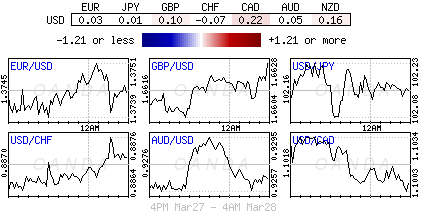

It has taken awhile, but the forex market is finally moving, albeit slow, but moving. For the past five sessions the 18-member single currency had been relatively contained, knocking on it weekly low on a number of occasions, but without any real convection of wanting to go any lower until this morning. Lower than expected inflation data released earlier in Europe, coupled with a sharp fall in excess liquidity, and supported by the constant bearish ECB rhetoric, is pushing an ECB easing agenda to the fore ahead of next weeks monetary policy meeting. The only downside is that the market has been put through this similar scenario at both the February and March meetings.

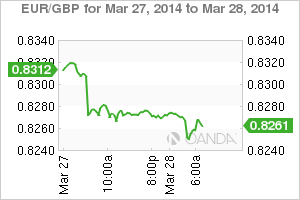

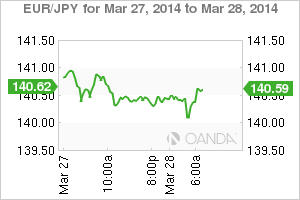

Despite the Euro-zone flash HICP not due for release until next Monday, the unexpectedly negative Spanish CPI number (-0.2% vs. +0.1%) and a lower German Saxony inflation print (falls to +0.9%) this morning has hurt the EUR and forced further liquidation in the European session. The weaker than expected readings have created a downside risk that could help "pry open the ECB's tool box." As a result the EUR sold off aggressively as investors position for Monday's flash CPI. This morning's print heightens the risk of the Euro-zone CPI coming in less than +0.7% forecasted which heighten an April 3rd ECB rate cut risk.

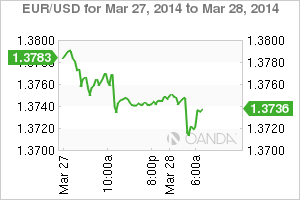

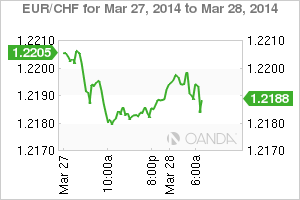

For many, it was a no-brainer to short the EUR or add to current short positions once the psychological €1.3750 was breached. The 55-DMA at €1.3711 will now provide the next current support level, followed by 1.3670 (close to February's low) and the 100-DMA at 1.3673. On top of the lower than expected inflation prints, money markets and fixed income (FI) traders will tell you that there is excess liquidity at a cycle low of €104b, which is very close to breaking the psychological €100b mark. Falling below this level would lead to effective tightening of ECB monetary policy as the over-night "EONIA rates (banks loan to each other) trades close to the refi-rate (banks pay to ECB for funding) as opposed to the deposit floor rate (sets a hard floor to money-market rates)."

This is "déjà vu" third time, but will it bring luck for those naysayers? The usual sets of "tools" are again being talked about and of course are all to provide stimulus. First, there is the question of sterilization; the ECB could leave the SMP unsterilized either partially or fully. Second regarding rates, a cut in the deposit and refi rates mixed with a strengthening of forward guidance could be implemented and finally, implementing QE that involves ABS's. The fact that the EONIA curve continues to flatten combined with a general weakening of the EUR price itself would suggest that market expectations are currently being priced in for some action. The risk, just like before, if nothing changes the market will risk a violent reversal of the favorable downside moves on the EUR and money market rates.

Is the timing right for the ECB? The previous two meets the market had been expecting more and on both occasions with many ending up getting burnt. The ECB previously indicated it was becoming increasingly sensitive to further gains in the EUR. This month Draghi explained the impact of the exchange rate on inflation, saying that the ECB assumed that a +10% rise in the trade-weighted EUR would reduce inflation by -0.5%). This morning's numerous CPI readings seem to have reinforced the implications of a strong currency. When considering yield differentials, "real" yields do matter for currency trend. Real rate strength has been supporting the EUR over the past 12-months, and a decline in real rates seen recently has helped to weaken the 'single currency.' Watch the dynamics of short term US/Bund spread - currently has widened to the most in two-years. However, it's Friday and a percentage of the market do not want to be too exposed to Russian/West event risk. There will be a natural inclination by a few to offload some of their regional outright exposure just for the weekend, which could provide the EUR with some support on pullbacks.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.