- EUR/USD

Current level - 1.1478

The uptrend is intact, heading for a test of 1.1494 peak and a break through the latter will expose challenge last year's high at 1.1720.

| Minor | Intraday | Major | Intraweek | |

| Resistance | 1.1494 | 1.1610 | 1.1494 | 1.1720 |

| Support | 1.1433 | 1.1370 | 1.1370 | 1.1217 |

__________

- USD/JPY

Current level - 106.38

The downtrend broke through 107.60 low and the bias remains bearish, for a slide towards 105.40 support zone. Initial resistance lies at 107.00, followed by the crucial area around 107.60.

| Minor | Intraday | Major | Intraweek | |

| Resistance | 107.00 | 107.60 | 107.60 | 109.90 |

| Support | 106.10 | 105.40 | 105.40 | 105.40 |

__________

-

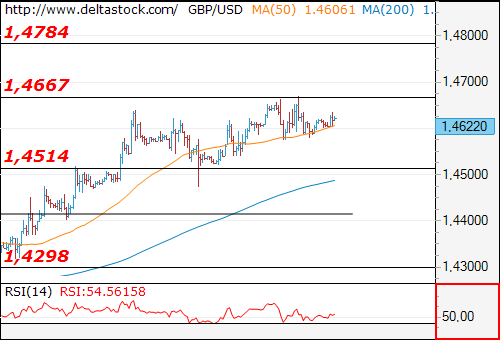

GBP/USD

Current level - 1.4540

Despite yesterday's short-lived dip to 1.4470, the overall bias remains bullish, for a rise towards 1.4670, en route to 1.4785. Initial intraday support lies at 1.4514.

| Minor | Intraday | Major | Intraweek | |

| Resistance | 1.4670 | 1.4785 | 1.4670 | 1.4785 |

| Support | 1.4514 | 1.4400 | 1.4300 | 1.4000 |

__________

| DATE | ORDER | ENTRY | SL | TP1 | TP2 | |

| EUR/USD | April 28 | BUY MKT | 1.1330 | 1.1270 | 1.1450 | --- |

| USD/JPY | April 28 | SELL MKT | 108.90 | 109.60 | 107.70 | --- |

| GBP/USD | April 28 | BUY MKT | 1.4540 | 1.4500 | 1.4660 | 1.4770 |

These analyses are for information purposes only. They DO NOT post a BUY or SELL recommendation for any of the financial instruments herein analyzed. The information is obtained from generally accessible data sources. The forecasts made are based on technical analysis. However, Deltastock’s Analyst Dept. also takes into consideration a number of fundamental and macroeconomic factors, which we believe impact the price moves of the observed instruments. Deltastock Inc. assumes no responsibility for errors, inaccuracies or omissions in these materials, nor shall it be liable for damages arising out of any person's reliance upon the information on this page. Deltastock Inc. shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation, losses or unrealized gains that may result. Any information is subject to change without notice. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Deltastock AD is fully licensed and regulated under MiFID. The company is regulated and authorised by the Financial Supervision Commission (FSC), Bulgaria, Reg. No. RG-03-01

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.