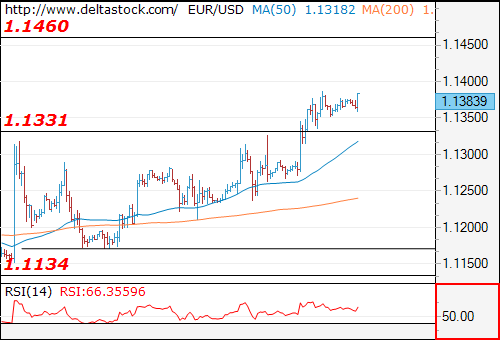

- EUR/USD

Current level - 1.1383

The outlook here remains positive above 1.1330 support zone, for a further rise towards 1.1460. Crucial on the downside is 1.1260 low.

| Minor | Intraday | Major | Intraweek | |

| Resistance | 1.1390 | 1.1460 | 1.1460 | 1.1565 |

| Support | 1.1330 | 1.1260 | 1.1012 | 1.0930 |

__________

- USD/JPY

Current level - 120.17

The intraday bias is slightly positive above 120.00 static support, for a rise towards 120.50, en route to 121.30. Major hurdle on the downside lies at 119.50.

| Minor | Intraday | Major | Intraweek | |

| Resistance | 120.50 | 121.32 | 122.30 | 123.70 |

| Support | 119.50 | 118.67 | 118.67 | 116.15 |

__________

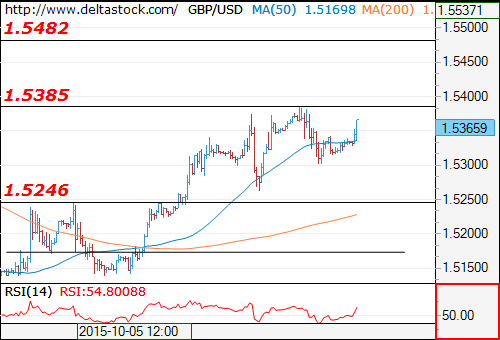

GBP/USD

Current level - 1.5365

The pullback below 1.5385 high is corrective, preceding next leg upwards, to 1.5480. Major support lies at 1.5240.

| Minor | Intraday | Major | Intraweek | |

| Resistance | 1.5385 | 1.5480 | 1.5478 | 1.5660 |

| Support | 1.5240 | 1.5175 | 1.5080 | 1.4850 |

__________

| DATE | ORDER | ENTRY | SL | TP1 | TP2 | |

| EUR/USD | October 12 | BUY MKT | 1.1383 | 1.1300 | 1.1460 | --- |

| USD/JPY | October 5 | BUY MKT | 120.03 | 119.40 | 121.20 | --- |

| GBP/USD | October 12 | BUY MKT | 1.5365 | 1.5280 | 1.5480 | --- |

These analyses are for information purposes only. They DO NOT post a BUY or SELL recommendation for any of the financial instruments herein analyzed. The information is obtained from generally accessible data sources. The forecasts made are based on technical analysis. However, Deltastock’s Analyst Dept. also takes into consideration a number of fundamental and macroeconomic factors, which we believe impact the price moves of the observed instruments. Deltastock Inc. assumes no responsibility for errors, inaccuracies or omissions in these materials, nor shall it be liable for damages arising out of any person's reliance upon the information on this page. Deltastock Inc. shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation, losses or unrealized gains that may result. Any information is subject to change without notice. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Deltastock AD is fully licensed and regulated under MiFID. The company is regulated and authorised by the Financial Supervision Commission (FSC), Bulgaria, Reg. No. RG-03-01

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.