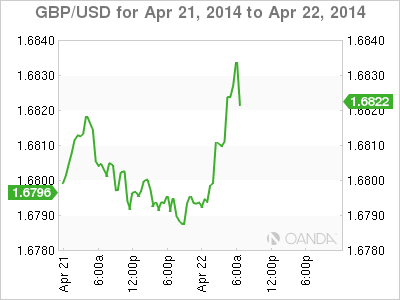

In the current environment Central Bankers do not want to sit on their hands and ignore a strengthening currency. The deal has been mostly about verbal intervention on behalf of their domestic currency. A good example should be the BoE this week - it's expected to be more forceful in highlighting the impact of GBP strength on the outlook for monetary policy. In Japan, PM Abe government and Governor Kuroda at the BoJ (carry trade opportunities talk) have been focusing on the value of the JPY. A weaker domestic currency is part of their solution in dealing with deflation. For other Central Bankers like PBoC and ECB, they have been more active and blatant in dealing with their own currency strength.

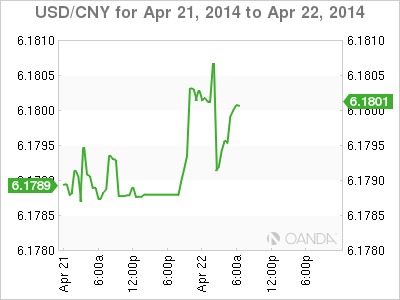

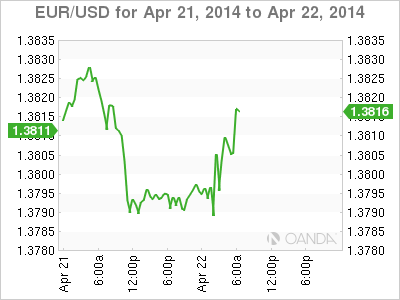

In Q1 the PBoC has worked tirelessly against most speculators positions. Record long CNY positions have been held. These are the ones that have been built up over the past 18-months in anticipation for the market to trade through that psychological CNY6.0000 handle. However, since the dollar lows in mid-January, and under the manipulation of the PBoC, CNY has fallen -3% - authorities have not only ended the gradual appreciation of their own currency but are in fact are weakening it (CNY6.1810). The ECB has taken a different stance, for them the tipping point has been the 18-member single currency trading through the €1.40 handle. Draghi and company has been talking mostly about the impact of a stronger EUR, which according to authorities requires further monetary stimulus. The chance of the ECB taking the plunge and initiate asset purchases seems to be climbing. The market is pegging it higher than a 50% chance of ECB asset purchases happening. Embarking on this strategy would help the ECB achieve a number of objectives. Directly, they would be able to increase their monetary base and reduce yields, and indirectly, lower the exchange rate, reduce credit spreads further and support further lending. For the FED, they have focused on inflation been too low which the market interprets that rates will remain "lower for longer."

Governor Carney at the BoE has not been as vocal as his fellow Central Bankers when it comes to domestic currency valuation. He and his cohorts at the BoE have been relatively quite despite GBP being on a tear of late and trading close to its highest level in six-years (on a trade weighted basis £1.6331) as UK fundamental continues to trump market expectations. Even with inflation trading at a four-year low (+1.6%) and well below the BoE's threshold (+2%), the market should expect governor Carney to mention sterling's strength and its impact on monetary policy when the minutes from April 9th BoE MPC meeting are released tomorrow. Other releases this week that are expected to effect the pound are March's public sector finance data and the CBI's April manufacturing and retail sales surveys due tomorrow and Thursday.

Watching the EUR is like watching paint dry. The EU session has seen near "no" action when it comes to the 18-member single currency. The EUR continues to be glued to €1.3800 - it's rumored large vanilla expiries are the big influencer at that level. The market seems to be waiting for data releases stateside for confirmation of direction. Most participants will want to digest this morning's US existing home sales before embarking on another adventure. For the already interested investor, like the EUR bear, continue to struggle to build on the sell signal generated by yesterday's downward breach sub-€1.3800 handle. The lack of follow through has the short term bear positions worried. Trading below €1.3790 is suppose to open up the way to €1.3749'ish level. The longer that the EUR fails to break down the more attractive the topside becomes.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.